Research Summary

The report provides an in-depth analysis of the latest trends in the crypto and DeFi markets. It highlights key developments such as Raydium’s record-high fees, North Korean hackers infiltrating job boards, and the introduction of Chain GDP. The report also discusses investment opportunities in tokenized treasuries and the expected staking on Starknet.

Key Takeaways

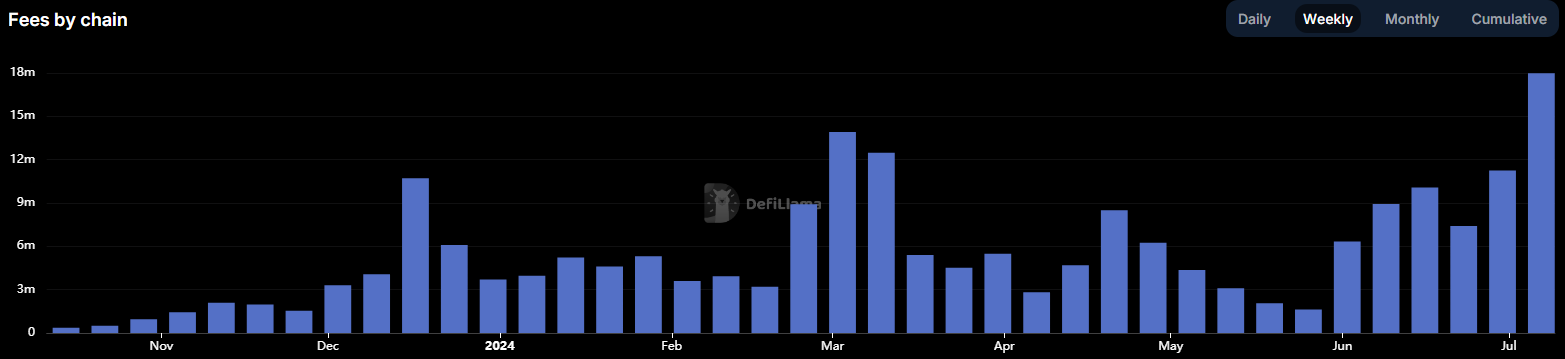

Raydium’s Record-High Fees

- Raydium’s Revenue Surge: Raydium, an on-chain AMM order book on Solana, had its highest fee-earning week ever, surpassing Ethereum, Tron, Solana, and Uniswap. This surge in fees followed Raydium’s support for easy Twitter Blink creation for assets and a boom in “politifi” memecoins.

North Korean Hackers’ Infiltration

- North Korean Cyber Threat: North Korean hackers have been infiltrating job boards, earning the country up to $600 million annually, according to the UN. This highlights the increasing cybersecurity risks in the digital space.

