Research Summary

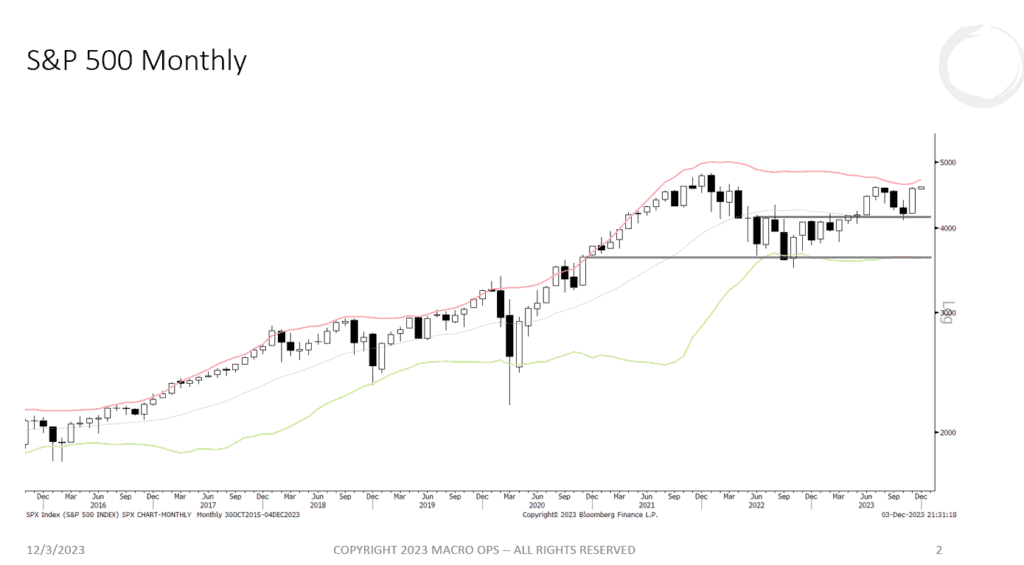

The report provides an analysis of various financial markets, including stocks, commodities, and currencies. It discusses the current state of the markets, highlighting key trends and potential future movements. The report also provides insights into the performance of specific assets such as gold, potash, and the USDCNH currency pair.

