Research Summary

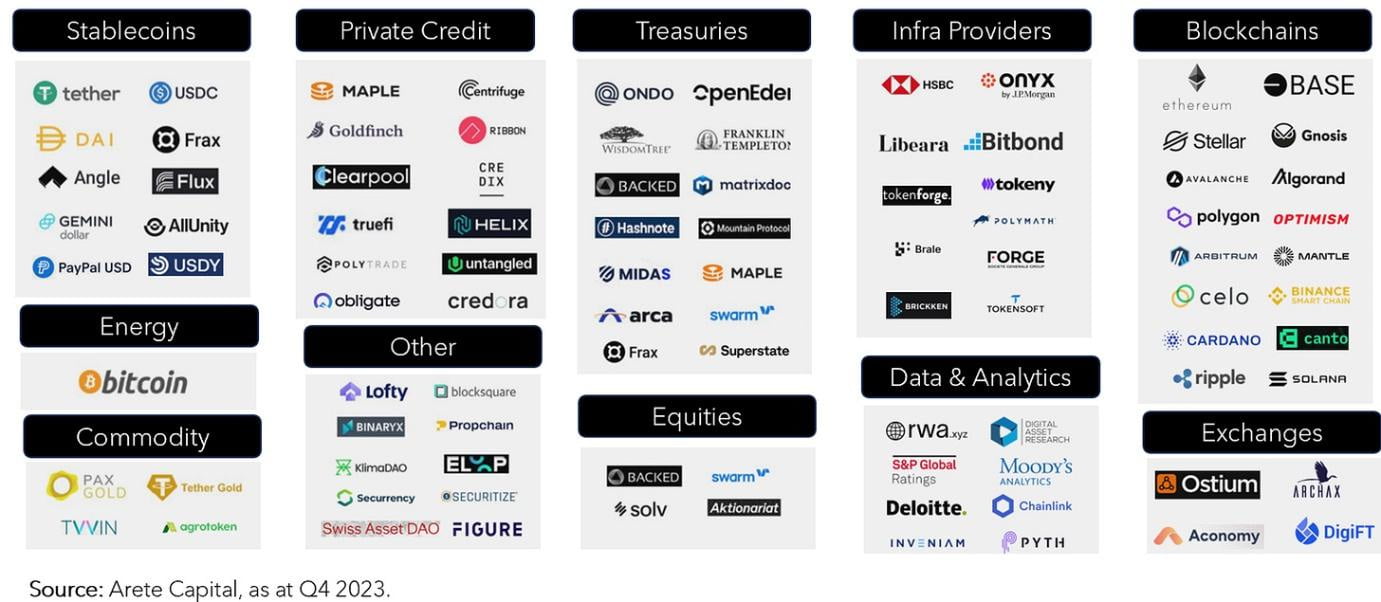

The report explores the integration of blockchain technology into financial markets, focusing on the tokenization of real-world assets (RWAs) and the rise of Institutional DeFi. It discusses the potential of on-chain assets, the evolution of tokenization, and the challenges of bridging off-chain and on-chain worlds. The report also highlights the role of stablecoins, the tokenization of US Treasury debt, and the growth of the on-chain private credit lending market.

Key Takeaways

Revolutionizing Financial Markets with Blockchain

- Blockchain’s Impact: The report likens blockchain technology to the invention of the printing press, revolutionizing financial markets by enabling trustless distribution of value through cryptographically secured distributed public ledgers. It supports over $1.6 trillion in on-chain asset value, with RWAs constituting less than 10% at $132 billion.

- Tokenization of RWAs: Tokenization is transforming physical analog assets into virtual digital tokens, increasing liquidity and reducing distribution costs and settlement times. The tokenization of RWAs is expected to grow to a market value of $6.8 trillion by 2030.

- Challenges and Solutions: Bridging off-chain and on-chain worlds requires blending blockchain innovations with traditional financial system practices. Institutional DeFi is addressing these challenges with new token standards, permissioned liquidity pools, private blockchains, and clearer regulations.

- Role of Stablecoins: Stablecoins are currently the most successful on-chain tokenization use case, representing less than 10% of the total crypto market value. They serve as an on-ramp to the digital asset ecosystem and provide stability for people in economically unstable regions.

- Tokenization of US Treasury Debt: The tokenization of US Treasury debt is gaining traction, with tokenized treasuries offering a 5% yield compared to the 0% from traditional stablecoins, representing a shift in over $100bn of value.

Actionable Insights

- Explore the Potential of On-Chain Assets: With the on-chain asset market offering advantages such as faster and cheaper value transfer rails, it’s worth exploring how these assets can enhance transparency and liquidity in financial markets.

- Understand the Role of Tokenization: As tokenization transforms physical assets into digital tokens, it’s crucial to understand how this process can increase liquidity, reduce costs, and shorten settlement times.

- Monitor the Growth of Institutional DeFi: With Institutional DeFi addressing the challenges of blending blockchain innovations with traditional financial practices, monitoring its growth can provide insights into the future of financial markets.

- Consider the Impact of Stablecoins: Given the significant role of stablecoins in the on-chain tokenization market, considering their impact can provide a better understanding of their potential in risk management and as a stable digital asset.

- Assess the Benefits of Tokenized Treasuries: With tokenized treasuries offering higher yields than traditional stablecoins, assessing their benefits can provide insights into potential shifts in value within the financial market.