Research Summary

The report discusses five promising farming protocols: Canto, Kamino Finance, Kelp DAO, Camelot, and Perennial. These platforms offer various opportunities for yield farming, with some providing potential airdrop benefits. The report also highlights the annual percentage rates (APRs) of different liquidity pools within these platforms.

Key Takeaways

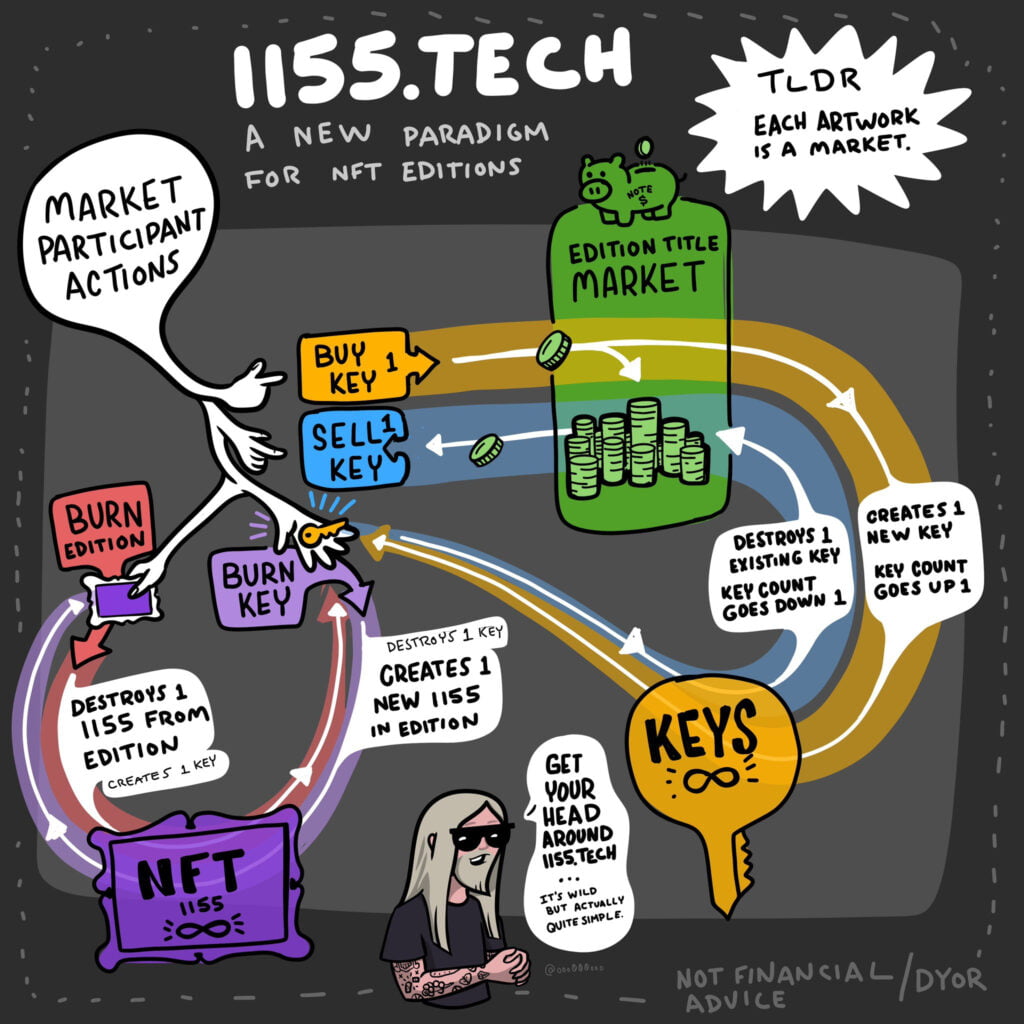

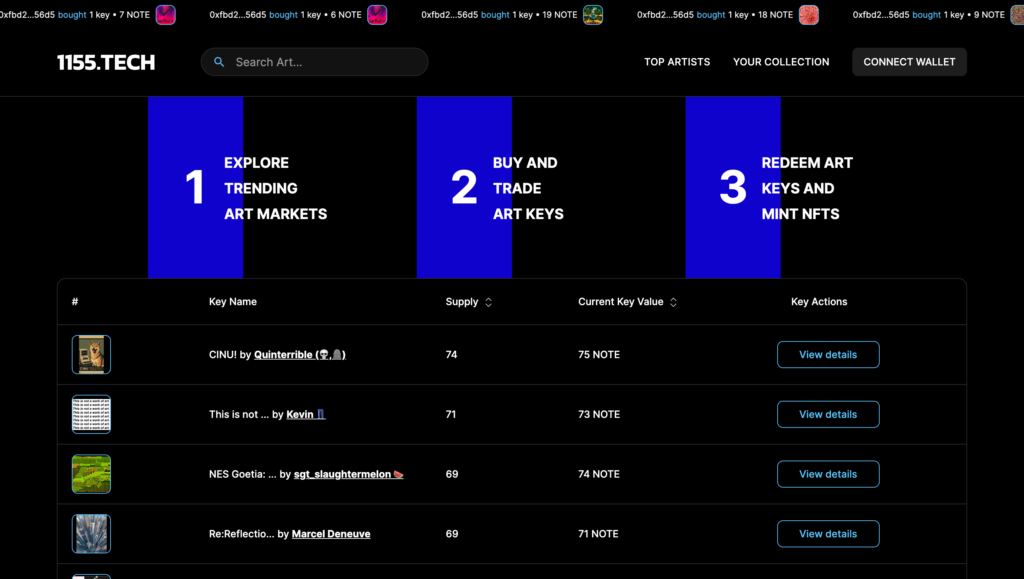

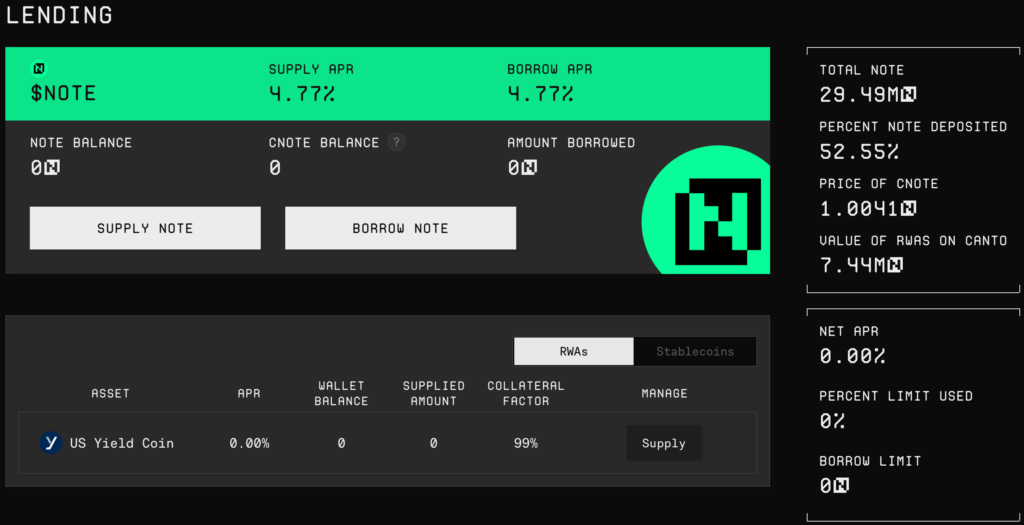

Lucrative Opportunities in Canto

- High-Yield Pools: Canto, a Cosmos-based L1, offers lucrative pools with stable yields. The report highlights four pools with APRs ranging from 27% to 76%.

Kamino Finance’s Automated Trading Vaults

- Impressive Performance: Kamino Finance, a hands-off market-making platform on Solana, has seen its automated trading vaults perform well due to a recent influx in Solana trading volume. The report lists four vaults with APRs ranging from 156% to 257%.

Kelp DAO’s Liquid Restaking Protocol

- TVL Surge: Kelp DAO, a liquid restaking protocol leveraging Eigenlayer, has seen its total value locked (TVL) skyrocket to over $120M. Users can deposit LSTs like ETHx and stETH to earn Eigenlayer points and Kelp Miles.

Camelot’s High-Yield Farms

- Attractive Yields: Camelot, the liquidity hub of Arbitrum, offers some of the best yields in DeFi. The report highlights four farms with APRs ranging from 67% to 259%.

Perennial’s Lucrative Liquidity Provision

- High APRs: Perennial, a perpetual exchange on Arbitrum, offers high APRs for vault depositors. The report mentions an 83% APR for the ETH and LINK vault and a 186% APR for the SOL, MATIC, and BTC vault.

Actionable Insights

- Explore Canto’s High-Yield Pools: Investors interested in stable yields might consider exploring the high-yield pools offered by Canto.

- Consider Kamino Finance’s Automated Trading Vaults: With the recent influx in Solana trading volume, Kamino Finance’s automated trading vaults could be worth considering for potential high returns.

- Investigate Kelp DAO’s Liquid Restaking Protocol: The surge in Kelp DAO’s TVL suggests that its liquid restaking protocol leveraging Eigenlayer could offer promising opportunities.

- Examine Camelot’s High-Yield Farms: Given the attractive yields offered by Camelot, investors might want to examine its high-yield farms.

- Research Perennial’s Liquidity Provision: The high APRs offered by Perennial for vault depositors could make it a platform worth researching for potential returns.