Research Summary

The report provides a comprehensive analysis of Filecoin’s performance in Q3’23. It covers key metrics such as storage deals, storage utilization, client onboarding, and revenue. The report also discusses the introduction of the Filecoin Virtual Machine (FVM) and its impact on the network, including the growth of net deposits and borrows. It further explores the Filecoin ecosystem, including use cases, accelerators, and hackathons, and provides a qualitative analysis of key events and releases.

Key Takeaways

Filecoin’s Storage Market Growth

- Active Deals Increase: Filecoin’s active storage deals grew by 45% QoQ and nearly 10x YoY in Q3’23. This growth indicates an increasing demand for Filecoin’s decentralized storage.

- Storage Utilization vs. Capacity: Despite a 10% QoQ decrease in Filecoin’s storage capacity, storage utilization grew from 7.6% in Q2’23 to 12.6% in Q3’23. This suggests that the network is being used more efficiently.

- Client Onboarding: Nearly 1,900 clients onboarded datasets on Filecoin by the end of Q3’23. Of these, 422 clients onboarded large datasets (over 1,000 TiB in storage size), marking a 25% QoQ increase.

Filecoin’s Revenue Decline

- Protocol Revenue Decrease: Filecoin’s protocol revenue from storage fees decreased by 68% in FIL terms (73% in USD terms) in Q3’23. This decline aligns with the overall decrease in demand-side revenue across the decentralized cloud storage space.

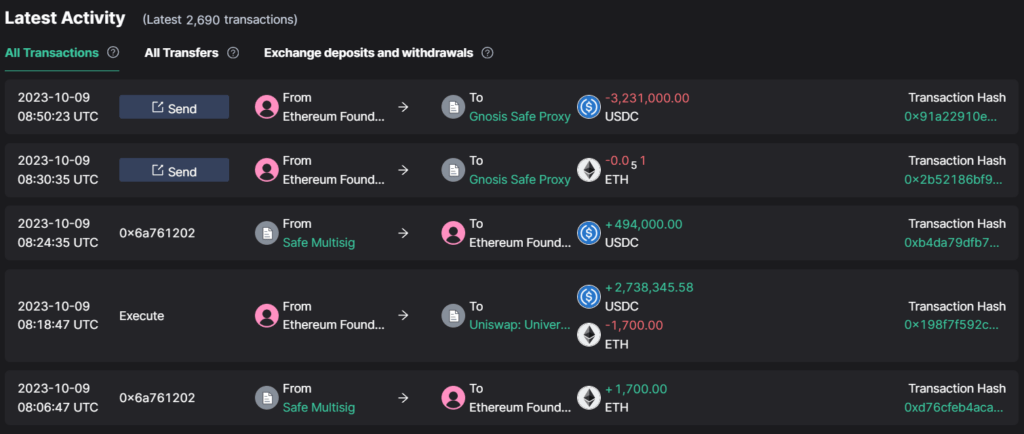

Filecoin Virtual Machine (FVM) Impact

- Smart Contracts and New Use Cases: The introduction of the FVM brought Ethereum-style smart contracts to Filecoin, enabling new use cases such as liquid staking, perpetual storage, and decentralized compute.

- Growth in Net Deposits and Borrows: Both net deposits and borrows on the FVM saw sustained growth in Q3’23, indicating increased activity and engagement on the platform.

Filecoin Ecosystem Development

- Use Cases: As of September 2023, 115 known projects were developed within the Filecoin Ecosystem, with most offering data services. Other projects focused on media and entertainment, and specific data needs.

- Accelerators & Hackathons: Filecoin has been actively developing its ecosystem through partnerships with accelerators and hackathons, providing funding and support for early-stage projects and teams.

Key Events and Releases

- Partnerships: Filecoin partnered with Brave and ECC to enhance privacy features in the Brave browser. It also partnered with Consensys to launch the Consensys Scale Program, designed to assist blockchain ventures in the Seed to Series A stages.

- Releases: Filecoin proposed a timeline and scope for the upcoming V21 network upgrade, Watermelon. It also released VenusV1.13.0, which includes several updates and enhancements.

Actionable Insights

- Monitor the Impact of FVM: The introduction of the Filecoin Virtual Machine (FVM) has brought Ethereum-style smart contracts to Filecoin, enabling new use cases. Stakeholders should monitor the impact of these developments on the network’s performance and user engagement.

- Investigate the Potential of Filecoin’s Ecosystem: With 115 known projects developed within the Filecoin Ecosystem, there is potential for diverse applications and use cases. Stakeholders should explore these projects for potential collaborations or integrations.

- Assess the Implications of Revenue Decline: Filecoin’s protocol revenue from storage fees decreased significantly in Q3’23. Stakeholders should assess the implications of this decline and consider strategies to boost revenue.