Research Summary

The report provides a comprehensive analysis of Osmosis, a decentralized exchange (DEX) in the Cosmos ecosystem. It discusses the platform’s performance, key metrics, and future plans, including its integration with Celestia, a data availability layer. The report also highlights the changes in trading volume, total value locked (TVL), and fees paid on Osmosis in the third quarter.

Key Takeaways

Osmosis Performance and Key Metrics

- Trading Volume: The report reveals that trading volume on Osmosis fell by 17% in the third quarter. The most significant drops were seen in wBTC and wETH, which fell by 27% and 34% respectively. Despite a 34% drop in token price, OSMO trading volume only fell by 20%.

- Total Value Locked (TVL): TVL on Osmosis fell below $100 million in the third quarter. However, trading fees paid in the quarter still totaled over $1 million, providing liquidity providers with over 4% APY from trading fees alone.

- Transaction Activity: The number of swapping transactions on Osmosis fell by 59% in the third quarter. Liquidity Provider (LP) actions and Osmosis staking also saw a decrease in transactions by 58% and 46% respectively.

- OSMO Tokenomics: The report notes that OSMO tokenomics and inflation updates have brought the annualized inflation rate close to single digits, with circulating supply increasing only 2.8% in the third quarter.

Osmosis Integration with Celestia

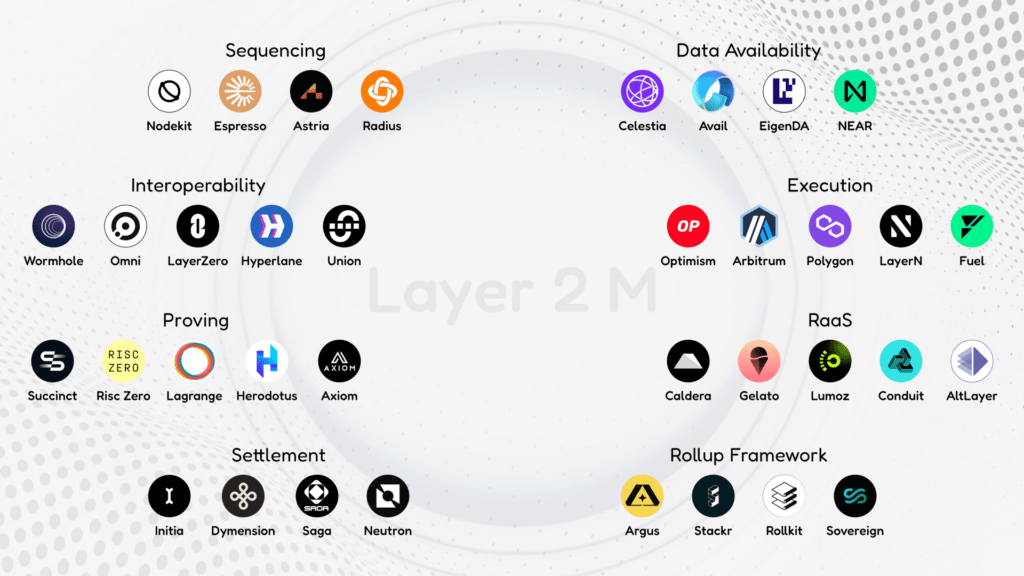

- Expansion Beyond Cosmos: Osmosis is planning to integrate with Celestia’s data availability layer, marking a significant expansion beyond the Cosmos ecosystem. This integration aims to bridge liquidity between rollups on Celestia and existing IBC-connected chains.

- Trust-minimized Bridging System: In collaboration with Hyperlane, Osmosis plans to develop a trust-minimized bridging system that eliminates reliance on trusted third parties and chain operators during cross-rollup transactions. This system would enhance security through state transition verification and a fraud-proof mechanism.

Actionable Insights

- Investigate the Potential of Osmosis: Given the platform’s plans to integrate with Celestia and expand beyond the Cosmos ecosystem, there may be potential for increased liquidity and user activity on Osmosis. This could present opportunities for liquidity providers and traders on the platform.

- Monitor OSMO Tokenomics: The report highlights that OSMO tokenomics and inflation updates have brought the annualized inflation rate close to single digits. This could have implications for the value of OSMO tokens and may be worth monitoring for potential investors.

- Consider the Impact of Decreased Trading Activity: The decrease in trading volume and transaction activity on Osmosis in the third quarter could impact the platform’s performance and the returns for liquidity providers. This trend should be considered when evaluating the potential of Osmosis.