Research Summary

The report provides a comprehensive review of Aptos, a Layer-1 blockchain, highlighting its performance, upgrades, partnerships, and future plans. It covers the network’s scalability, safety, reliability, and upgradeability, its DeFi ecosystem, NFT market, and gaming sector. The report also discusses Aptos’ strategic partnerships with major entities like Alibaba Cloud and SK Telecom.

Key Takeaways

Aptos’ Performance and Future Upgrades

- Scalability Achievement: Aptos demonstrated its scalability by achieving a peak throughput of 30,000 transactions per second (TPS) and processing over 2 billion transactions in a single day in a test environment.

- Upcoming Upgrades: Planned upgrades for Aptos in 2024, such as storage sharding and the introduction of Aggregators for NFT solutions, are expected to significantly enhance the network’s performance on the mainnet.

Strategic Partnerships and Ecosystem Growth

- Strategic Partnerships: Aptos Labs and the Aptos Foundation have formed strategic partnerships with major entities like Alibaba Cloud, SK Telecom, Readygg, and BlockGames, indicating a growing ecosystem and potential for mainstream adoption.

- Ecosystem Growth: The launch of the onchain order book infrastructure Econia has facilitated trading on various third-party protocols, notably boosting Aries Markets’ Total Value Locked (TVL) by 1,529% quarter-over-quarter to $30.6 million.

Aptos’ Financial Performance

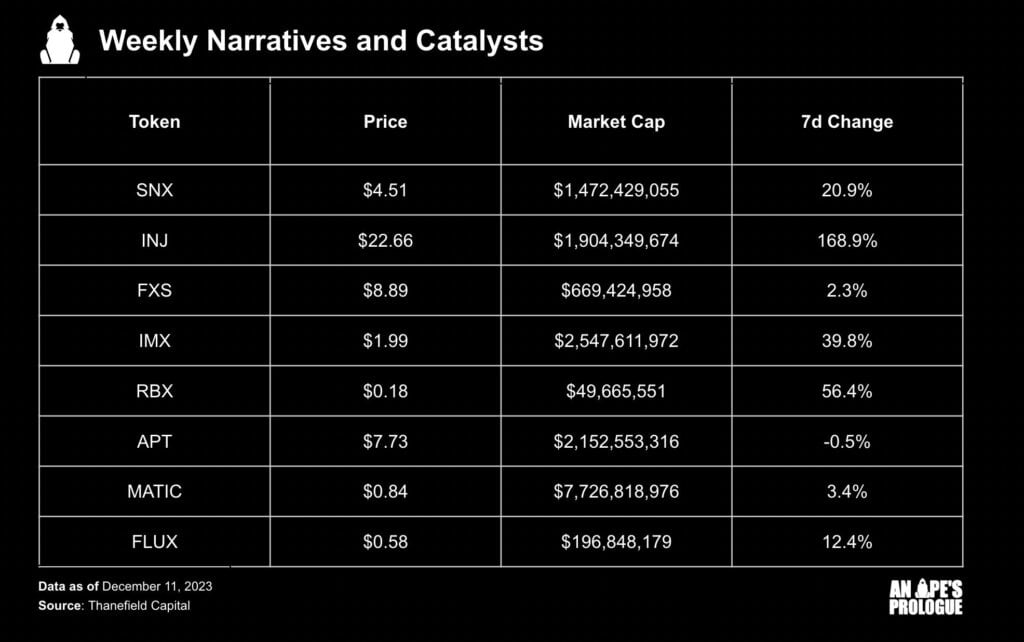

- Market Cap Growth: The crypto market saw a rebound in Q4’23, with APT’s circulating market cap increasing by 126% quarter-over-quarter to $2.9 billion, outperforming similar market cap cryptocurrencies.

- Revenue Growth: Aptos’ revenue, derived from protocol fees, grew by 10% quarter-over-quarter in APT terms to over 46,000 and by 30% in USD to $345,000, with a notable spike in December due to an inscriptions craze.

DeFi and NFT Market Developments

- DeFi Market Growth: Aptos’s DeFi Total Value Locked (TVL) saw a significant increase of 169% quarter-over-quarter (QoQ) to $121 million, with a 54% increase in APT terms, indicating growth beyond mere APT price appreciation.

- NFT Market Growth: NFT trading volume on Aptos reached $2.5 million in Q4, a 460% quarter-over-quarter increase, with Topaz, BlueMove, and Wapal being the leading marketplaces.

Actionable Insights

- Monitor Aptos’ Upcoming Upgrades: Stakeholders should keep an eye on the planned upgrades for Aptos in 2024, such as storage sharding and the introduction of Aggregators for NFT solutions, as these are expected to significantly enhance the network’s performance.

- Assess Impact of Strategic Partnerships: The strategic partnerships formed by Aptos Labs and the Aptos Foundation with major entities like Alibaba Cloud and SK Telecom could have significant implications for the growth and mainstream adoption of the Aptos ecosystem. Stakeholders should assess the potential impact of these partnerships.

- Track Aptos’ Financial Performance: Given the significant growth in APT’s circulating market cap and Aptos’ revenue, stakeholders should continue to track the financial performance of Aptos for potential opportunities.

- Explore DeFi and NFT Market Developments: The significant growth in Aptos’s DeFi Total Value Locked (TVL) and NFT trading volume indicates potential opportunities in these markets. Stakeholders should explore these developments for potential strategic moves.