Research Summary

The report discusses the unique features and potential of Mu Exchange, a first-of-its-kind Perpetual Decentralized Exchange (Perp DEX) built on the Gnosis Chain. It highlights the platform’s ability to allow users to earn yield on their collateral while trading perpetuals, its low transaction fees, and its 100% distribution of trading revenue back to the vaults.

Key Takeaways

Unique Features of Mu Exchange

- Yield Earning While Trading: Mu Exchange is the first Perp DEX that allows users to earn yields on their collateral while trading with leverage. This is made possible by accepting $sDAI as collateral, which continues to generate returns at the DAI Saving Rate even after opening a leveraged trading position.

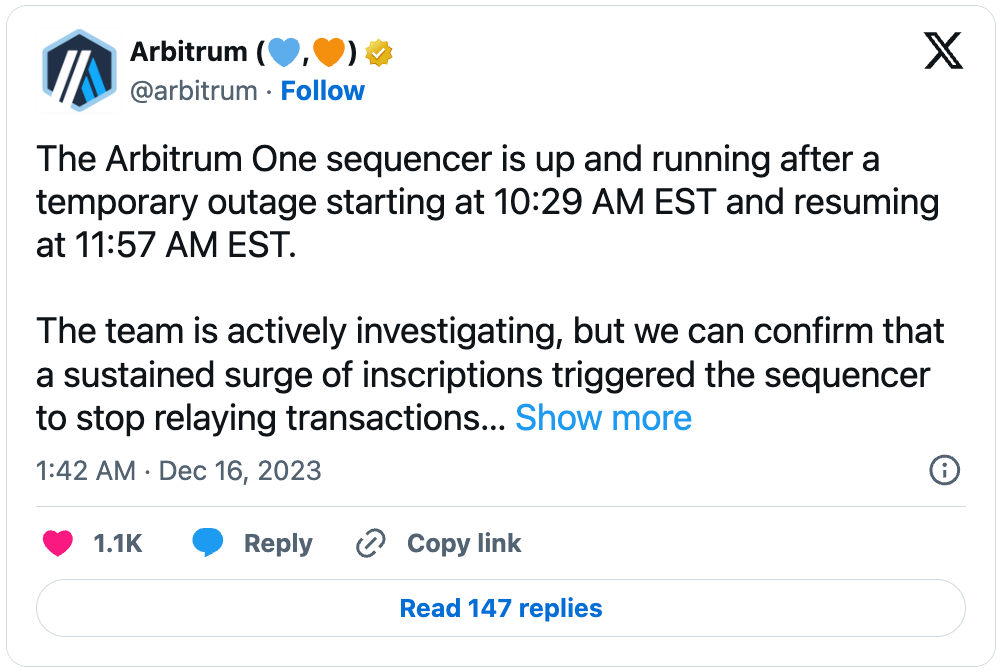

- Low Transaction Fees: Built on the Gnosis Chain, Mu Exchange boasts 500x lower gas fees than Arbitrum, with a fee of approximately $0.007 USD per transaction. This makes it an attractive platform for users seeking to minimize transaction costs.

- Revenue Distribution: Mu Exchange is committed to adding value back to token holders by distributing 100% of trading revenue back to the vaults. This is a significant improvement over other platforms like GMX.IO and GainsNetwork.io, which only give back 70% and control their APR, respectively.

Staking Vault

- Profit Sharing: The $msDAI Vault allows stakers to earn a portion of exchange fees and trader losses in exchange for providing liquidity. The vault serves as the counterparty to all trades, earning fees when traders lose and paying out when traders profit.

- Protection Systems: Mu Exchange has systems in place to protect the vault from excessive losses by limiting open interest. This ensures that the vault’s returns are not overly affected by trader losses.

Tokenomics

- No Current Token: As of the report, Mu Exchange does not have a token. Any token claiming to be Mu’s governance token is invalid. When a token is released in the future, details will be shared publicly.

- Fee Distribution: Open/Close Position Fees are currently 0.08% for both sides. The fee distribution varies depending on whether a referral is involved, with a portion going to the referrer, keepers, the msDAI vault, and the Mu treasury.

Roadmap

- Aggressive Feature Rollout: Mu Exchange plans to aggressively roll out new features, including more than 300 trading pairs, two new asset integrations weekly, and a user-friendly interface. This indicates the platform’s commitment to continuous improvement and user satisfaction.

Conclusion

- Promising Traction: Mu Exchange has shown promising traction in its early stages, with over $1M in trading volume. Its innovative features and focus on value distribution to users position it to capture market share in the growing Perp DEX sector.

Actionable Insights

- Consider the Potential of Mu Exchange: With its unique features such as yield earning while trading, low transaction fees, and full revenue distribution, Mu Exchange presents a compelling case for users seeking to maximize their returns in the Perp DEX sector.

- Monitor Mu Exchange’s Progress: Given its aggressive feature rollout plan and early traction, it would be beneficial to keep an eye on Mu Exchange’s progress and growth.

- Understand the Risks: While Mu Exchange offers promising features, it’s important to understand the risks involved, particularly with regards to its protection systems and the potential for excessive losses.