Research Summary

The report provides a comprehensive analysis of the BNB Smart Chain (BSC) for Q3. It covers key metrics such as active validators, token-burning mechanism, total value locked (TVL) in DeFi, and the impact of Binance’s adverse events. The report also discusses the launch of opBNB, the development of BNB Greenfield, and the performance of various applications on BSC.

Key Takeaways

BNB Smart Chain Performance and Developments

- Active Validators and Token Burning: The number of active validators on BSC grew by 10% QoQ, indicating increased network security. BNB’s token-burning mechanism led to a 1.3% decline in circulating supply, contributing to its deflationary nature.

- Impact of Binance’s Adverse Events: Despite Binance’s adverse events, including lost partnerships and SEC allegations, BNB maintained its position as the fourth-largest cryptoasset by market capitalization, at $35.3 billion.

- Launch of opBNB and Development of BNB Greenfield: BNB Chain launched its optimistic rollup, opBNB, in Q3 and made progress in developing BNB Greenfield, a storage network planned to launch in Q4.

- Onchain Activity and Fee Changes: BNB Chain’s onchain activity in Q3 reflected market speculation, with a decline in revenue and transactions. The average fee in BNB dropped by 12% in Q3, suggesting less complex tasks being performed on BSC.

Applications and DeFi on BNB Smart Chain

- Applications Growth: Applications like Friend3, a messaging application, and XCAD Network, a watch-to-earn platform, experienced significant growth in unique active wallets (UAW) in Q3.

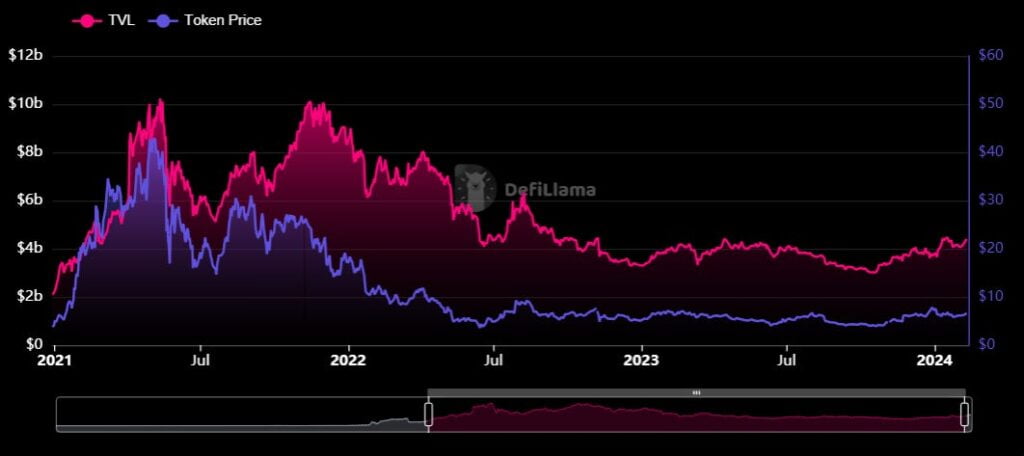

- DeFi Total Value Locked (TVL): The value locked in DeFi on BSC remained relatively steady in Q3, with changes measured in BNB reflecting changes in activity.

- Stablecoin Transfers and GameFi: Stablecoin transfers and GameFi experienced declines in Q3, while DeFi helped anchor these declines.

- NFT Space Performance: The NFT space on BSC performed strongly in Q3, with an increase in secondary sales volume and growth in unique buyers and sellers.

Actionable Insights

- Investigate the Potential of opBNB: The launch of opBNB, an EVM-compatible optimistic rollup, may have attracted new users, potentially diverting them from BSC. This could present opportunities for developers and investors.

- Monitor the Impact of Binance’s Adverse Events: Despite Binance’s adverse events, BNB maintained its position as the fourth-largest cryptoasset by market capitalization. It’s crucial to monitor how these events continue to impact BNB’s performance.

- Explore the Growth of Applications on BSC: Applications like Friend3 and XCAD Network experienced significant growth in Q3. This suggests potential opportunities for developers and investors in these and similar applications.

- Assess the Performance of DeFi and NFTs on BSC: Despite declines in stablecoin transfers and GameFi, DeFi and NFTs performed strongly on BSC in Q3. This could present opportunities for developers and investors in these sectors.