Research Summary

The report discusses Thena Finance, a decentralized exchange (DEX), liquidity layer, and automated market maker (AMM) built on the Binance Smart Chain (BNB Chain). It covers the project’s use case, adoption, revenue, tokenomics, treasury, governance, team, competitors, risks, and audits. The report also highlights Thena’s recent launch of its perpetual DEX, ALPHA, and its potential for growth on the BNB Chain.

Key Takeaways

Thena’s Use Case and Adoption

- Thena’s Functionality: Thena allows users to swap tokens with low fees, stake assets to earn passive income, and provide a liquidity layer for the BNB Chain. It aims to become the native liquidity layer on the BNB Chain, which is the third-largest chain in terms of total value locked (TVL), with over 600 protocols and 880k active addresses in the last 24 hours.

- Launch of ALPHA: Thena has recently launched its own perpetual DEX called ALPHA, which is currently in the public Beta phase. The team has also introduced a borrowing/lending feature using the $THE token.

Thena’s Revenue and Tokenomics

- Revenue Generation: Over the past 30 days, Thena has generated $518k in revenue, making it the fourth highest on the BNB Chain. Trading fees are directed to holders that lock their tokens for $veTHE, with holders currently receiving 80% of the platform trading fees.

- Tokenomics: There are three main tokens in the Thena Ecosystem: $THE (utility token), $veTHE (governance token), and theNFT (non-fungible token). Users can lock their $THE tokens for up to 2 years to get $veTHE, which allows them to receive trading fees, bribes, and weekly veTHE distribution.

Thena’s Governance and Team

- Governance: Thena’s governance revolves around the ve(3,3) mechanics. Holders of $veTHE can participate in governance by casting votes on proposals for protocol improvements and voting for liquidity pools through gauges and bribes.

- Team: Thena was launched in January 2023 by an anonymous team. The protocol prides itself on being community-run with no venture capitalists and no seed round. Tokens were airdropped to early users and other BNB Chain protocols in a ‘fair launch’.

Thena’s Risks and Audits

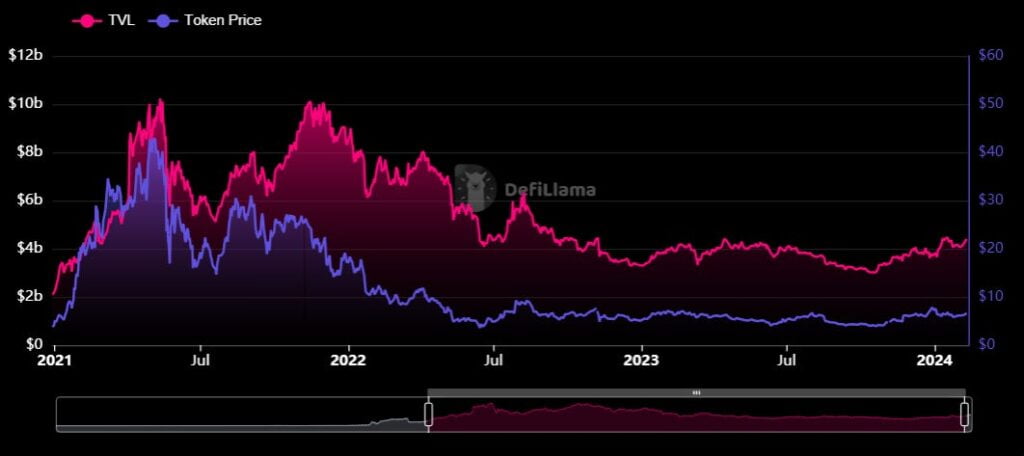

- Risks: The report notes a concerning downward trend in Thena’s TVL, which stands at $32.6m, reflecting a 13% decrease over the past month. However, there are indications that the TVL may be stabilizing, forming a base around $30m.

- Audits: Thena V2 has been audited by OpenZeppelin in June 2023. The protocol is adapted from the Velodrome codebase, which was audited through the Code4rena bug bounty contest. The AMM part of Solidly has been audited by PeckShield.

Actionable Insights

- Monitor Thena’s Growth: Given the potential for growth on the BNB Chain, it would be beneficial to keep an eye on Thena’s adoption rate, particularly with the recent launch of its ALPHA DEX.

- Understand Thena’s Tokenomics: The unique tokenomics of Thena, including the use of $THE, $veTHE, and theNFT, and the benefits of locking tokens, could be a point of interest for those looking to engage with the protocol.

- Consider Thena’s Governance Model: The ve(3,3) governance model offers an interesting approach to decentralized decision-making, which could be of interest to those studying different governance models in the DeFi space.

- Assess Thena’s Risk Profile: The downward trend in Thena’s TVL and the complexity of its token locking mechanism could be potential risk factors to consider when evaluating the protocol.