Research Summary

The report discusses the bullish trend of Solana’s price, supported by a breakout from a descending channel pattern and rising RSI. It also highlights the filing of the first-ever Solana ETF by VanEck with the SEC. The report proposes a Call Ratio Spread strategy for traders who believe in Solana’s bullish trend.

Key Takeaways

Solana’s Bullish Trend

- Breakout from Descending Channel: Solana’s price has broken out of a descending channel pattern, indicating a bullish trend. This breakout is supported by the rising Relative Strength Index (RSI) from oversold levels.

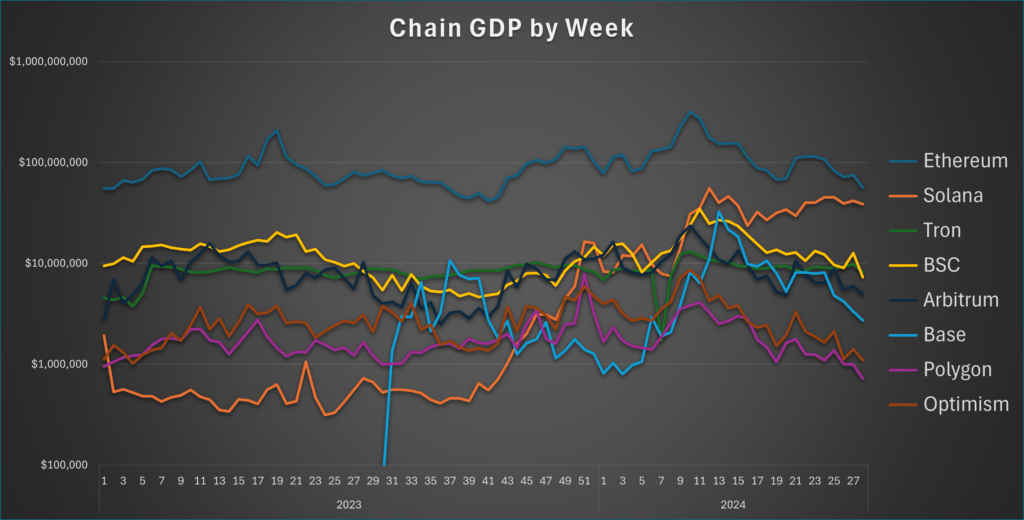

- Strong Market Demand: Solana’s strong market demand and highly decentralized network make it stand out among other crypto assets. Its high-performance blockchain platform is known for scalability and low transaction fees.

VanEck’s Solana ETF

- First-Ever Solana ETF: Wealth Manager VanEck has filed for the first-ever Solana ETF with the SEC, highlighting Solana’s strong market demand and decentralized network. This move signifies the expansion of VanEck’s crypto offerings with a Solana trust.

Call Ratio Spread Strategy

- Trade Structure: The proposed Call Ratio Spread strategy involves buying an OTM Call option and then selling two Calls of the same expiry, further OTM. The strategy targets a spot level of less than $170.

- Maximum Profit and Net Credit: The strategy offers a maximum profit of $100.3 per contract and a net credit of $0.3 per contract. However, significant losses are possible due to the position’s net short Call exposure.

Actionable Insights

- Consider the Call Ratio Spread Strategy: Traders who believe in Solana’s bullish trend might consider initiating the proposed Call Ratio Spread strategy. This involves buying a higher strike Call option and simultaneously selling Calls in double the quantity of a higher strike price.

- Monitor Solana’s Price Action: Traders should closely monitor Solana’s price action, particularly its breakout from the descending channel pattern and rising RSI, to make informed trading decisions.

- Keep an Eye on VanEck’s Solana ETF: The filing of the first-ever Solana ETF by VanEck with the SEC is a significant development. Traders should keep an eye on this as it could potentially impact Solana’s price.