Research Summary

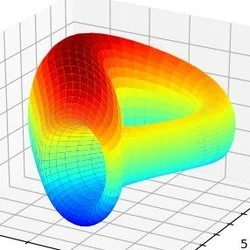

The article discusses the recent proposal to deploy the $wstETH market for $crvUSD on Curve Finance. This proposal has led to a 15x increase in its debt ceiling from $10M to $150M. The article explores the effectiveness of $crvUSD, especially in the context of the recent SEC drama against Binance and Coinbase. Despite a 4% price drop in $ETH, liquidation losses on $crvUSD loans only amounted to 0.6% on average. The article further discusses Curve’s Lending-Liquidating AMM Algorithm (LLAMMA), which allows for soft liquidation of positions across a price range and more efficient use of collateral. However, the article also warns of the possibility of hard liquidation in the event of a rapid price fall.

Actionable Insights

- Monitor Regulatory Developments: Keep an eye on regulatory actions such as the recent SEC drama against Binance and Coinbase, as they can significantly impact crypto prices and consequently, the performance of products like $crvUSD.

- Assess Investor Behavior: Track the utilization of the debt ceiling for $crvUSD. As of the time of writing, only 9.55% of the debt ceiling is being utilized, indicating flat demand for $crvUSD.

- Stay Informed on Exchange Activity: Follow the developments on Curve Finance, especially the deployment and testing of $crvUSD at scale. This can provide insights into the performance and potential of $crvUSD.

- Understand Liquidation Mechanisms: Familiarize yourself with Curve’s LLAMMA, which allows for soft liquidation and more efficient use of collateral. However, be aware of the potential for hard liquidation in the event of a rapid price fall.