Research Summary

The report discusses the recent trends in digital asset fund flows, highlighting minor outflows of $16m, primarily from the US and Germany. It suggests that this trend is more related to profit-taking than a change in sentiment towards digital assets. Altcoins, particularly Solana, Cardano, XRP, and Chainlink, saw inflows, while Bitcoin experienced significant outflows. Blockchain equities continued to see substantial inflows.

Key Takeaways

Minor Outflows in Digital Asset Investment

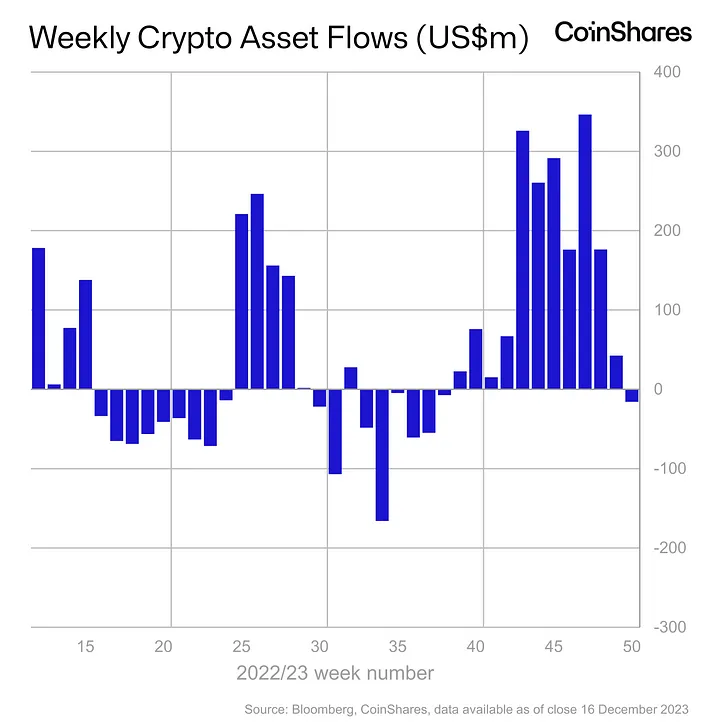

- End of Inflows Streak: Digital asset investment products experienced minor outflows totalling $16m, ending an 11-week streak of inflows. Despite this, trading activity remained robust, totalling $3.6bn for the week, well above the year-to-date average of $1.6bn.

Regional Variations in Fund Flows

- US and Germany Lead Outflows: The outflows were primarily concentrated in the US and Germany, which saw outflows of $18m and $10m respectively. This was partially offset by continued inflows into Canada and Switzerland, totalling $6.9m and $9.1m respectively.

Bitcoin Experiences Outflows

- Bitcoin’s Decline: Bitcoin saw the most significant outflows, totalling $33m last week. Short-bitcoin also saw minor outflows of $0.3m.

Altcoins Buck the Trend

- Altcoins’ Inflows: Altcoins, on the other hand, saw inflows of $21m. The main beneficiaries were Solana, Cardano, XRP, and Chainlink, which saw inflows of $10.6m, $3m, $2.7m, and $2m respectively.

Blockchain Equities Continue to Attract Investment

- Blockchain Equities’ Inflows: Blockchain equities continued to experience positive sentiment, with substantial inflows totalling $122m last week. This brings the total inflows over the last 9 weeks to $294m, the largest run on record.

Actionable Insights

- Monitor Altcoins: Given the recent inflows into altcoins, particularly Solana, Cardano, XRP, and Chainlink, it may be beneficial to keep a close eye on these digital assets and their market performance.

- Assess Regional Variations: The report highlights significant regional variations in digital asset fund flows. Understanding these variations could provide insights into regional market dynamics and investor sentiment.

- Consider Blockchain Equities: The continued inflows into blockchain equities suggest positive sentiment towards this asset class. It may be worth exploring the factors driving this trend and the potential implications for the broader digital asset market.