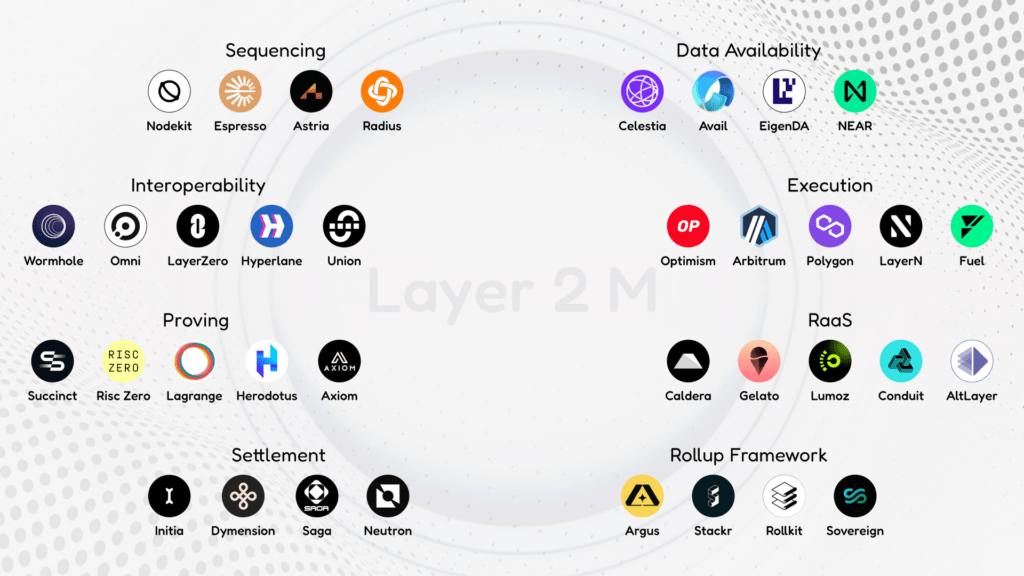

Introduction of Chain GDP

- Chain GDP as a New Metric: The report introduces Chain GDP, a proposed metric to accurately capture economic activity on a blockchain. This could provide a more comprehensive understanding of the economic value generated within the crypto ecosystem.

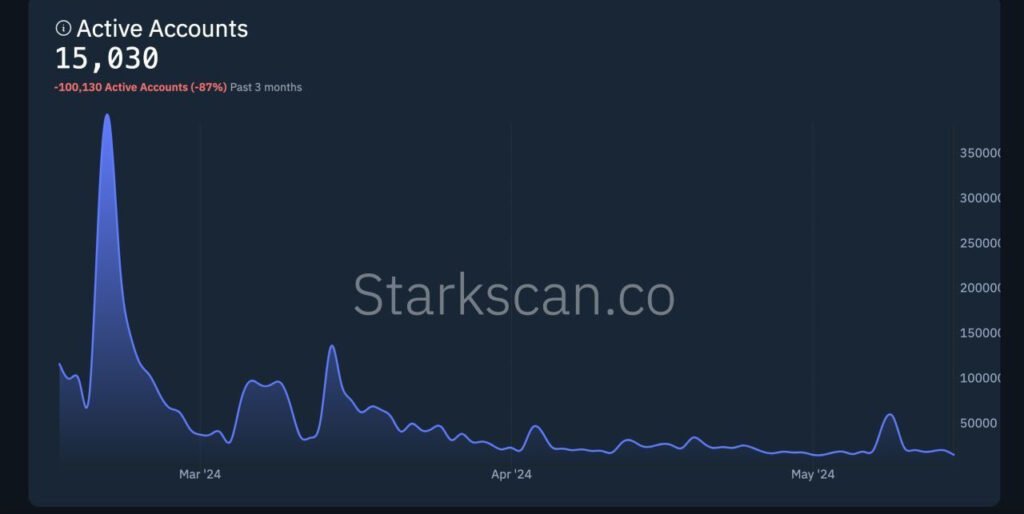

Starknet Staking

- Starknet’s Staking Plan: Starknet is expected to introduce staking by Q4. Stakers will have to lock their tokens for 21 days before they can withdraw, indicating a potential increase in the platform’s liquidity.

Crypto Investment Products

- Investment Inflows: Crypto investment products saw $1.4 billion in inflows last week, with Bitcoin having the 5th largest weekly inflows this year. This suggests a growing interest in crypto as an investment asset class.

Actionable Insights

- Monitor Raydium’s Performance: Given Raydium’s record-high fees, it may be worthwhile to monitor its performance and the factors contributing to its revenue surge.

- Assess Cybersecurity Measures: The infiltration by North Korean hackers underscores the importance of robust cybersecurity measures in the digital space, particularly for job boards and similar platforms.

- Understand Chain GDP: The introduction of Chain GDP as a new metric could provide a more comprehensive understanding of economic activity on a blockchain. It may be beneficial to understand how this metric is calculated and its potential implications.

- Consider Staking on Starknet: With the expected introduction of staking on Starknet, potential stakers should consider the platform’s staking terms and potential returns.

- Track Crypto Investment Trends: The significant inflows into crypto investment products indicate a growing interest in crypto as an investment asset class. Tracking these trends could provide insights into investor sentiment and market dynamics.