Research Summary

The report provides an in-depth analysis of the growing trend of tokenizing real-world assets (RWAs) on public blockchains. It highlights the activities of key players such as BlackRock, Franklin Templeton, Figure, Tether, and Paxos. The report also discusses the role of platforms like Centrifuge, Provenance, Ondo Finance, and Clearpool in facilitating the tokenization of RWAs.

Key Takeaways

Transition from Private to Public Blockchains

- Shift in Asset Management: Initially, RWAs were primarily issued on private, permissioned blockchains like Nasdaq Linq and JPM Quorum. However, asset managers have increasingly turned to public blockchains for interoperability. Recent public blockchain issuances have come from asset managers like BlackRock (Ethereum) and Franklin Templeton (Stellar & Polygon).

Tokenization of Consumer Loans

- Figure’s Dominance: Figure has been extremely active in the tokenization space, maintaining over $7B in consumer loans onchain. Specifically, Figure originates Home Equity Lines of Credit (HELOC) on the Provenance Blockchain and was recognized as the largest non-bank HELOC provider in the USA in 2022.

Emergence of Composable RWA Products

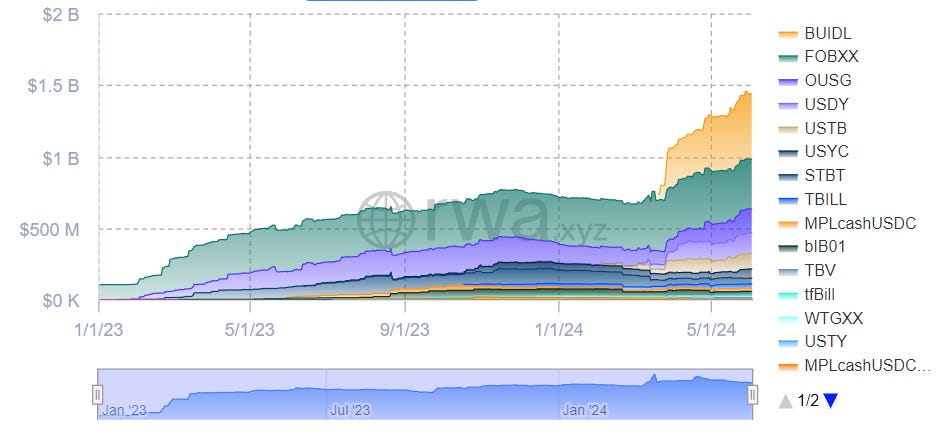

- BlackRock and Securitize’s Innovation: In April, BlackRock and Securitize launched $BUIDL, a tokenized money market fund (MMF) on Ethereum. Now the largest tokenized MMF, it boasts over $427M in AUM. Other tokenized treasury products are exploring ways to leverage its infrastructure.

Decentralized Credit Marketplace

- Clearpool’s Milestone: Clearpool, a decentralized credit marketplace, recently hit a major milestone with $500M in total loans originated. It provides a separate permissioned platform, Clearpool Prime, to meet the KYC and AML compliance needs of institutional market participants.

Tokenization of Real-World Assets

- Centrifuge’s Role: Centrifuge is the platform for tokenizing real-world assets onchain. One of its products, Centrifuge Prime, provides DAOs the onchain infrastructure and support to allocate their treasury to RWAs. Gnosis DAO recently executed an onchain investment of $1M USDC into the Anemoy Liquid Treasury Fund pool on Centrifuge.

Actionable Insights

- Explore the Potential of Public Blockchains: With asset managers increasingly turning to public blockchains for interoperability, it may be beneficial to explore the potential of these platforms for tokenizing real-world assets.

- Consider the Role of Tokenization: Given Figure’s success in tokenizing consumer loans, it may be worth considering the role of tokenization in other areas of finance.

- Monitor the Growth of Composable RWA Products: The success of BlackRock and Securitize’s $BUIDL suggests that composable RWA products could become increasingly important in the future.

- Assess the Impact of Decentralized Credit Marketplaces: Clearpool’s milestone of $500M in total loans originated highlights the potential impact of decentralized credit marketplaces on the finance industry.

- Understand the Benefits of Tokenizing Real-World Assets: Centrifuge’s role in providing onchain infrastructure for DAOs to allocate their treasury to RWAs underscores the benefits of tokenizing real-world assets.