Podcast Summary

This podcast episode delves into the intricacies of the current economic climate, the role of the Federal Reserve, and the impact of these factors on the cryptocurrency market. The host also discusses the potential of Solana as a promising investment, the significance of the Bitcoin ETF, and the future of the crypto economy. The conversation further explores the challenges of managing an economy with slow growth and high debt levels, and the role of stimulus in addressing these challenges.

Key Takeaways

Understanding the Current Economic Climate

- Correlation between Treasury Yields and Market: The host discusses the relationship between treasury yields and the market, noting its option-like nature. The host also mentions the desire for rates to rise to bring liquidity into the system, but cautions that historically, when the Fed pivots, prices tend to go down.

- Debt and Refinancing: The host highlights the issue of debt and the need for refinancing every three to five years. The host also mentions the excess issuance that occurred during the pandemic and the need to monetize that debt.

- Slow Growth and High Debt Levels: The host discusses the challenges of managing an economy with slow growth and high debt levels, and the role of stimulus in addressing these challenges.

Role of Cryptocurrency in the Economy

- Debasement of Currency and Scarcity of Assets: The host discusses the debasement of currency and the socialization of debt, highlighting the importance of scarce assets like crypto and technology.

- Correlation of Cryptocurrency with Broader Market: The hosts note that historical correlation between cryptocurrency and other assets has been low, and there is a belief that it could become an idiosyncratic asset class.

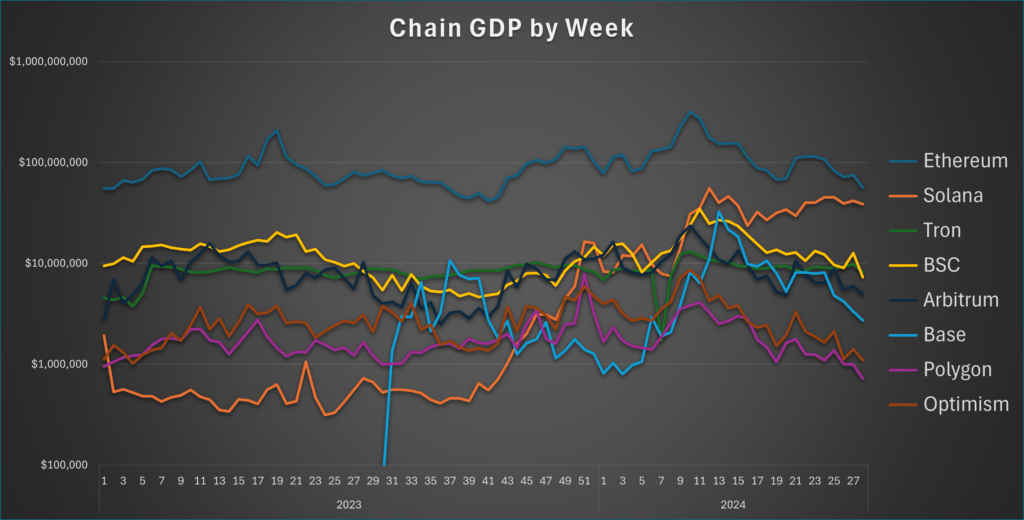

- Impact of ETFs on Crypto Economy: The hosts discuss the potential impact of ETFs on the crypto economy, with the expectation that capital will flow into Bitcoin first and then move to other altcoins.

Investment Opportunities in the Crypto Space

- Shift in Focus to Solana: The hosts discuss their recent shift in focus towards Solana as a potential investment opportunity. They highlight Solana’s potential to solve the scalability trilemma and its ability to handle a wide range of use cases.

- Opportunity in NFT Market: The speaker suggests that the NFT market will eventually rebound, with high-end projects and utility-based projects being the most likely to succeed.

- Bitcoin ETF as a Catalyst: The speaker discusses the Bitcoin ETF and its potential to bring more investors, including retail investors, into the crypto space.

Sentiment Analysis

- Bullish: The host expresses optimism about the future due to the slow return of liquidity. They also express bullishness on Solana, noting its potential to solve the scalability trilemma and its ability to handle a wide range of use cases. The speaker also expresses optimism about the current market situation, mentioning the upcoming liquidity and the Bitcoin spot ETF, which they believe will create a favorable environment for growth.

- Bearish: The host acknowledges that the recession experienced by the stock market is not the same as the recession experienced by the average person, who is feeling the impact of inflation and rising prices. The host predicts that unemployment numbers will continue to rise and mentions the struggles faced by businesses and individuals in the current economic climate.

- Neutral: The host discusses the correlation between treasury yields and the market, highlighting the option-like nature of the relationship. They also discuss the issue of debt and the need for refinancing every three to five years, noting that the Fed balance sheet lags behind the interest payments due from the previous cycle.