Research Summary

The report discusses the potential for Ethereum ($ETH) to outperform in 2024, with a significant rotation to $ETH already observed. The author predicts a huge inflow into the Ethereum ecosystem due to the expected ETH ETF in Q2 2024. The report also highlights the influence of Bitcoin’s price action and the ETHBTC ratio on Ethereum’s price trend.

Key Takeaways

Ethereum’s Potential Outperformance

- Ethereum’s Expected Rise: The report predicts that Ethereum will outperform in 2024, with a significant rotation to $ETH already observed. This is based on the expectation of a huge inflow into the Ethereum ecosystem due to the anticipated ETH ETF in Q2 2024.

Bitcoin’s Influence on Ethereum

- Bitcoin’s Price Action: The report notes that Bitcoin’s price action and the ETHBTC ratio will influence Ethereum’s price trend. This is because the approval of Bitcoin spot ETFs could pave the way for a spot ETH ETF approval this year, allowing more asset managers to invest in crypto.

Key Price Levels for Ethereum

- Important Price Levels: For ETH price levels, $2,400 is an important level to watch. Sustained weekly closes above this would be bullish. $3,500 served as major resistance in 2022 and remains a key psychological barrier, though hitting it too fast could signal a local top forming.

Trading Behavior Post-BTC ETF Approval

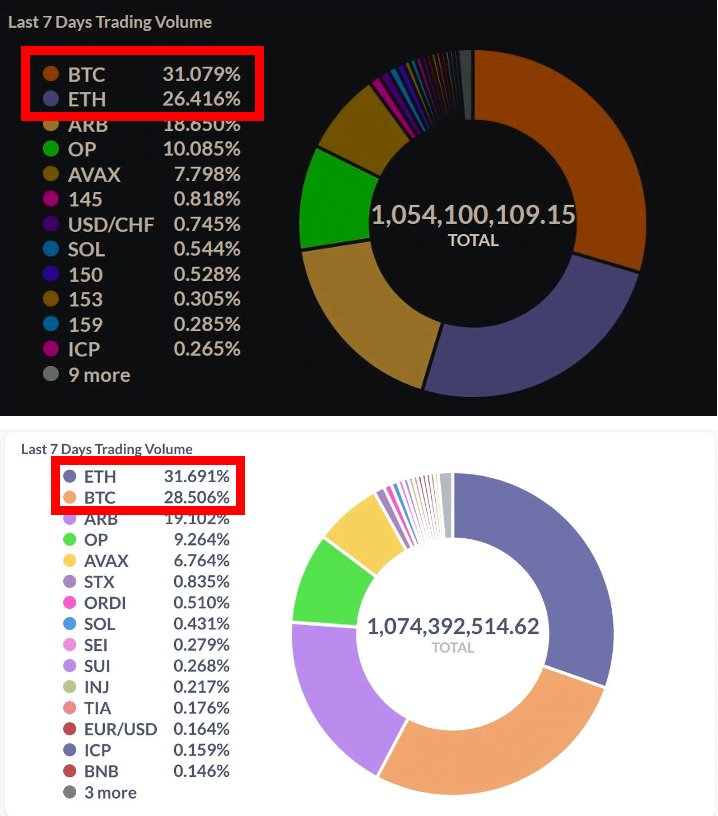

- Shift in Trading Behavior: The report observes that after the BTC ETF approval, ETH has become the dominant asset traded, a shift from the dominance of $BTC before the approval. This observation is based on traders’ behavior on the Mux platform.

Metrics from Mux Protocol

- Mux Protocol’s Stats: The report refers to stats from @muxprotocol, which show a 7-day volume at $1B with a 40% increase, daily growth of 100 new users, and unique users of 28K. These numbers are seen as representative of the general crypto market money flow.

Actionable Insights

- Monitor Ethereum’s Price Levels: Investors should keep a close eye on Ethereum’s price levels, particularly the $2,400 and $3,500 marks, as these could indicate bullish or bearish trends.

- Consider the Influence of Bitcoin: The approval of Bitcoin spot ETFs could influence Ethereum’s price trend. Therefore, investors should consider the impact of Bitcoin’s price action and the ETHBTC ratio when making investment decisions.

- Observe Trading Behavior: The shift in trading behavior from $BTC to $ETH following the BTC ETF approval could indicate a trend. Investors should monitor this to understand the market sentiment towards Ethereum.