Research Summary

The report discusses the performance of various cryptocurrencies over the past week, with a particular focus on Bitcoin ($BTC) and Solana ($SOL). It also covers the impact of fake news about a Bitcoin ETF approval, the performance of altcoins, and the potential implications of a Bitcoin ETF approval. The report also highlights the performance of other cryptocurrencies such as $STX, $BCH, $BSV, $INJ, $RNDR, $SUI, $BLUR, $MATIC, $TRB, $BLZ, $BIGTIME, $LOOM, $ORBS, $MOON, $BRICK, $RLB, $UNIBOT, $BANANA, $PAAL, $OX, $BITCOIN, $MOG, $SPX, $JOE, and $REKT.

Key Takeaways

Bitcoin’s Performance Amid Fake ETF News

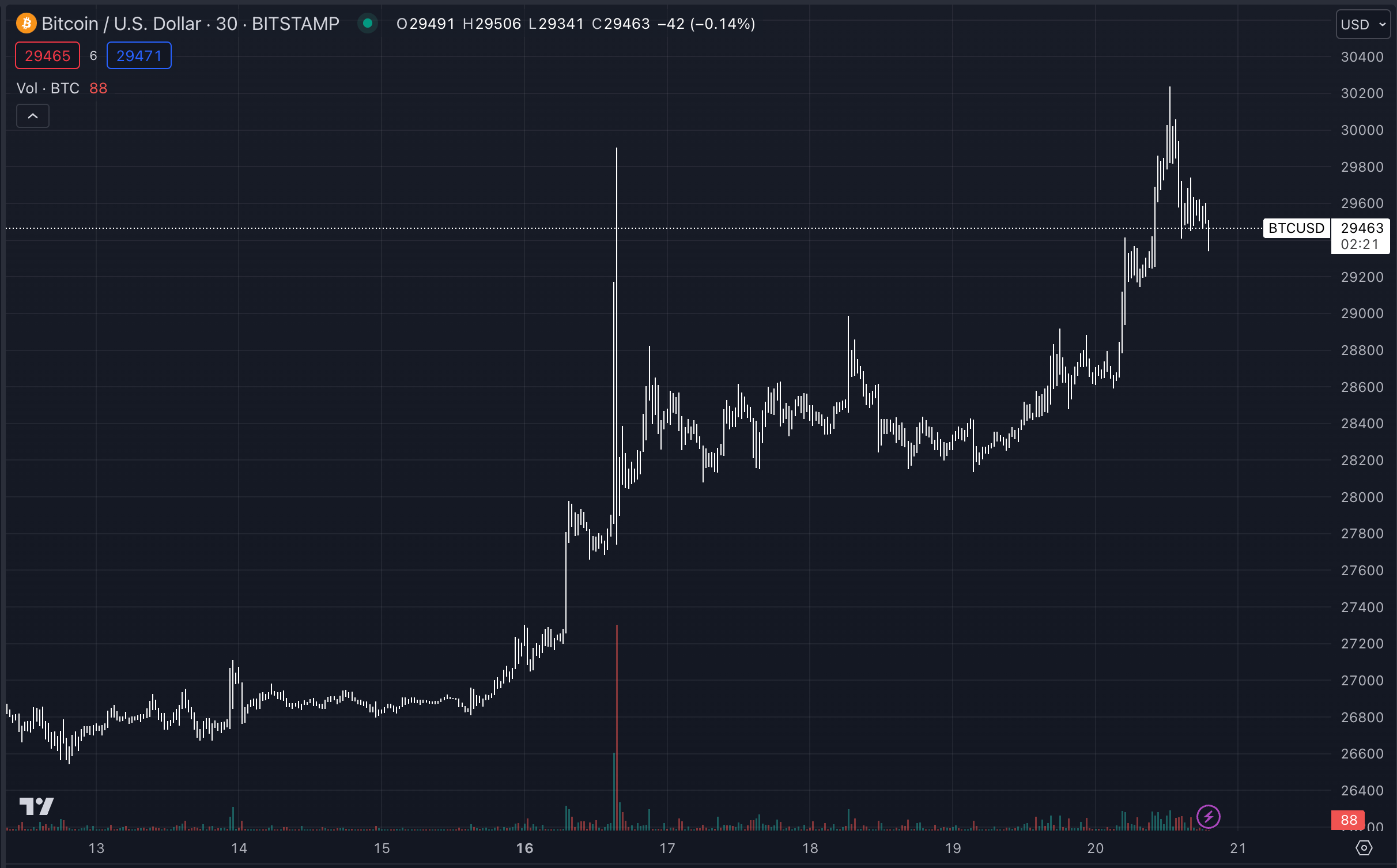

- Bitcoin’s Resilience: Despite a fake news report about a Bitcoin ETF approval, Bitcoin’s price increased by more than 10% over the week. The fake news led to a 7% increase in Bitcoin’s price within six minutes, but the price retraced after it was confirmed that the news was false. However, the incident led many to realize that a Bitcoin ETF approval could be imminent, leading to a new bullish impulse for Bitcoin.

Solana’s Strong Performance

- Solana’s Outperformance: Solana was the best-performing large-cap cryptocurrency over the week, with a 26% gain. Despite being one of the most shorted majors due to expected selling pressure from Galaxy’s liquidation of liquid $SOL tokens, Solana’s price increased due to short sellers having to re-buy at higher prices.

Altcoin Market Developments

- Altcoin Market Movements: Other notable performers over the week included $STX, $BCH, and $BSV, which are closely related to Bitcoin. The report also mentions the performance of $INJ, $RNDR, $SUI, $BLUR, $MATIC, $TRB, $BLZ, $BIGTIME, $LOOM, $ORBS, $MOON, $BRICK, $RLB, $UNIBOT, $BANANA, $PAAL, $OX, $BITCOIN, $MOG, $SPX, $JOE, and $REKT.

Impact of Uniswap’s Fee Switch

- Uniswap’s Fee Switch: Uniswap’s announcement of a 0.15% fee on swaps done on their official website led to a 6% drop in the $UNI token’s price. The new fee does not benefit $UNI token holders, leading to market perception of the token as potentially worthless.

Implications of a Bitcoin ETF Approval

- Bitcoin ETF Approval Implications: The report suggests that a Bitcoin ETF approval could lead to a significant increase in Bitcoin’s price. However, it also suggests that the approval could mark a local top, as the catalyst will be behind us and no actual meaningful flow will come right after the approval day.

Actionable Insights

- Investigate the Potential of Bitcoin: Given the market’s reaction to the fake news of a Bitcoin ETF approval, it may be worth investigating the potential impact of an actual approval on Bitcoin’s price.

- Consider the Impact of Short Selling on Solana: The report suggests that short selling has contributed to Solana’s strong performance. This dynamic could be worth considering when evaluating Solana’s future performance.

- Assess the Impact of Fee Changes on Uniswap: Uniswap’s decision to introduce a new fee on swaps has negatively impacted the $UNI token’s price. It may be worth assessing the potential impact of future fee changes on Uniswap’s performance.

- Monitor the Performance of Altcoins: The report highlights the performance of various altcoins over the past week. Monitoring the performance of these altcoins could provide insights into potential investment opportunities.