Research Summary

The report provides an analysis of the cryptocurrency VC sector in February 2024, highlighting a 14% increase in the number of public investment projects and a 6% increase in the total financing amount compared to January 2024. It also details the top 10 financing rounds, including investments in EigenLayer, Flare Network, Avail, Oobit, and Analog.

Key Takeaways

Increased Activity in Cryptocurrency VC Sector

- Uptick in Public Investment Projects: The report indicates a 14% increase in the number of public investment projects in the cryptocurrency VC sector in February 2024 compared to the previous month. This suggests a growing interest and confidence in the sector.

- Rise in Total Financing Amount: The total financing amount in February 2024 was $700 million, marking a 6% increase from January 2024. This indicates a higher level of capital investment in the sector.

Top Financing Rounds

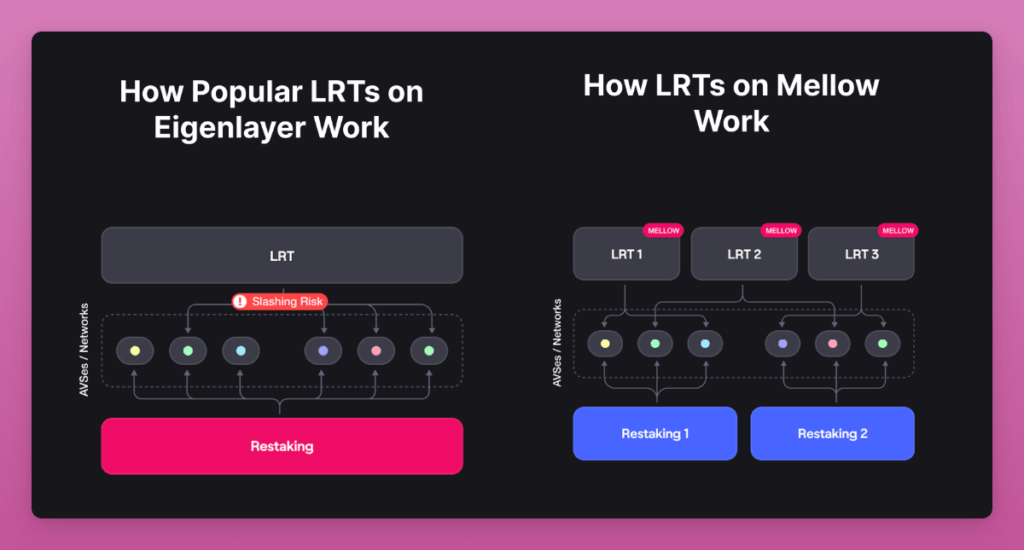

- Significant Investment in EigenLayer: Andreessen Horowitz invested $100 million in EigenLayer, making it the largest financing round in February 2024. This underscores the potential that investors see in the company.

- Flare Network’s Private Financing: Flare Network raised $35 million in private financing, indicating strong investor confidence in its smart contract protocols.

- Oobit’s Series A Financing: Mobile crypto payment app Oobit raised $25 million in a Series A financing round, highlighting the growing interest in crypto payment solutions.

Investment in Infrastructure Projects

- Infrastructure Projects Lead in Financing: Infrastructure projects accounted for approximately 24% of the financing amount in the cryptocurrency market in February 2024, indicating a focus on building robust systems for the sector.

Year-on-Year Comparison

- Decrease in Year-on-Year Financing: Despite the month-on-month increase, the total financing amount in February 2024 marked a 27.1% decrease compared to February 2023. This suggests a potential cooling off in the sector compared to the previous year.

Actionable Insights

- Monitor Infrastructure Projects: Given the significant financing amount directed towards infrastructure projects, it would be beneficial to keep a close eye on developments in this area.

- Assess Investment Trends: The increase in the number of public investment projects and total financing amount suggests a growing interest in the cryptocurrency VC sector. It would be prudent to assess these trends for potential opportunities.

- Consider Year-on-Year Trends: Despite the month-on-month increase, the year-on-year decrease in total financing amount indicates a potential cooling off in the sector. This should be taken into account when making investment decisions.