Research Summary

The report provides a comprehensive overview of the market for the week of 14th to 18th August 2023. It covers the dynamics of the market, including the performance of various sectors, the impact of bond yields, and the global economic landscape. The report also delves into the earnings season, highlighting the performance of major companies and the reactions to their earnings. Finally, it offers insights into the Federal Reserve’s stance and the potential economic conditions ahead.

Key Takeaways

Market Recap – Third Red Week

- Market Dynamics: After a third ugly week, the market is looking for relief with mixed sector performance. Technology and energy performed well, while healthcare, utilities, and staples showed a risk-off feel.

- Banking Sector: Weakness in bank stocks was observed, with Moody’s lowering ratings for 10 U.S. banks and Minneapolis Fed President Kashkari discussing stricter capital regulations.

- Housing Market: Mortgage Rates hit a record high, overshadowing investments by Warren Buffett in Lennar, DR Horton, and NVR.

Macro Roundup – Rates, China and Japan

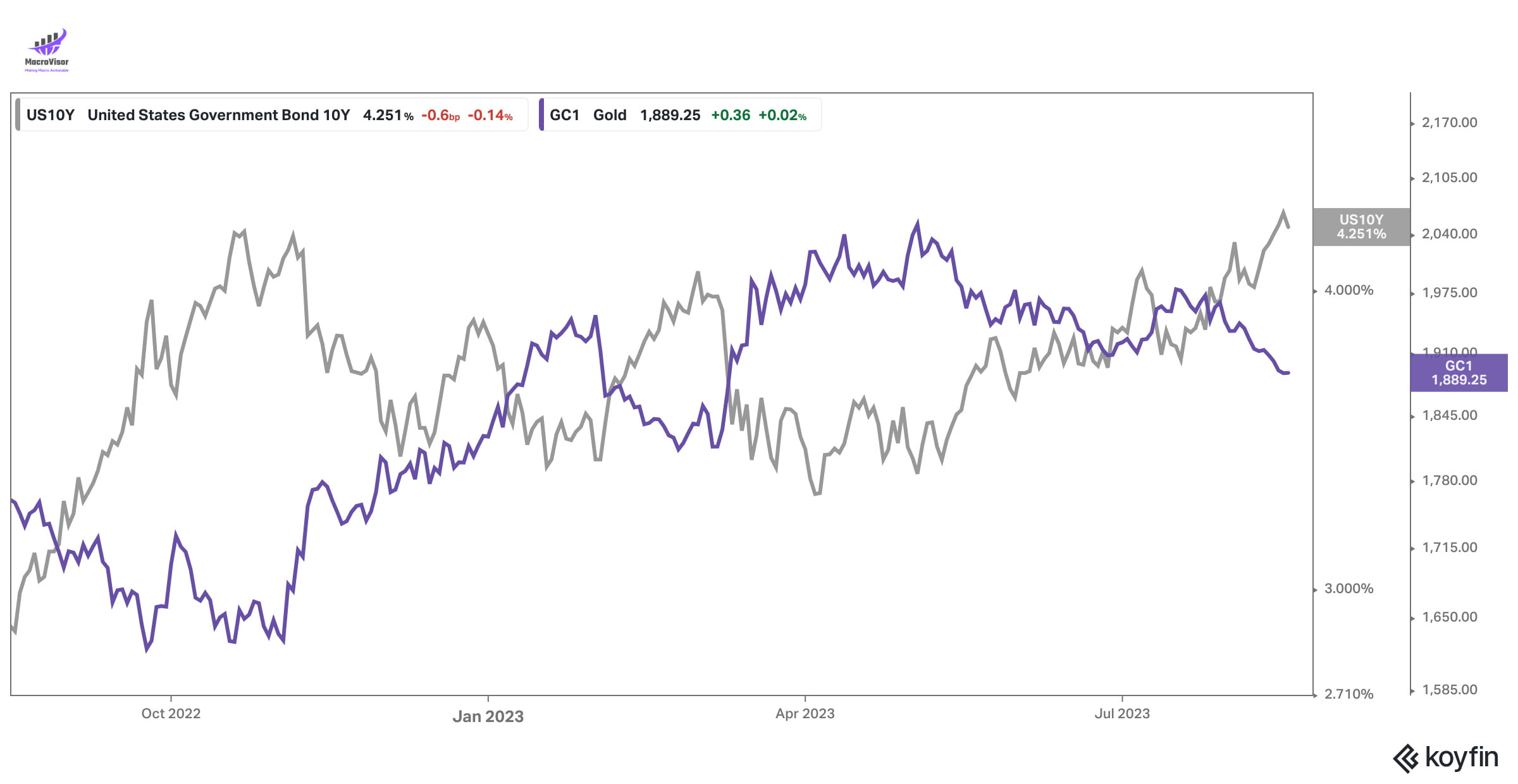

- Global Yields: Bond yields continue to hover at October 2022 highs, affecting equities and bonds in Europe and the UK.

- Interest Rates: The market is pricing in one more hike, with a possible cut from mid-2024. The rate of 5.75% may seem high, but it comes with consequences.

- China and Japan: China’s GDP continues to be revised downward, and Japan faces a balancing act with yields and currency management.

Earnings Season

- S&P 500 Earnings: 95% of the S&P500 has reported earnings, with a blended earnings decline of -4.59%. Retail earnings were mixed, with warnings about the macro environment.

- Reactions to Earnings: Volatile and unpredictable reactions to earnings were observed, leaning more heavily on the negative.

- Retail Performance: Home Depot, Walmart, Target, and others showed varied results, with caution on the outlook and concerns about declining inflation.

Closing Thoughts – Powell has left the building!

- Fed’s Stance: A calmer Powell is expected to talk about being data-dependent, keeping the door open for a hike in September.

- Economic Conditions: The Fed has managed to get inflation down relatively smoothly, with strong GDP and retail spending. Some deterioration is expected, but the Fed has considered this.

Actionable Insights

- Monitor Market Trends: Investors should keep an eye on the mixed sector performance and the impact of bond yields on equities and bonds.

- Consider Banking Sector: The lowering of ratings and potential stricter regulations may affect investment decisions in the banking sector.

- Evaluate Retail Earnings: The varied results and warnings about the macro environment in the retail sector should be considered for investment strategies.

- Understand Fed’s Approach: The Federal Reserve’s stance on interest rates and inflation management should be factored into long-term investment planning.