Key Takeaways

Market Trends and Predictions

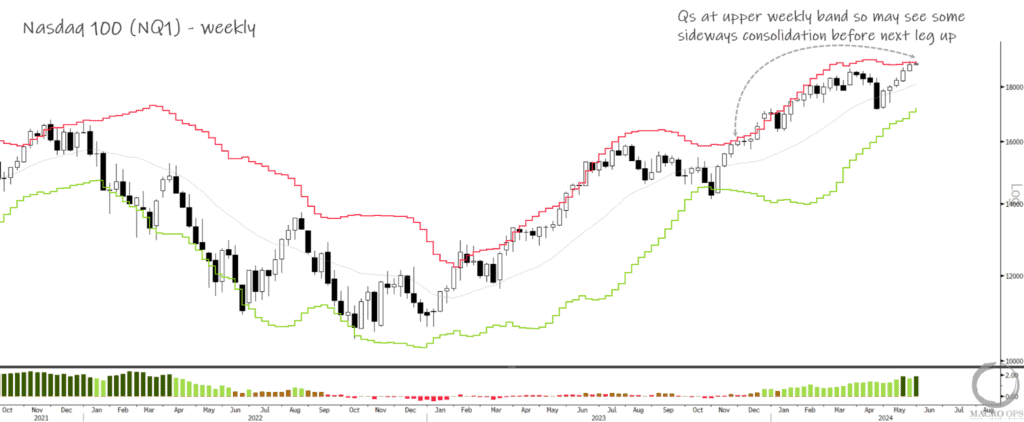

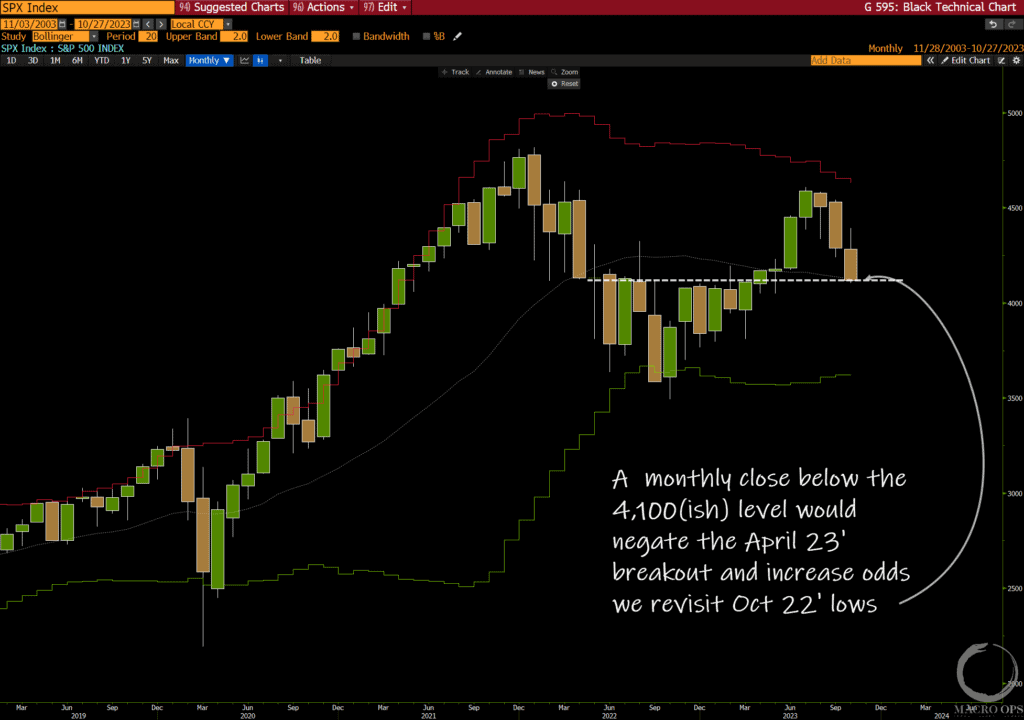

- Market Consolidation: The report suggests that the primary path of least resistance for the market is still upwards, but there may be some sideways consolidation in the coming weeks as the index consolidates its gains.

- Aggregated Index Fund Flows: The report highlights an interesting development in aggregated index fund flows. This indicator crossed above 90% in March, triggering a sell signal that preceded the April correction in stocks. It has since dropped to 16%, just shy of the 10% or below needed for a buy signal.

Asset Performance

- Gold Market: The report notes that while the authors have been bullish on precious metals for the past nine months, there are signs of poor seasonality, extended breadth, and extended technicals that may lead to a correction in the near future.

- Intrepid Potash (IPI): The small-cap potash producer confirmed its breakout from its 12-month base last week, suggesting potential future growth.

Currency Analysis

- USDCNH Currency Pair: The report identifies the USDCNH currency pair as being in a major compression regime, which could lead to a major expansionary regime and big trends. The authors suggest waiting for the market to reveal its direction.

Actionable Insights

- Monitor Market Consolidation: Investors should keep an eye on the potential sideways consolidation in the market, as this could present opportunities for strategic investment decisions.

- Watch for Buy Signals in Index Fund Flows: With the aggregated index fund flows indicator nearing the 10% threshold for a buy signal, investors should monitor this closely for potential investment opportunities.

- Consider Gold Market Conditions: Given the potential for a correction in the gold market, investors may want to reassess their positions and strategies in this area.

- Track Performance of Intrepid Potash (IPI): Following its confirmed breakout, investors may want to research the potential of Intrepid Potash for their portfolios.

- Observe USDCNH Currency Pair: The current compression regime of the USDCNH currency pair could lead to significant trends. Investors should monitor this pair closely to capitalize on potential market movements.