Research Summary

The report discusses the recent 13F filings for Q1, highlighting the increasing interest of institutional investors in the crypto market. It focuses on two significant filings: a $1.94bn position by Millennium Management in Blackrock’s ETF (IBIT) and a $164m allocation by the State of Wisconsin Investment Board (SWIB) in both IBIT and GBTC.

Key Takeaways

Institutional Interest in Crypto

- Increasing Institutional Participation: The report indicates a growing interest from institutional investors in the crypto market, as evidenced by the recent 13F filings. This shift suggests that the long-anticipated arrival of institutions in the crypto space is becoming a reality.

- Blackrock’s ETF as Preferred Instrument: Blackrock’s ETF (IBIT) appears to be the instrument of choice for most institutional investors venturing into crypto. The ETF has shown impressive growth, with $16.65bn in AUM, up from zero just a few months ago.

Significant 13F Filings

- Millennium Management’s Position: Millennium Management, a global multi-strategy hedge fund with over $61.1bn AUM, reported a substantial $1.94bn position. However, the report suggests that this might not be a directional position, as it could be related to non-directional basis trading.

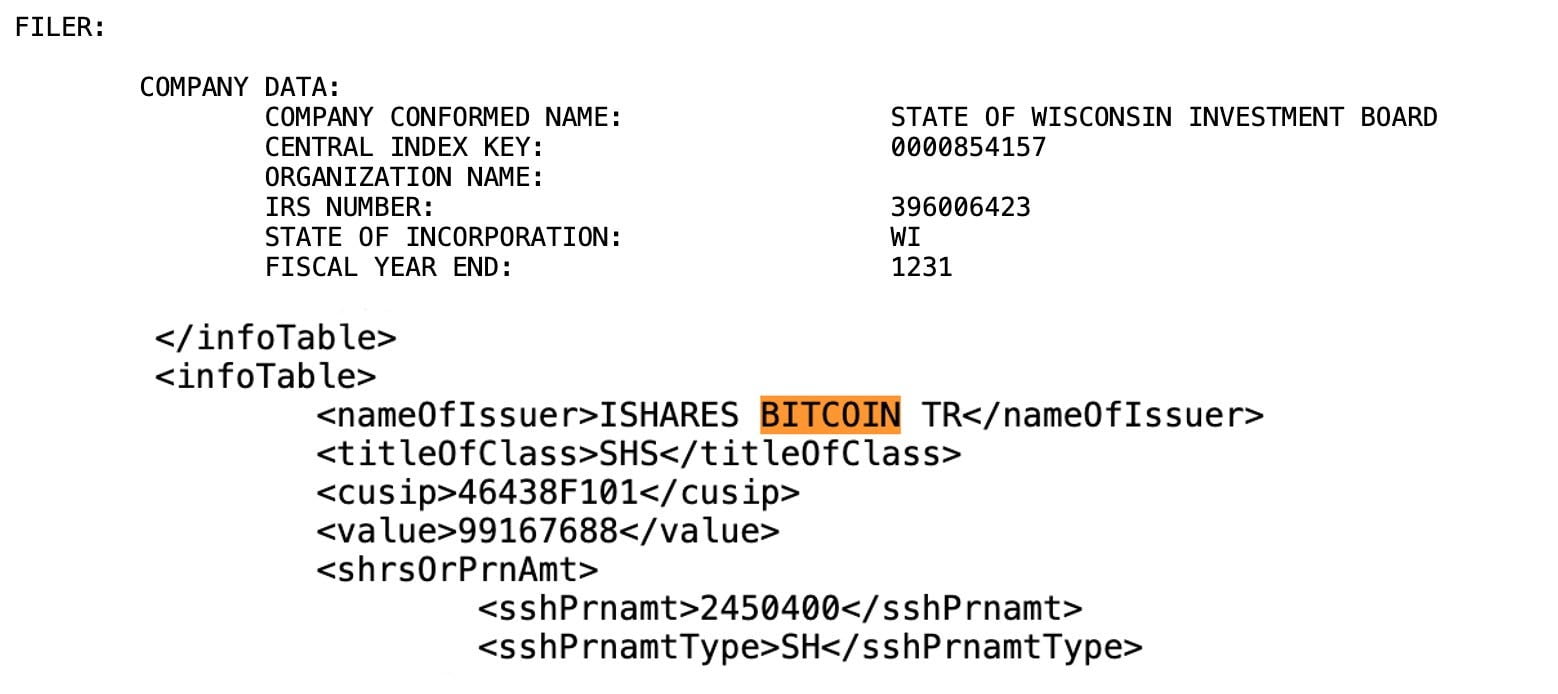

- State of Wisconsin Investment Board’s Allocation: The SWIB, which manages $156bn in assets, allocated $164m in both IBIT and GBTC. This allocation, although small in relation to SWIB’s total AUM, is significant as it represents a public pension fund investing almost directly into BTC.

Implications for the Crypto Market

- Long-term Investment Potential: Pension funds, known for their long-term investment orientation, are showing interest in crypto. The report suggests that SWIB’s position is likely to grow over time, indicating potential long-term institutional investment in the crypto market.

- Watershed Moment for Crypto: The report describes SWIB’s investment as a watershed moment for crypto, signaling the potential for more pension funds to invest in the sector. Given the slow-moving nature of these funds, this could be the start of a trend that will continue into the future.

Actionable Insights

- Monitor Institutional Activity: The increasing institutional interest in crypto suggests that market participants should closely monitor institutional activity, as it could significantly impact the crypto market.

- Understand Investment Strategies: It’s crucial to understand the investment strategies of institutional investors, such as Millennium Management’s potential non-directional basis trading, to gain insights into market trends.

- Consider Long-term Implications: The entry of pension funds into the crypto market could have long-term implications. Market participants should consider these potential impacts when making strategic decisions.