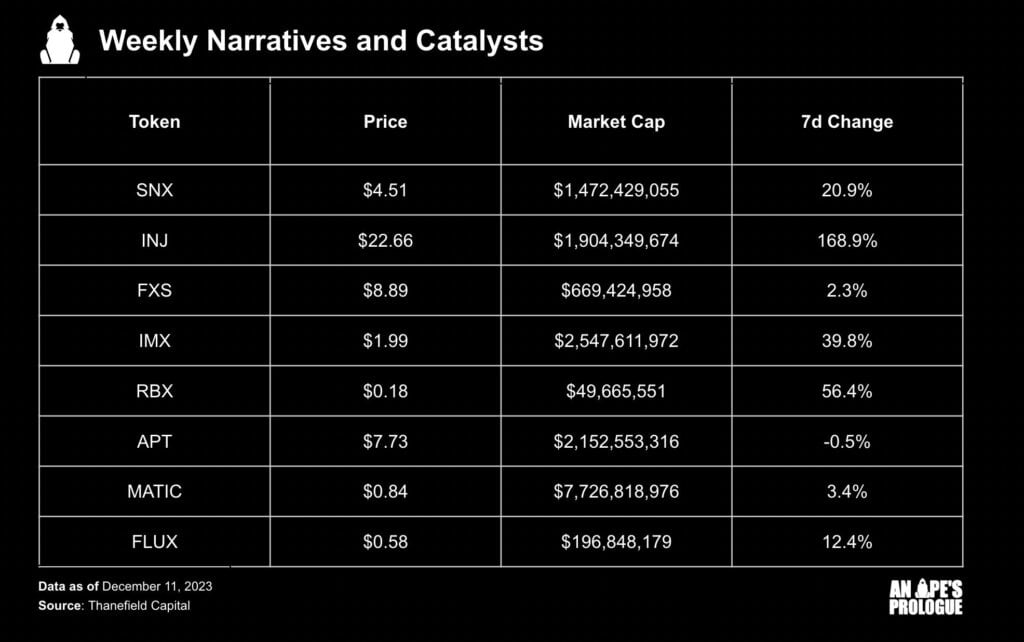

Research Summary

The report discusses the performance of Synthetix, a decentralized synthetic asset issuance and liquidity protocol, in Q3 2023. It highlights the strong growth in product usage, with volume and fees up over 10% from the previous quarter. The report also discusses the addition of 32 new markets to Synthetix Perps, the increase in yield for stakers, and the upcoming launch of V3. It further delves into the performance of the SNX token and the implications of the end of OP incentives.

Key Takeaways

Synthetix’s Growth in Q3 2023

- Product Usage Increase: Synthetix saw a significant increase in product usage in Q3 2023, with volume and fees both up over 10% from the previous quarter.

- New Markets Addition: Synthetix Perps added 32 new markets in Q3, now offering liquidity on 74 different underliers.

- Yield for Stakers: With revenues for the quarter higher and the SNX token price lower, yield for stakers annualized over 12% through the quarter.

Performance of SNX Token

- Trading Fees: Trading fees accounted for 46% of staker earnings in the third quarter. However, after the end of OP incentives, trading fees accounted for less than 30% of staker earnings.

- SNX Token Price: Despite the higher revenues, the SNX token price was lower in Q3 2023.

- Impact of OP Incentives End: The end of OP incentives led to a fall in volumes at the end of Q3 and a shift in the earnings mix.

Upcoming Launch of V3

- V3 Development: V3 is nearly feature complete and a testnet trading competition has begun on Perps V3 on Base with mainnet launch expected in November or December.

- New Front End: Synthetix founder Kain has pitched a new front end for Synthetix while Kwenta and Polynomial continue to grow.

- Impact on Users: The launch of V3 is expected to enhance the user experience and provide more opportunities for trading.

Actionable Insights

- Monitor the Launch of V3: The upcoming launch of V3 could bring significant changes to Synthetix’s operations and user experience. Stakeholders should monitor this development closely.

- Assess the Impact of OP Incentives End: The end of OP incentives has led to a shift in the earnings mix and a fall in volumes. Stakeholders should assess the long-term impact of this change.

- Investigate the Potential of New Markets: The addition of 32 new markets to Synthetix Perps presents new opportunities. Stakeholders should investigate the potential of these markets.