Research Summary

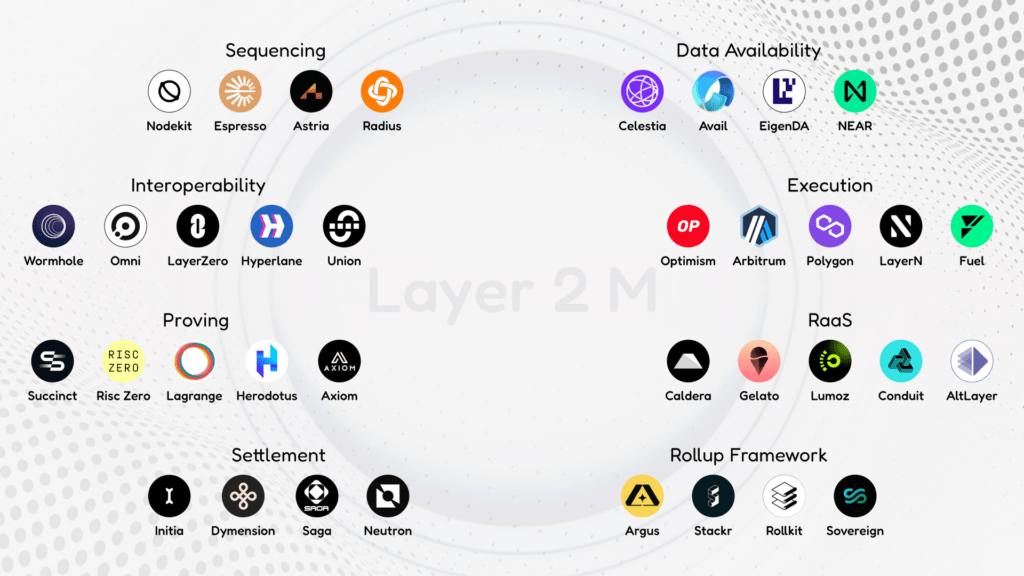

The report discusses the systemic issues in the crypto ecosystem, particularly the manipulation of the market by venture capitalists (VCs). It uses Starknet as a case study to illustrate how VCs and insiders capture most gains, leaving retail investors with significant downside risk. The report calls for more transparency, fairer distribution models, and a stronger focus on real-world utility and adoption.

Key Takeaways

Market Manipulation by VCs

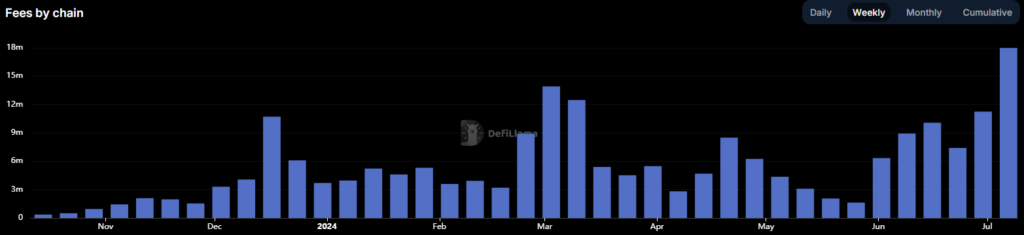

- VCs’ Role in Market Manipulation: The report highlights how VCs pump billions into unproven projects, which then list on exchanges at inflated valuations. Market makers maintain artificially high market caps, and retail investors provide exit liquidity, often leading to a price collapse.

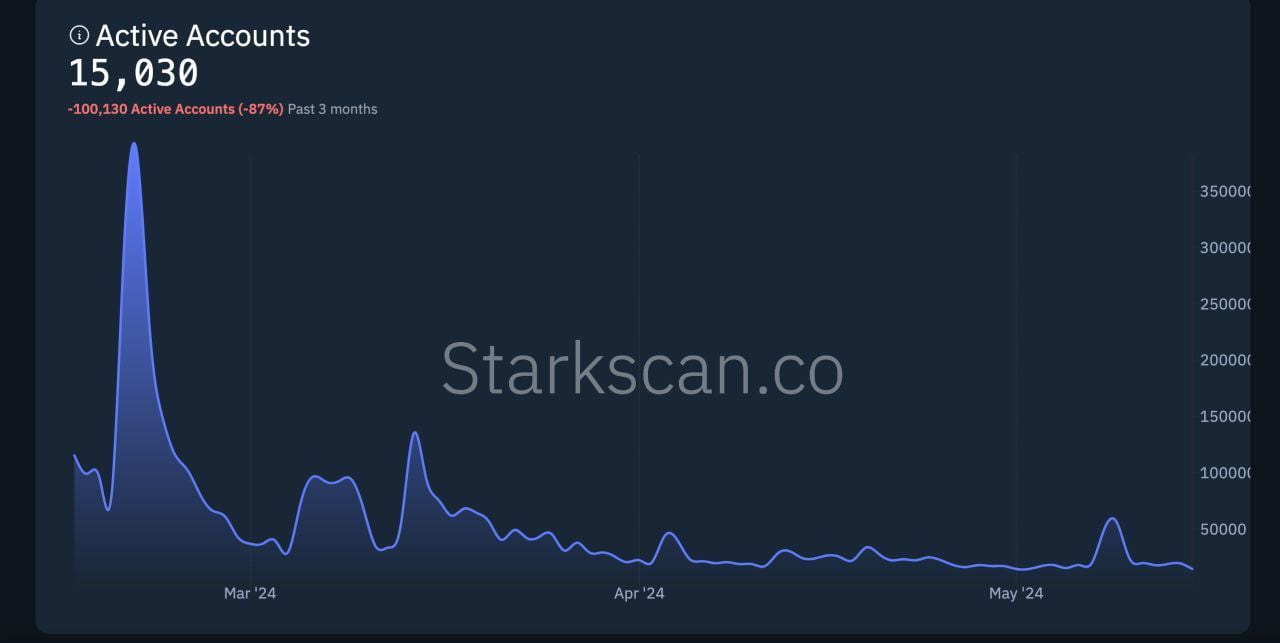

- Case Study – Starknet: Despite minimal adoption, Starknet, an Ethereum L2 solution, achieved an $8B valuation in 2022. Its market cap at launch was $2.8B, which has since declined to $800M, exemplifying the larger issue in the crypto industry.

Consequences of Market Manipulation

- Impact on Retail Investors: The report notes that this pattern of market manipulation leads to VCs and insiders capturing most gains, while retail investors face significant downside risk. This could potentially lead to a liquidity crisis for overvalued projects.

- Distorted Market Dynamics: The manipulation inhibits true price discovery and distorts market dynamics, leading to a lack of retail participation and no genuine “altcoin season”.

Need for Change

- Call for Transparency and Fairness: The report calls for more transparent tokenomics, fairer distribution models, and a stronger focus on real-world utility and adoption. It also emphasizes the need for investors to prioritize due diligence.

- Starknet’s Developer Growth: Despite the growth of developers on Starknet, there is still a lack of real users. The number of developers increased by 30% in the last year, but the report questions their origin and the real-world utility of the platform.

Actionable Insights

- Investor Due Diligence: Investors should focus on token distribution, vesting schedules, actual user adoption metrics, and real-world use cases when evaluating crypto projects.

- Need for Regulatory Oversight: The report’s findings suggest a need for regulatory oversight to prevent market manipulation and ensure fairer distribution models.

- Focus on Real-World Utility: Crypto projects should focus on demonstrating real-world utility and adoption to attract genuine retail participation and ensure long-term viability.