Research Summary

The report discusses the current financial landscape, focusing on the performance of major indices, liquidity conditions, international and US growth, copper consolidation, and the performance of cryptocurrencies and precious metals. It also highlights the short-term overbought state of US markets, the bearish stance of speculators on the Dow, and the potential for a bullish breakout in gold.

Key Takeaways

Market Conditions and Speculator Sentiment

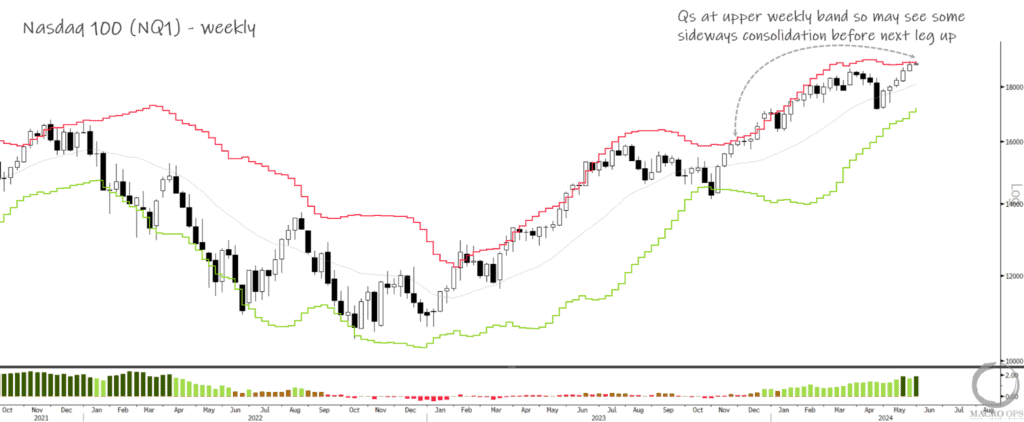

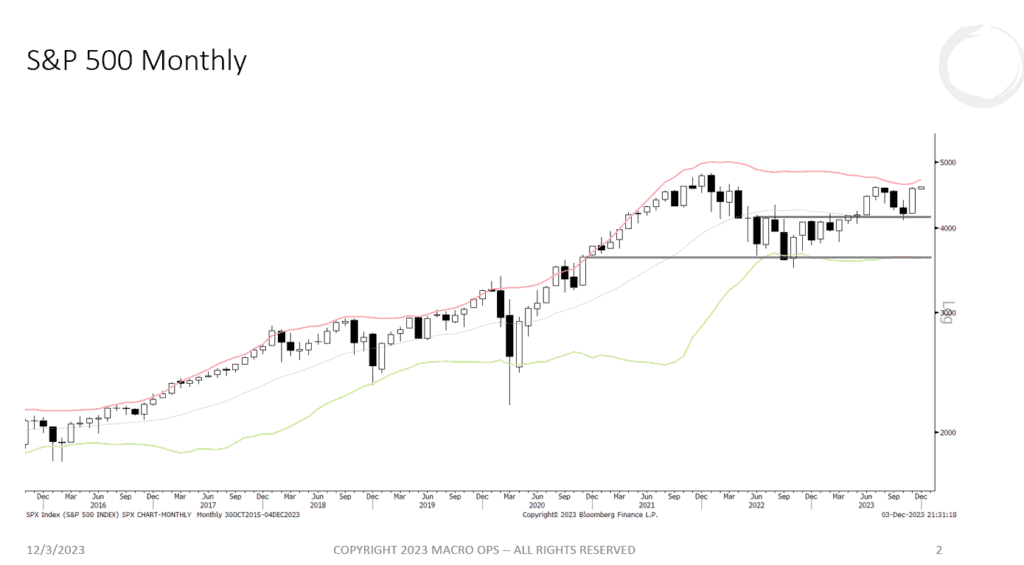

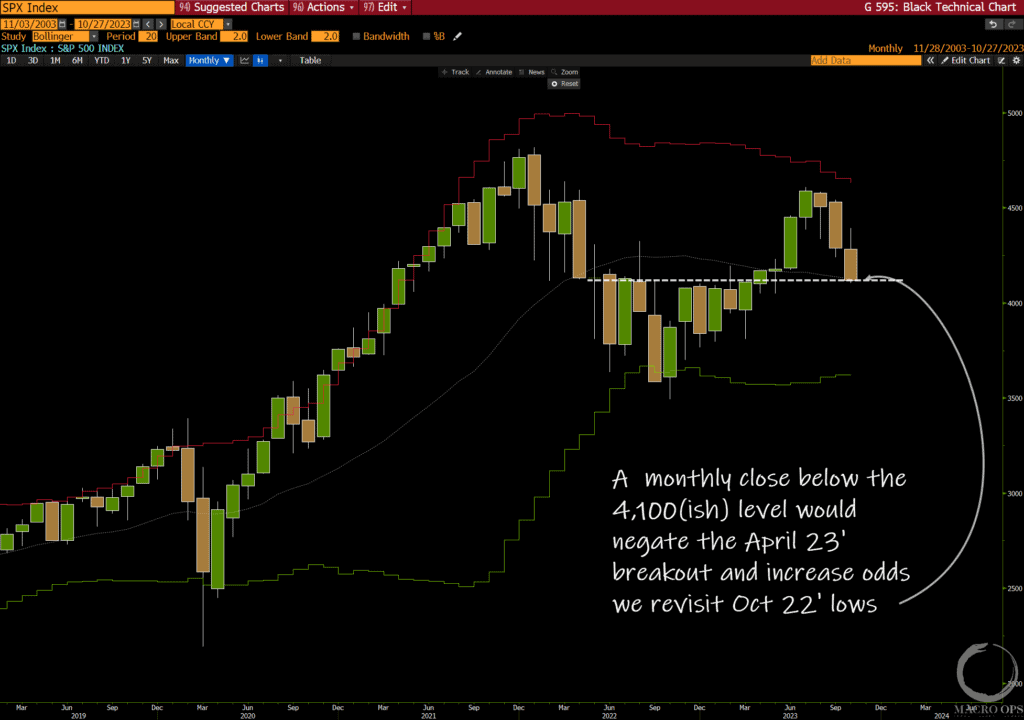

- US Market Overbought: The report suggests that the US market appears overbought in the short term. However, the intermediate-term path of least resistance remains upward, indicating a potential for continued growth.

- Speculators Bearish on Dow: Despite the positive outlook, speculators, both large and small, remain extremely short on the Dow. This bearish sentiment could influence market dynamics in the near future.

Economic Indicators and Global Growth

- Improving Liquidity Conditions: The report points to an inflection lower in the Chicago Adjusted National Financial Conditions Index, indicating easing liquidity conditions. This development is seen as positive for equities.

- Rebounding International Growth: South Korean exports, considered a good barometer of the global economy, have turned positive on a YoY% basis for the first time since the end of 2022. This suggests a rebound in international growth.

