Research Summary

The report discusses the recent developments in the DeFi and NFT sectors, focusing on the launch of Prisma Finance, a CDP protocol, and its governance token $PRISMA. It also highlights the significant growth in Total Value Locked (TVL) in Prisma, largely contributed by Justin Sun. The report further discusses the yield opportunities in Prisma and the potential risks. It also covers the performance of altcoins and the recent exploits of trading bot’s routers.

Key Takeaways

Prisma Finance’s Launch and Growth

- Launch of Prisma Finance: Prisma Finance, a CDP protocol built on the Liquity codebase, was launched in late September. It allows users to deposit various ETH Liquid staking derivatives as collateral and mint their native stablecoin mkUSD.

- Significant Growth in TVL: The launch of the governance token $PRISMA led to a significant increase in Prisma’s TVL, growing from ~$85m to $300m+ within a few days. Justin Sun contributed over 60,000 wstETH, representing over 1/3 of the current TVL.

Yield Opportunities and Risks in Prisma

- Attractive Yield Opportunities: Prisma offers attractive yield opportunities for those with idle ETH. Despite a 50% haircut for immediate claiming and a 1% mkUSD minting fee, the yields still look favorable.

- Potential Risks: Some farmers are buying mkUSD at market and farming with it to avoid locking up collateral and the 1% minting fee. However, as most farmers are insta-claiming and dumping the token, there could be a risk of capital flow if the yields dry up as $PRISMA price dwindles.

Performance of Altcoins and Onchain Shenanigans

- Altcoins Performance: The report highlights a great week for altcoins with Solana running up almost 50%. The emergent meme sector also had a phenomenal first half of the week, with fresh coins testing the $30-40m range.

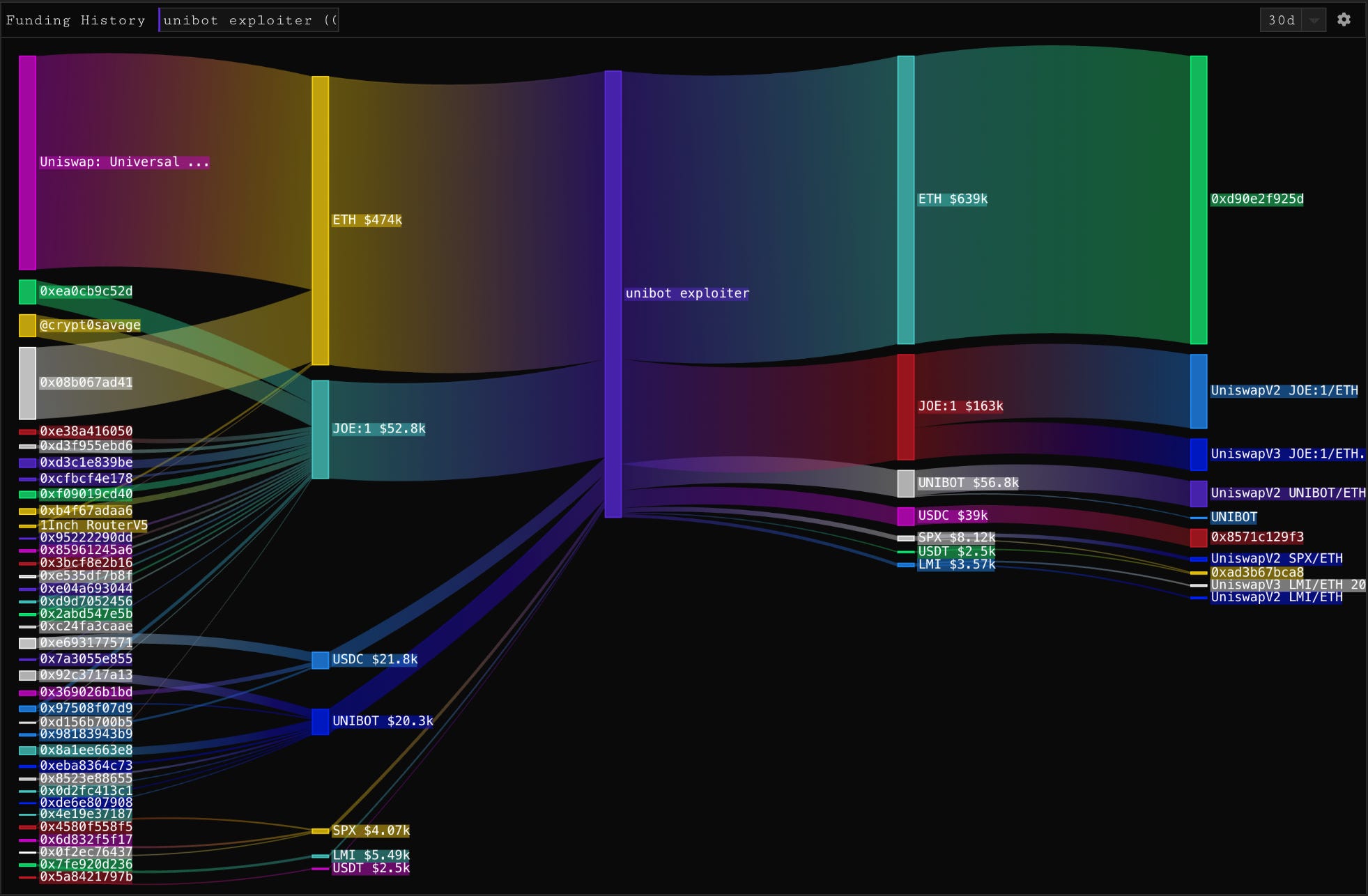

- Trading Bot’s Router Exploits: The report mentions the second exploit of a trading bot’s router in 10 days, with the hacker stealing and selling any tokens that a user had approved on the new router. However, all affected users were refunded.

Actionable Insights

- Monitor Prisma’s Performance: Given the significant growth in Prisma’s TVL and the attractive yield opportunities, it would be beneficial to monitor its performance and the potential risks associated with it.

- Investigate Altcoins: With the strong performance of altcoins, it would be worth investigating these coins for potential opportunities.

- Stay Alert to Security Risks: The recent exploits of trading bot’s routers highlight the importance of staying alert to security risks in the DeFi and NFT sectors.