Research Summary

The report discusses the recent upgrade of dYdX to version 4, which has transitioned to a standalone blockchain based on the Cosmos SDK and Tendermint Proof-of-stake consensus protocol. The report also highlights the shift in the onchain environment, noting a significant change in the types of coins that are successful and the participants involved.

Key Takeaways

dYdX v4: A Significant Upgrade

- Transition to Standalone Blockchain: dYdX v4 has transitioned to a standalone blockchain based on the Cosmos SDK and Tendermint Proof-of-stake consensus protocol. This move allows for full customizability over how the blockchain works and further decentralization.

- Changes to DYDX Token: The DYDX token, previously used for governance, will now be used for validation with stakers receiving trading fees from the exchange. This change is expected to provide real cash flow yield for the token.

- Value Transfer to New Chain: Over $1.3 billion of value or 350 million+ DYDX tokens have been bridged to the new chain.

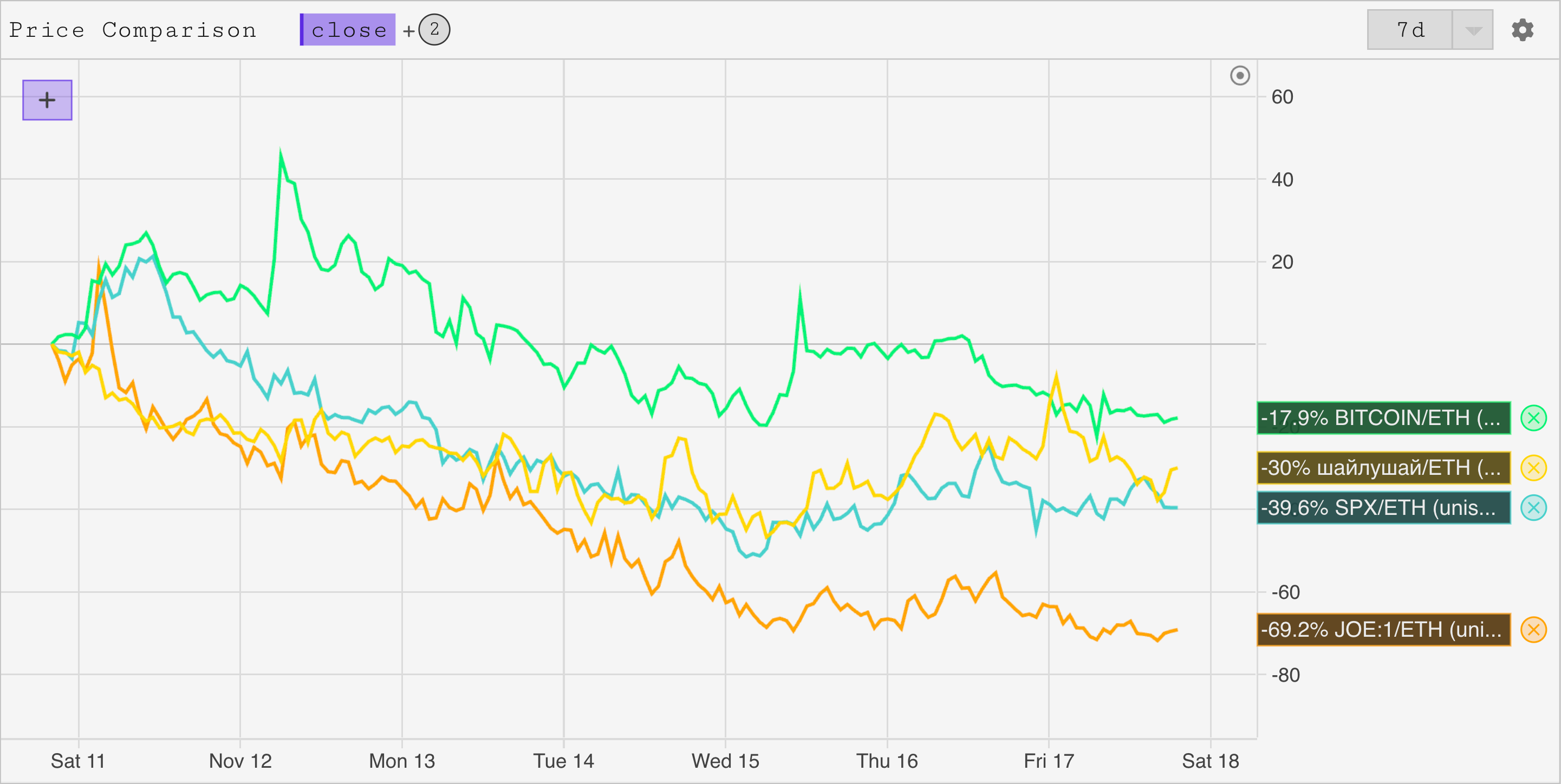

Market Volatility and Token Liquidity

- Anticipated Volatility: Despite the positive momentum surrounding dYdX, the report anticipates significant volatility in early December when Team and Investor tokens become liquid for the first time.

The Onchain Shift

- Shift in Participant Demographics: The report notes a significant shift in the onchain environment, with a change in the types of coins that are successful and the participants involved. This shift is believed to be correlated with the wider market’s price appreciation.

- Changing Audience for Meme Coins: The report suggests that the audience for meme coins is changing and growing, and that these coins need to have mainstream appeal to achieve exponential growth.

Actionable Insights

- Monitor the Impact of dYdX v4: The transition of dYdX to a standalone blockchain and the changes to the DYDX token could have significant implications for the platform’s performance and the token’s value. Stakeholders should monitor these developments closely.

- Prepare for Potential Volatility: The anticipated volatility in early December when Team and Investor tokens become liquid could present both risks and opportunities. Stakeholders should prepare accordingly.

- Understand the Changing Onchain Environment: The shift in the onchain environment, including the changing demographics of participants and the types of successful coins, could have significant implications for investment strategies. Stakeholders should seek to understand these changes and adjust their strategies accordingly.