Research Summary

The report analyzes the impact of the launch of U.S. Bitcoin ETFs, which saw significant inflows but were offset by outflows from GBTC and BITO. It discusses the role of market psychology and structural factors in Bitcoin’s performance, and highlights the dominance of U.S. ETFs in the global BTC ETP market.

Key Takeaways

Impact of U.S. Bitcoin ETF Launch

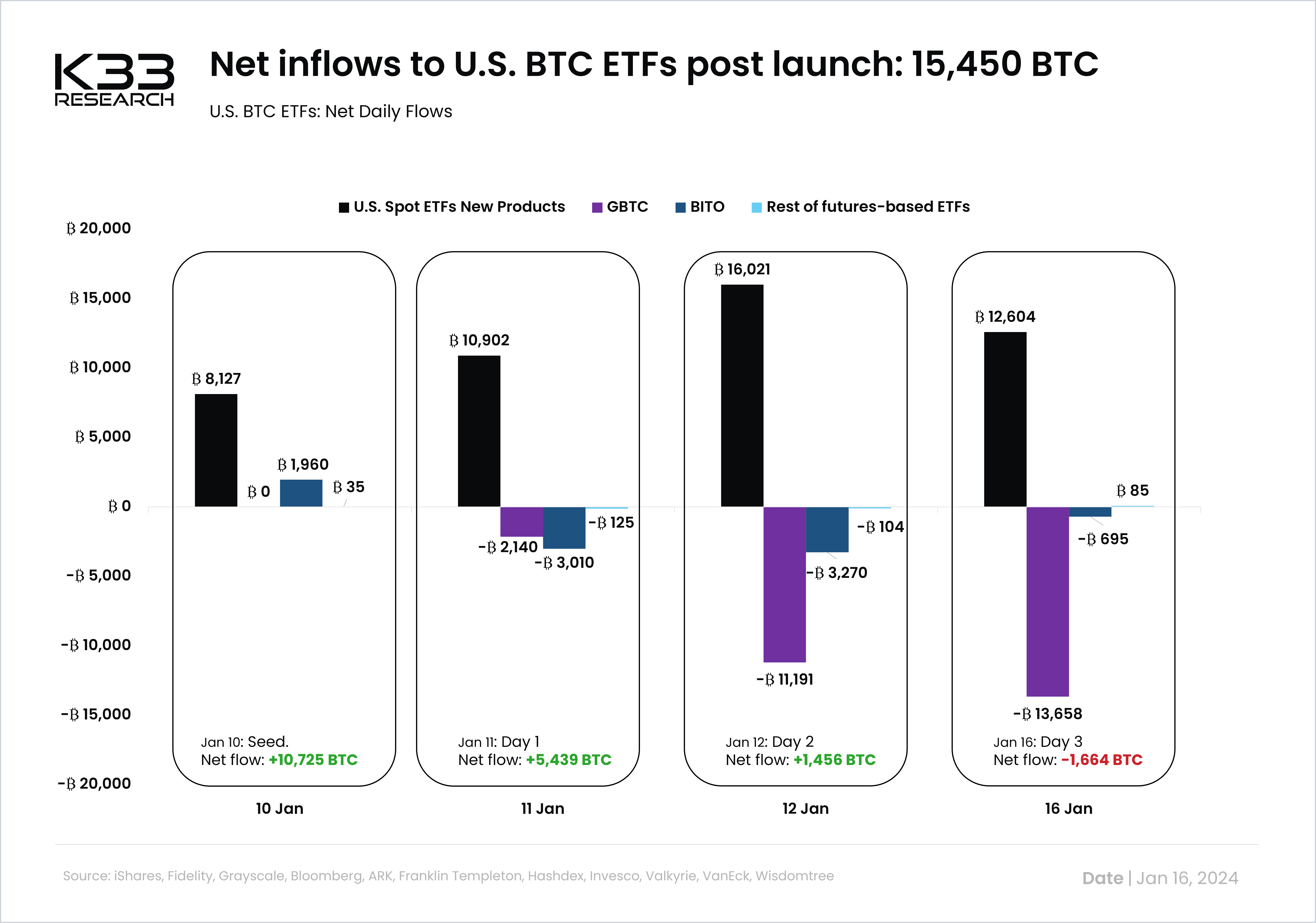

- Significant Inflows: The launch of U.S. Bitcoin ETFs was successful, with 47,654 BTC in inflows in the first two days. However, outflows from GBTC and BITO reduced the net positive flow to 15,540 BTC.

- Role of Market Psychology and Structural Factors: Despite the strong launch, Bitcoin’s price fell due to factors such as GBTC’s high fees compared to its peers, which incentivized rotation to other funds, and selling pressure from traders playing the ETF narrative.

Performance of GBTC and BITO

- GBTC’s Narrowing Discount: GBTC’s discount to NAV has narrowed from -45% to 0% over the past seven months, gaining 170% compared to BTC’s 57% in the same period. However, GBTC has seen outflows due to its higher fees and profit realization.

- BITO’s Post-Launch Outflows: BITO saw net outflows of 6,975 BTC after the launch of more straightforward spot products, causing selling pressure on CME and pushing CME’s futures premiums lower.

Global BTC ETP Market

- U.S. Dominance: U.S. ETFs represent 80% of the global BTC ETP balances. After the GBTC conversion, Bitcoin ETPs globally hold 864,719 BTC, roughly 45% of the size of crypto exchange reserves.

- Outflows from Other Jurisdictions: Following the U.S. spot ETF approval, ETPs in other jurisdictions and futures-based products shifted from inflows to outflows. Canadian and European BTC ETPs saw substantial outflows alongside U.S. futures-based ETFs.

Future Expectations

- Continued Structural Flows: The report expects large structural flows from GBTC to other issuers to continue due to GBTC’s substantial fees compared to its peers.

- Increasing BTC ETP Holdings: Currently, 4.4% of the circulating bitcoin supply is held in BTC ETPs globally, a number expected to increase in 2024.

Actionable Insights

- Monitor ETF Flows: Given the significant impact of ETF flows on Bitcoin’s price, it would be beneficial to closely monitor these flows, particularly in the U.S. which holds an 80% market share within BTC ETPs.

- Consider Fee Structures: The report highlights the role of fee structures in fund rotation. Investors should consider the fees associated with different funds when making investment decisions.

- Understand Market Psychology: The report underscores the importance of understanding market psychology in predicting price movements. Investors should consider factors such as selling pressure and profit realization in their analysis.