Research Summary

The report examines the legacy of Facebook’s cryptocurrency project, Diem, and its influence on the crypto space, particularly through the Move programming language. It provides a detailed analysis of two emerging blockchains, Aptos and Sui, which utilize Move. The report compares their performance, adoption, and potential, highlighting key metrics such as Total Value Locked (TVL), transaction counts, and Decentralized Exchange (DEX) volumes.

Key Takeaways

Legacy of Diem and Influence of Move

- Diem’s Influence: Despite the failure of Facebook’s Diem project, its open-source work, including the Move programming language and Move Virtual Machine (MoveVM), continues to shape the crypto space. Move emphasizes safety and resource management, aiming to minimize smart contract vulnerabilities.

- Move’s Flexibility: The Move language allows for the creation of custom digital objects that can be passed and returned by functions in smart contracts, offering a more intuitive and flexible approach compared to Solidity’s hashmap-based asset storage.

Aptos: Performance and Adoption

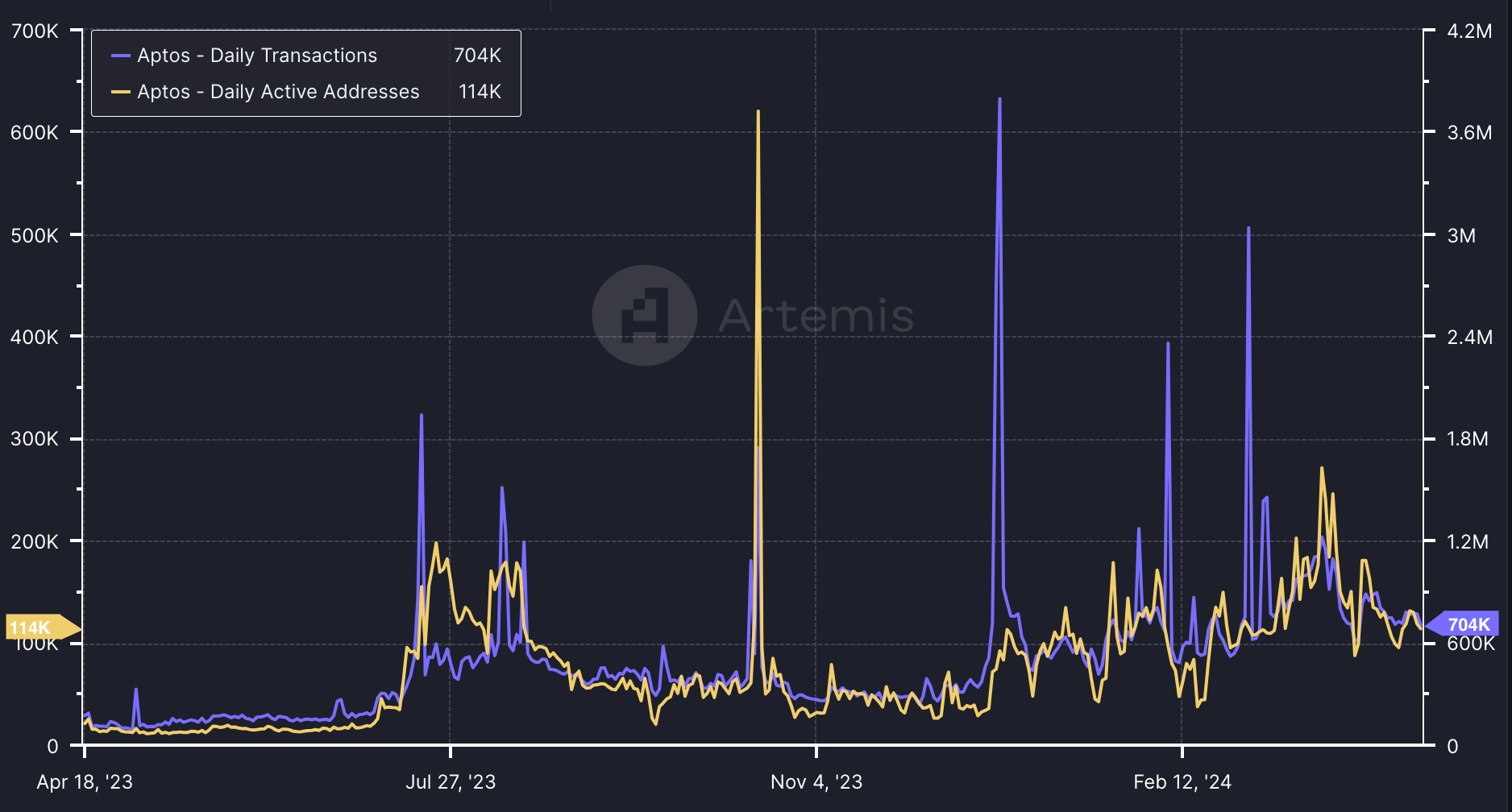

- Aptos’ Performance: Aptos, a blockchain built on remnants of Diem, promises high throughput but has shown modest performance, averaging around 700,000 transactions daily. Its DeFi sector is lagging, with a TVL of $350 million.

- Aptos’ Adoption: Despite challenges, Aptos is making strides in real-world assets (RWA) and tokenization, with initiatives like the Aptos Fungible Asset Standard and partnerships such as the one with Ondo Finance for USDY token exposure to U.S. Treasuries.

Sui: Performance and Adoption

- Sui’s Performance: Sui, another blockchain utilizing Move, averages around 1.5 million transactions per day. Its Total Value Locked (TVL) in DeFi is $600 million, showing a rapid growth rate and potential to enter the top 10 blockchains by TVL.

- Sui’s Adoption: Sui-based DEXes are achieving daily trading volumes of $50-150 million, reflecting real usage and adoption. Sui is also expanding into gaming and social sectors, partnering with ByteDance and announcing a web3 gaming console, SuiPlay0x1, in collaboration with Playtron.

Comparative Analysis of Aptos and Sui

- Comparative Performance: Sui’s technology is reportedly superior to that of Aptos, as evidenced by higher Total Value Locked (TVL), Decentralized Exchange (DEX) volumes, and transaction counts. However, Sui trails Aptos in user numbers.

- Comparative Valuation: Sui’s valuation of $1.8 billion is considered relatively low compared to other Layer 1 (L1) and Layer 2 (L2) solutions. Aptos, with 40% of its supply circulating, has a market cap of $4 billion and a $10 billion fully diluted valuation (FDV).

Actionable Insights

- Consider the Potential of Move: The Move programming language, despite being developed for a failed project, is influencing the crypto space and could be a game-changer for smart contract development. Its adoption by new projects like Aptos and Sui indicates its potential.

- Monitor the Progress of Aptos and Sui: Both Aptos and Sui are emerging blockchains utilizing Move. Their performance, adoption, and potential should be closely monitored to understand the practical application and impact of Move in the crypto space.

- Assess the Impact of Tokenomics: Sui’s tokenomics, with only 13% of its tokens in circulation and a large token unlock impending, could impact its price action. Aptos, with 40% of its supply circulating, may offer different dynamics. Understanding these factors could provide insights into their future performance.