Research Summary

The report provides an in-depth analysis of the Axelar network’s performance in Q1 2024. It highlights the network’s growth, including an increase in connected chains, the launch of the Interchain Token Service (ITS) and Axelar Virtual Machine (AVM) on mainnet, and a significant rise in interchain transactions and active addresses. The report also discusses the network’s financial performance, with a notable increase in revenue and AXL’s price.

Key Takeaways

Growth in Connected Chains

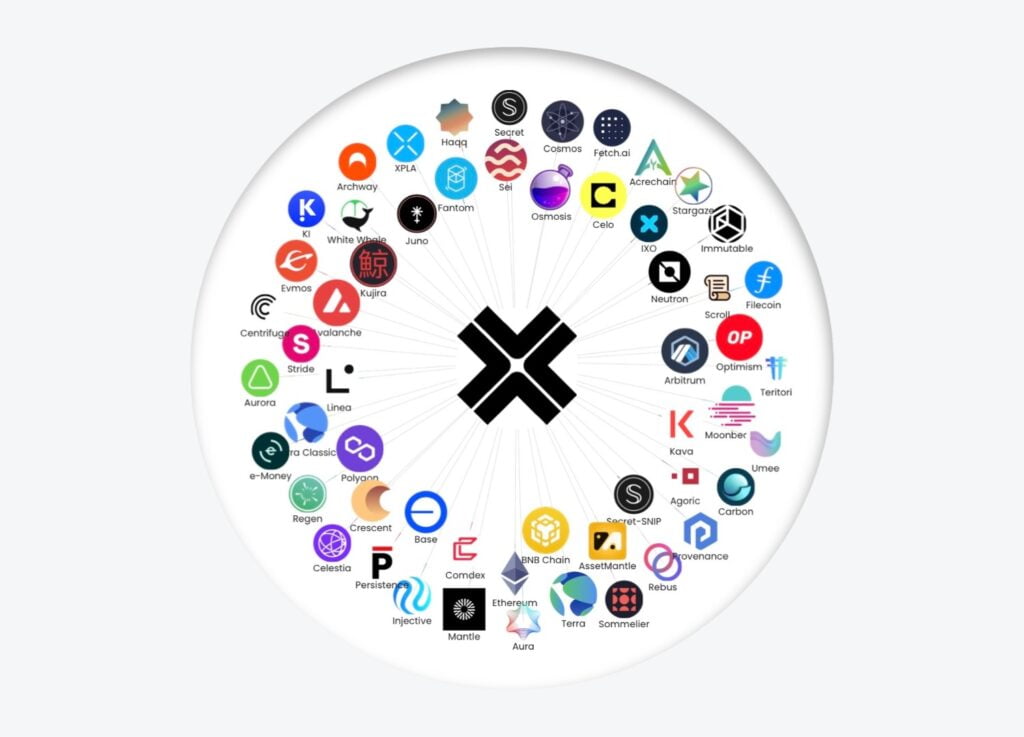

- Expansion of the Axelar Network: The number of chains connected to the Axelar network increased from 55 to 64 in Q1 2024. This growth was facilitated by the Interchain Amplifier, which allows permissionless connections to new networks.

Launch of ITS and AVM

- Enhanced Functionality: The Interchain Token Service (ITS) and Axelar Virtual Machine (AVM) were launched on mainnet in Q1. ITS preserves the fungibility and custom functionality of native tokens across multiple networks, while AVM enables arbitrary programmability on an open cross-chain layer.

Increased Interchain Activity

- Surge in Transactions and Active Addresses: Interchain transactions and active addresses on the Axelar network increased by 66% and 49% QoQ, respectively. This growth was driven by services like the Squid liquidity router, which is often the most active contract by interchain transactions and volume.

Financial Performance

- Revenue and Price Appreciation: Axelar’s revenue, denominated in AXL, increased by 35% QoQ, while the price of AXL rose by 69%. This led to a 208% QoQ increase in Axelar’s revenue in USD.

Ecosystem Developments

- Notable Integrations and Collaborations: The report highlights several significant ecosystem developments in Q1, including collaborations with Ripple and Immutable zkEVM, the launch of the Axelator Program, and the continued adoption of the Squid Router.

Actionable Insights

- Monitor the Development of Axelar’s Technologies: With the launch of ITS and AVM, and the ongoing development of the Interchain Amplifier and Interchain Maestro, Axelar is expanding its capabilities. Stakeholders should keep an eye on the progress and impact of these technologies.

- Assess the Impact of Increased Interchain Activity: The significant increase in interchain transactions and active addresses indicates growing usage of the Axelar network. This trend’s implications for Axelar’s future growth and the broader crypto ecosystem should be evaluated.

- Consider the Financial Performance: Axelar’s strong financial performance in Q1, marked by increased revenue and AXL price appreciation, suggests a positive outlook. However, the impact of market volatility and other factors on future performance should be considered.