- Contracting US Growth: The report highlights a drop in the Philly Fed State Index to -22, a level that historically has been associated with a recession in the US. This suggests a potential contraction in US growth.

Commodity and Cryptocurrency Performance

- Copper Consolidation: The report notes that copper continues to trade in a nearly year-long downward channel. However, copper enters its strongest period of seasonality starting in mid-December, which could influence its performance.

- Crypto Bull Flag: The report mentions a large breakout in the cryptocurrency Galaxy Digital Holdings, which is now consolidating its gains and forming a bull flag. A breakout from this range could be a positive development for the cryptocurrency.

- Gold’s Potential Bullish Breakout: The report suggests that gold may be on the verge of a bullish breakout, which would support the contracting US growth/bottoming ex. US growth picture.

Actionable Insights

- Monitor Market Conditions: Given the overbought state of the US market and the bearish sentiment on the Dow, it would be prudent to closely monitor market conditions for potential shifts.

- Assess Global Economic Indicators: The contrasting trends in international and US growth, as well as improving liquidity conditions, suggest the need to assess global economic indicators for investment decision-making.

- Track Commodity and Cryptocurrency Performance: The performance of copper and cryptocurrencies like Galaxy Digital Holdings, as well as the potential bullish breakout in gold, indicate the importance of tracking commodity and cryptocurrency performance for potential opportunities.