Research Summary

The report discusses the potential of Match Finance, a yield aggregator for Lybra Finance, a liquid staking stablecoin protocol. It highlights the market potential of liquid staking, the growth of Lybra, and the features and benefits of Match Finance. The report also compares Lybra and Match Finance with their competitors.

Key Takeaways

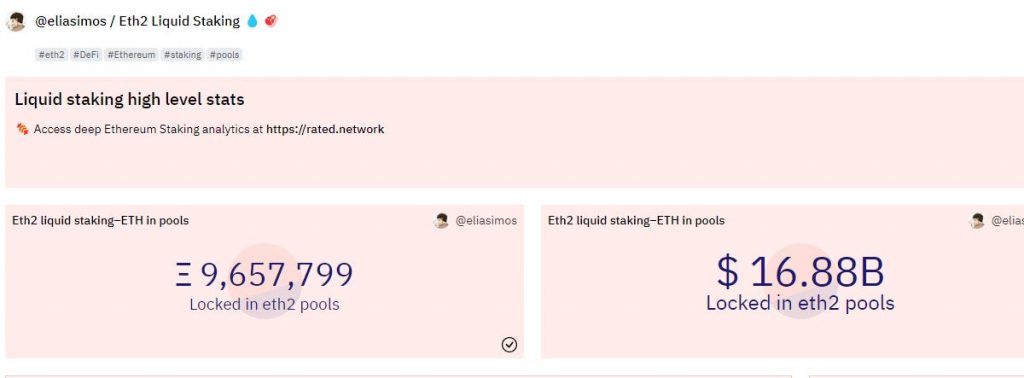

Market Potential of Liquid Staking

- Surge in Liquid Staking: The report notes that the market size of liquid staking has surpassed $30 billion, contributing to the growth of the top 10 liquid staking derivative (LSD) protocols on Ethereum, Avalanche, and Solana. This growth has also benefited Match Finance, which has seen its total value locked (TVL) increase by 7x in two months to $8.8 million.

Growth and Features of Lybra and Match Finance

- Lybra’s Growth: Lybra has seen significant growth, with its TVL doubling to $330 million since transitioning to its version 2, which allows users to farm rewards based on the collateral they provide to mint eUSD.

- Match Finance’s Features: Match Finance, a yield aggregator for Lybra, offers features such as automatic adjustment systems to lower liquidation risk, instant rewards, and a bribe market in Lybra. It aims to lower entry barriers to earn Lybra, simplify the minting, redemption, and risk management process, and offer a governance aggregator for Lybra.

Comparison with Competitors

- Advantages Over Competitors: The report compares Lybra and Match Finance with competitors such as Pendle and Equilibria. It notes that Lybra has a higher TVL, lower fully diluted valuation (FDV), and more fees than Pendle. Match Finance, as the first mover, is expected to capture most of Lybra’s value.

Valuation and Support

- Attractive Valuation: Match Finance has an initial market cap of approximately $460,000 and a fully diluted valuation of around $5 million. It has also received official support and recognition from the Lybra team.

Future Prospects

- Opportunity for High Returns: With the demand for liquid staking increasing, Match Finance offers an opportunity to capitalize on a fast-growing Lybra yield aggregator. The report suggests that Match Finance’s low market cap and revenue potential from Lybra’s high TVL provide attractive upside.

Actionable Insights

- Monitor the Growth of Liquid Staking: Given the significant growth of the liquid staking market, it may be beneficial to keep a close eye on this sector and the top LSD protocols.

- Assess the Potential of Match Finance: With its unique features and the backing of Lybra, Match Finance could offer significant potential. It may be worth exploring its yield aggregation services and governance aggregator for Lybra.

- Compare with Competitors: The report suggests that Lybra and Match Finance have advantages over competitors such as Pendle and Equilibria. It may be useful to compare these platforms to assess their potential.