Research Summary

The report provides an in-depth analysis of the tokenized US treasury market, highlighting key players, market growth, and investor trends. It emphasizes the dominance of Franklin Templeton and Ondo Finance, the significant market growth, and the increasing investor interest in tokenized US treasuries.

Key Takeaways

Market Dominance of Franklin Templeton and Ondo Finance

- Franklin Templeton’s Market Leadership: As the largest tokenized US treasury issuer, Franklin Templeton holds 44.6% of the market share with a market capitalization of $210.8 million.

- Ondo Finance’s Strong Position: Ondo Finance is the second-largest issuer, controlling 25.3% of the market and boasting a market capitalization of $178.4 million.

Significant Market Growth

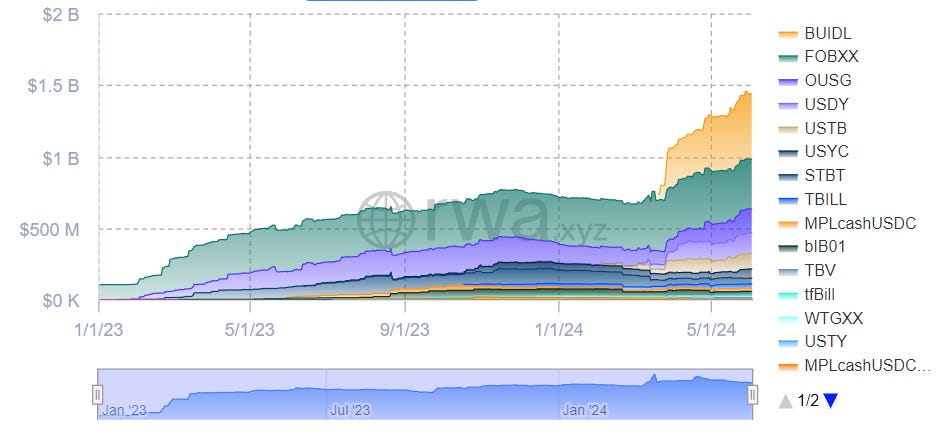

- Impressive Year-to-Date Growth: The tokenized US treasury market has grown by 518.3% from January to October, with the sector’s market cap increasing from $113.9 million to $704.4 million.

- Quarterly Increase in Market Cap: 10 out of the 11 protocols offering tokenized US treasuries saw a quarterly increase in market cap of 21.5% or $124.4 million.

Emerging Players and Networks

- Emergence of New Players: Newcomers to the tokenized treasuries space are quickly gaining traction, with eight out of 11 protocols launched in 2023.

- Ethereum and Stellar’s Dominance: Ethereum is the largest network for tokenized US treasuries, accounting for 48.4% of the total market cap in October 2023, followed by Stellar with 45.9%.

Investor Trends

- Investor Interest in Tokenized US Treasuries: Investors are increasingly seeking tokenized US treasuries to capture higher returns as global interest rates rise and yields in the crypto market decline.

Actionable Insights

- Monitor the Performance of Dominant Players: Keep an eye on the strategies and performance of Franklin Templeton and Ondo Finance, as they currently dominate the tokenized US treasury market.

- Investigate the Potential of Emerging Players: Consider the potential of newcomers in the tokenized treasuries space, as they are quickly gaining traction.

- Assess the Impact of Rising Global Interest Rates: Evaluate how rising global interest rates and declining crypto market yields are driving investor interest towards tokenized US treasuries.