Research Summary

The report covers a range of governance actions and their implications in the crypto space. It discusses Arbitrum’s staking proposal, the controversy surrounding LayerZero and Lido’s OFT, and Uniswap’s investment in Ekubo. The report also touches on various other proposals and discussions within the crypto community, including those from Aave, dYdX, Sushiswap, and others.

Key Takeaways

Arbitrum’s Staking Proposal

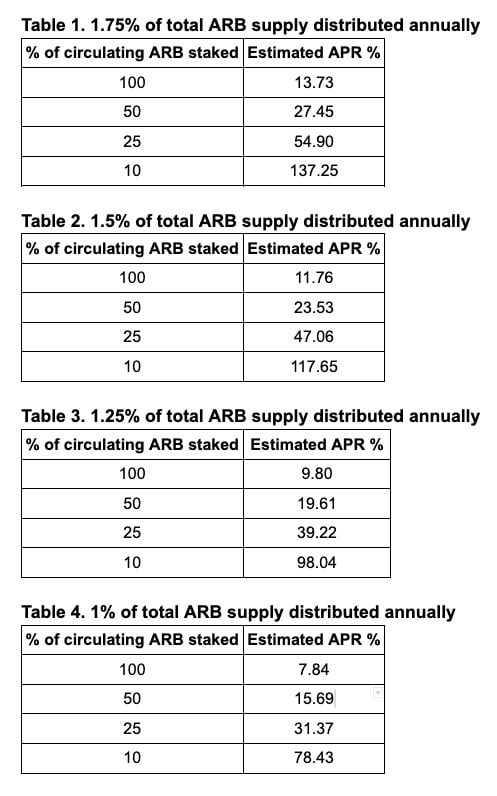

- Proposal Overview: Plutus DAO has proposed a native staking model for ARB holders, with rewards distributed based on lock time. The proposal aims to increase interest in the ARB token and reward long-term stakers.

- Implications: The estimated APRs are attractive for a one-year lock, and the introduction of a lock mechanism benefits PlutusDAO and plsARB. If the proposal passes, the utility of plsARB as a liquid locker will likely increase.

- Likelihood of Passing: The proposal has a medium to high chance of passing, with the snapshot vote showing 175m ARB leading with 53.5% of the votes.

LayerZero / Lido OFT Controversy

- Controversy Overview: LayerZero created an unauthorized bridge for Lido’s staked Ether (stETH) token, causing backlash from the community. LayerZero did not have Lido DAO’s permission to deploy.

- Implications: The controversy could accelerate the adoption of native wstETH on alternative chains, reducing liquidity fragmentation.

- Likelihood of Passing: The proposal is unlikely to move to snapshot in its current form.

Uniswap’s Investment in Ekubo

- Investment Overview: Uniswap DAO has voted to invest $12m worth of UNI tokens from its treasury to support Ekubo, an AMM on Starknet, in exchange for a 20% share of the Ekubo token.

- Implications: The UNI tokens will likely be used to fund operations for Ekubo operations, leading to selling pressure. The implied valuation of 60m FDV seems rich considering Ekubo’s current TVL.

- Results: The temperature snapshot vote saw 64% voting for the proposal, despite opposition from forum participants.

Actionable Insights

- Monitor Arbitrum’s Staking Proposal: Keep an eye on the progress of Arbitrum’s staking proposal, as its passing could increase the utility of plsARB as a liquid locker.

- Assess Impact of LayerZero / Lido Controversy: Evaluate the potential impact of the LayerZero / Lido controversy on the adoption of native wstETH on alternative chains.

- Track Uniswap’s Investment in Ekubo: Monitor Uniswap’s investment in Ekubo and its potential impact on Ekubo’s operations and valuation.