Research Summary

This report discusses the concept of market caps, fully diluted valuations (FDV), and token unlocks in the context of cryptocurrency investments. It explains how these factors can influence the perceived value of a crypto asset and how they can be manipulated to create paper profits. The report also highlights the importance of understanding these concepts for making informed investment decisions.

Key Takeaways

Understanding Market Caps and Fully Diluted Valuations

- Market Cap Definition: The market cap of a crypto asset is the price multiplied by the amount of coins/tokens that are currently in circulation.

- Fully Diluted Valuation (FDV) Definition: FDV is the price multiplied by the total amount of coins/tokens that will ever exist for that asset. The FDV is always larger than or equal to the market cap.

- Market Cap vs FDV: While market cap is a measure of public buying demand, FDV is a measure of supply. This distinction can lead to confusion when interpreting fully-diluted valuations.

Impact of Token Unlocks on Market Dynamics

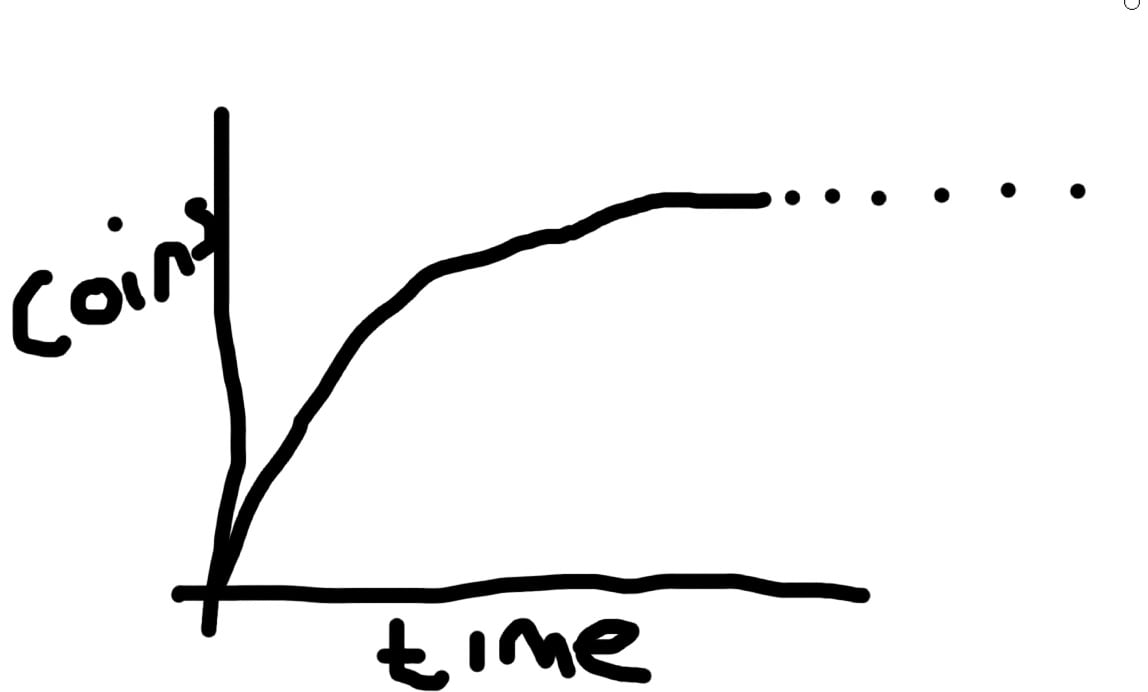

- Token Unlocks: Token unlocks can increase supply but not necessarily demand. This can lead to a decrease in token price unless there is an active market for the locked tokens.

- Locked Tokens Trading: Professional and sophisticated investors often trade locked coins using trust and legal enforcement as their guarantees. They buy or sell locked coins at a discount to the market price and sign contractual obligations to send the coins as they become unlocked.

- Unlock Events: Unlock events can be bearish or bullish depending on the market dynamics. If there has been an active Over-The-Counter (OTC) market for the locked coins and ‘weak hands’ have sold to higher conviction investors, then an unlock event is effectively just the removal of “fear”.

Identifying Bullish or Bearish Unlocks

- Professional Funds: Professional funds often decide whether it’s a better risk-adjusted trade to buy locked coins for a discount or open market coins. Longer-time horizon investors generally try to get the lowest priced entry possible and therefore don’t mind buying locked coins.

- Unlock Evaluation: The main way to figure out if an unlock may be bullish is to evaluate the quality of the project. Good proxies for this evaluation could be active users, Total Value Locked (TVL), or product-market fit.

- Institutional Interest: If a token has institutional interest, it’s likely that funds have tried to purchase locked tokens if there are any.

Understanding Unlock Schedules

- Unlock Schedules: It’s important to know the unlock schedule as well as estimating the off-market tokens’ current cost-basis. This can help inform whether there is additional bid demand from professional investors, or lots of high-profit multiples itching to be sold.

- Implications of High FDV: Every single high FDV project’s fully diluted valuation will eventually become unlocked. Investors should consider the implications of when and how that happens.

- Relative Valuations: Crypto valuation models are difficult because the ceiling is very high and direct financialisation of everything with 24/7 liquid markets is relatively new. Relative valuations can also be misleading due to anchoring effects.

Actionable Insights

- Understanding Market Dynamics: Investors should understand the dynamics of market caps, FDV, and token unlocks to make informed investment decisions.

- Assessing Project Quality: Evaluating the quality of a project can help determine whether an unlock event might be bullish or bearish.

- Considering Unlock Schedules: Investors should consider the unlock schedule and the current cost-basis of off-market tokens when making investment decisions.