Research Summary

The report covers a range of topics including Bitcoin Ordinals market trading volume, the number of Inscriptions minted on the Bitcoin blockchain, UniSat’s brc20-swap, the formation of a DeFi Committee by the Starknet Foundation, Optimism’s network upgrade, Evmos’ shift to Ethereum-based transactions, the launch of USDY by Mantle and Ondo Finance, Yuga Labs’ partnership with Magic Eden, Chainlink’s LINK staking, SushiSwap’s new tokenomics and launch on Filecoin, and Ava Labs’ layoffs.

Key Takeaways

Bitcoin Ordinals Market and Inscriptions

- Trading Volume Surge: On November 7th, the Bitcoin Ordinals trading market saw a trading volume exceeding $15.3 million, marking its historical second-highest level. OKX captured over 70% of the market share in trading volume.

- Inscriptions Growth: The cumulative number of Inscriptions minted on the Bitcoin blockchain has approached nearly 38 million, contributing over 2,400 BTC in transaction fees. There are more than 672,000 wallets holding Inscriptions assets.

UniSat and Starknet Foundation Developments

- UniSat’s brc20-swap: UniSat opened brc20-swap for addresses with over 1,000 UniSat points and enabled the withdrawal function for brc20-swap.

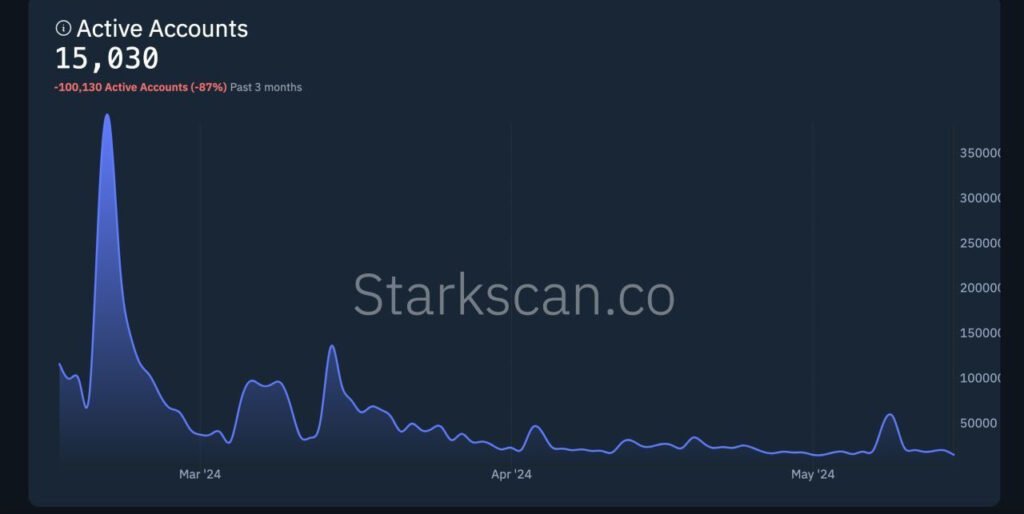

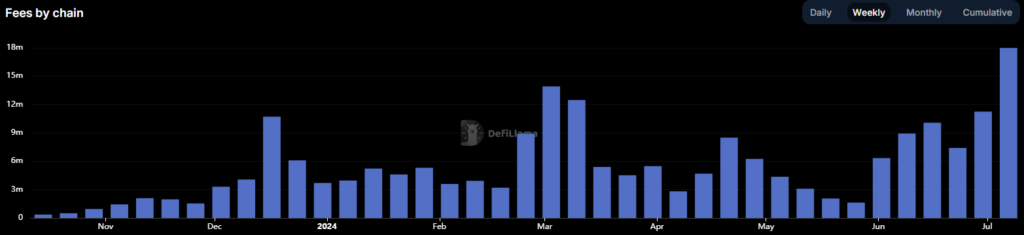

- Starknet Foundation’s DeFi Committee: The Starknet Foundation established a DeFi Committee to guide and develop the DeFi ecosystem on Starknet. A total budget of 50 million STRK has been allocated for the committee.

Network Upgrades and Shifts

- Optimism’s Network Upgrade: Optimism announced the first network upgrade after Bedrock, named Canyon, scheduled to activate on November 14th on the Superchain testnet.

- Evmos’ Shift to Ethereum: Evmos, an EVM-compatible chain within the Cosmos ecosystem, plans to discontinue support for Cosmos transactions and shift its focus to Ethereum-based transactions.

New Launches and Partnerships

- Launch of USDY: Mantle and Ondo Finance launched USDY, a stablecoin backed by Real World Assets, specifically short-term US Treasury bonds and bank demand deposits.

- Yuga Labs and Magic Eden Partnership: Yuga Labs partnered with Magic Eden to launch a new marketplace called Magic Eden ETH Market, the first Ethereum NFT marketplace that offers contractually protected royalties for creators.

Staking and Layoffs

- Chainlink’s LINK Staking: Chainlink announced the opening of LINK staking v0.2 for early access on December 8th. The LINK staking v0.2 pool has a capacity of 45 million LINK tokens, valued at approximately $650 million.

- Ava Labs’ Layoffs: Ava Labs conducted a large-scale layoff, affecting multiple teams, including communications and marketing. The layoffs affected 12% of Ava Labs’ employees.

Actionable Insights

- Monitor the Bitcoin Ordinals Market: Given the recent surge in trading volume, it may be beneficial to keep a close eye on the Bitcoin Ordinals market for potential trends and developments.

- Investigate the Potential of Inscriptions: With the growing number of Inscriptions minted on the Bitcoin blockchain, there may be potential opportunities in this area.

- Explore UniSat’s brc20-swap: UniSat’s brc20-swap could offer potential benefits for those holding over 1,000 UniSat points.

- Consider the Implications of Network Upgrades and Shifts: The network upgrade by Optimism and Evmos’ shift to Ethereum-based transactions could have significant implications for users and developers.

- Assess the Impact of New Launches and Partnerships: The launch of USDY and the partnership between Yuga Labs and Magic Eden could present new opportunities in the stablecoin and NFT marketplace sectors.

- Understand the Effects of Layoffs: Ava Labs’ layoffs could impact the company’s growth and strategy, which may be worth considering for stakeholders and potential investors.