Research Summary

The report discusses the recent developments in the crypto market, focusing on dYdX, Solana, and Avail. It highlights dYdX’s potential sale of its v3 exchange software and the subsequent token price drop, Solana’s partnership with Hamilton Lane for a private credit fund, and Avail’s mainnet launch and token performance.

Key Takeaways

dYdX’s Potential Sale and Token Price Drop

- dYdX’s Software Sale: Decentralized perpetual futures exchange, dYdX, is reportedly in talks to sell its v3 exchange software. This move comes after the exchange upgraded to v4 software and created dydxchain. The sale of part of its business is expected to have no benefit for token holders.

- Token Price Impact: The potential sale and a subsequent hack on the front end of dYdX’s exchange have led to a 6% drop in the token price. The team had previously agreed to revert some of the $430M revenue back to token holders, but this has been delayed until the transition to v4.

Solana’s Partnership with Hamilton Lane

- Private Credit Fund on Solana: Hamilton Lane, a billion-dollar asset manager, announced the launch of a private credit fund on the Solana blockchain. The Senior Credit Opportunities Fund (SCOPE) will be the first product to be launched only on Solana, furthering its real-world asset aspirations.

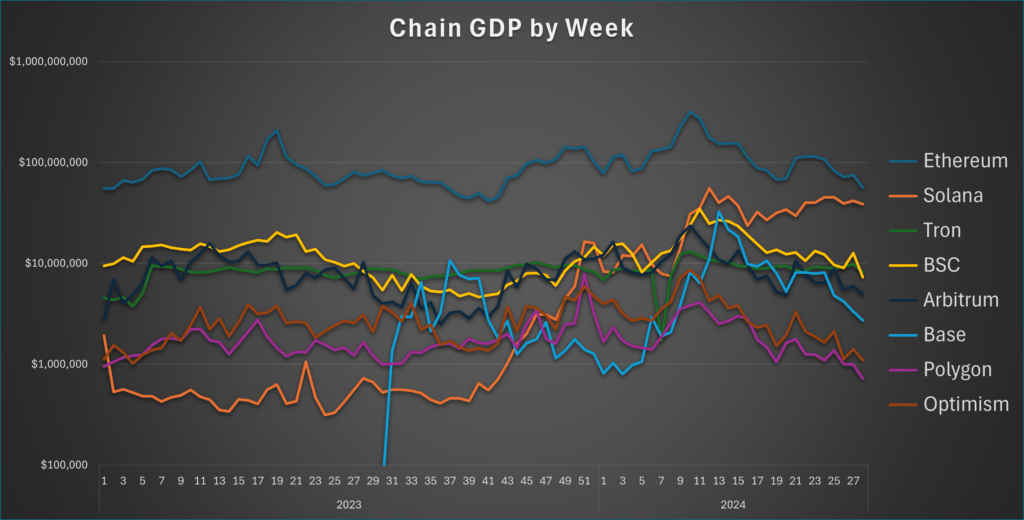

- Solana’s Performance: Following the announcement, Solana’s token price increased by 14.5%. The blockchain is also surpassing Ethereum on a metrics front with its 30-day DEX volumes reaching over $40B.

Avail’s Mainnet Launch and Token Performance

- Avail’s Mainnet Launch: Infrastructure project Avail launched its mainnet, marking the commencement of AVAIL token trading. The project aims to build a “unification layer for web3” by connecting various parts of blockchain infrastructure.

- AVAIL Token Performance: Contrary to the trend of poor performance for new issues, Avail’s token price has increased by 39% since its launch. Users can now stake their AVAIL on the network, with a liquid staking option available through deqfi.

Actionable Insights

- Monitor dYdX’s Developments: Keep an eye on dYdX’s potential software sale and its impact on the token price. Also, watch for the team’s actions regarding the promised revenue reversion to token holders.

- Research Solana’s Growth: Investigate Solana’s partnership with Hamilton Lane and its impact on the blockchain’s performance. Also, compare Solana’s metrics with Ethereum’s to understand its market position.

- Explore Avail’s Potential: Look into Avail’s mainnet launch and its implications for the project’s future. Also, track the performance of the AVAIL token and the response from the user community.