Research Summary

The report discusses the emergence of Real World Asset (RWA) tokenization, a concept born from the convergence of traditional finance and blockchain innovation. It explores the potential of this sector, the challenges it faces, and its future implications on global finance. The report also highlights MANTRA Chain, a project at the forefront of this revolution.

Key Takeaways

Integration of Blockchain and Traditional Finance

- Convergence of Two Worlds: The report emphasizes that the mainstream adoption of cryptocurrencies and blockchain technology is not about replacing the traditional financial system, but integrating with it. This convergence has led to the concept of RWA tokenization.

Real World Asset Tokenization

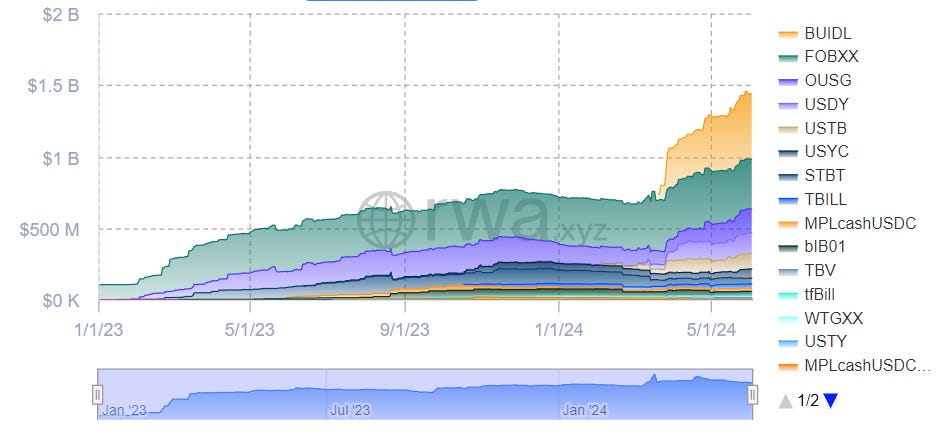

- Democratizing Access to Assets: RWA tokenization promises to democratize access to previously illiquid assets, enhance market efficiency, and create new avenues for economic growth and financial inclusion. The market cap of tokenization of global illiquid assets is projected to be a $16 trillion by 2030, according to a BCG report.

Market Projections and Potential Disruption

- Significant Market Opportunity: The report cites contrasting market projections. While the BCG report projects the market cap of tokenization of global illiquid assets to be $16 trillion by 2030, a McKinsey analysis projects the total tokenized market capitalization to reach around $2 trillion by 2030.

Leading RWA Protocols

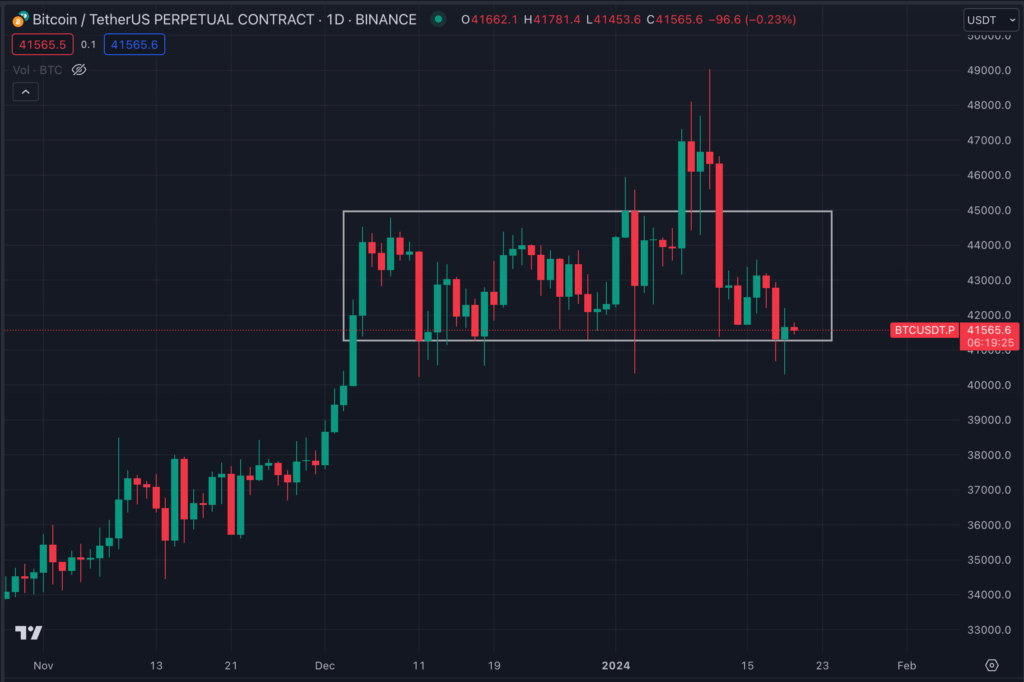

- Ondo Finance and MANTRA Chain: Ondo Finance is the leading RWA protocol with a 5x price increase since its launch at the start of the year. MANTRA Chain, another RWA project, has seen its price increase by over 30x in the past year and recently secured $11 million in funding.

Challenges and Opportunities

- Regulatory and Technical Complexities: The report acknowledges the challenges that RWA tokenization faces, including regulatory challenges, technical complexities, and the need for greater coordination among market participants for widespread adoption.

Actionable Insights

- Monitor the Progress of RWA Tokenization: Given the potential of RWA tokenization, it would be beneficial to keep a close eye on its development and the evolving regulatory landscape.

- Research the Potential of MANTRA Chain: With its recent funding and significant price increase, MANTRA Chain could be a key player in the RWA tokenization space. It would be worthwhile to further investigate its strategies and offerings.

- Understand the Market Projections: The contrasting market projections highlighted in the report suggest a need for a deeper understanding of the factors influencing these forecasts.