Key Insights

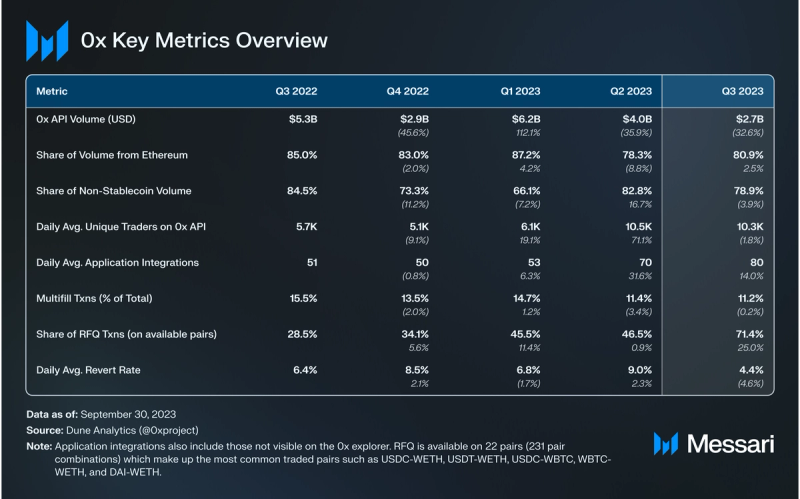

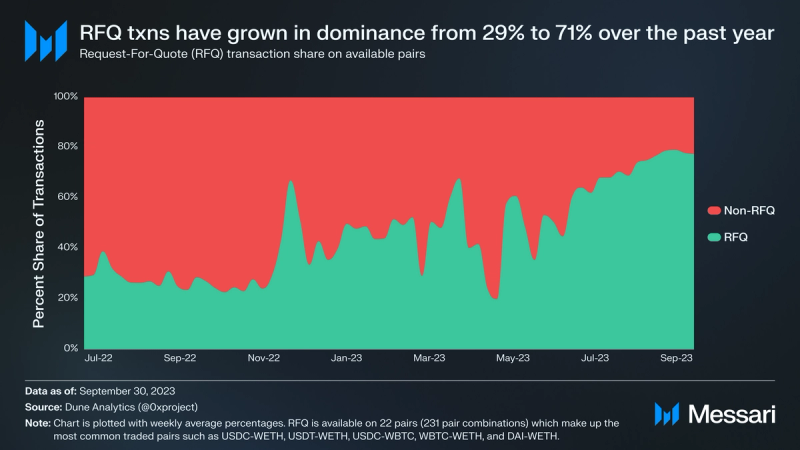

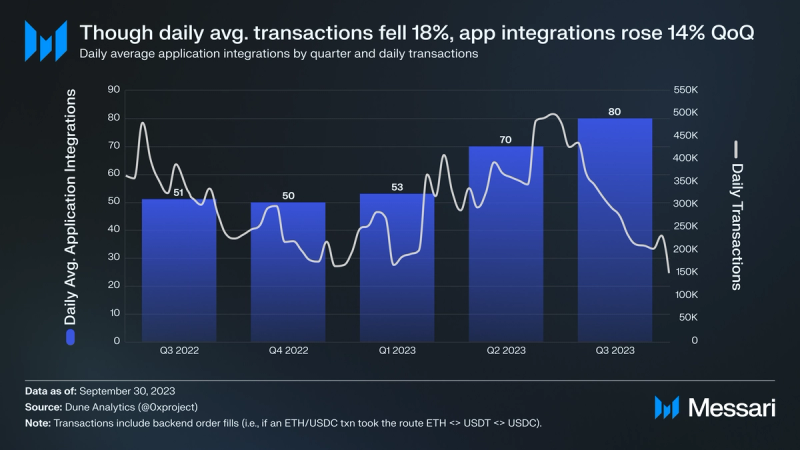

- In Q3 2023, 0x experienced record levels of daily application integrations at 80 (+14% QoQ). It also had the highest share of RFQ (less expensive/more efficient) transactions relative to the total processed at 71% (+25% QoQ)

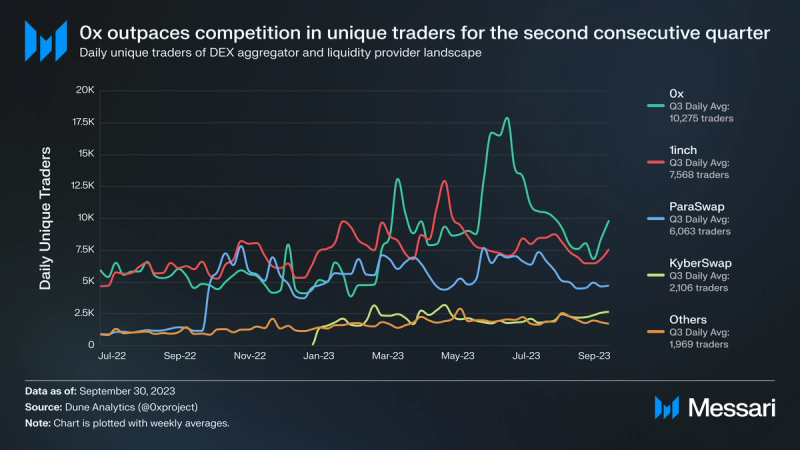

- Compared to its peers, 0x had the lowest level of the daily average rate of failed trades (revert rate) at 4.4% (-4.6% QoQ), whereas trading volume and daily average unique traders declined by 33% and 2%, respectively.

- 0x claimed an average of over 10,000 unique users per day in Q3, while the next closest competitor had less than 7,600.

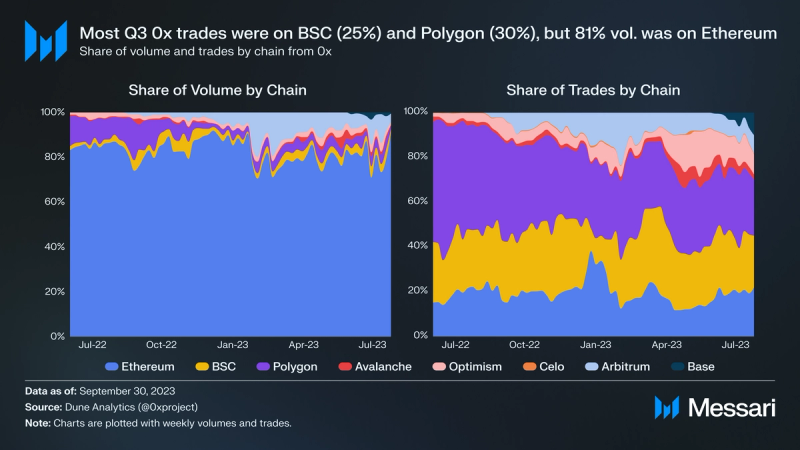

- Polygon and BNB Smart Chain (BSC) continued to account for more 0x trades than Ethereum in Q3, taking 30% and 25% of all trades, respectively. Simultaneously, Ethereum still dominated volume share at 81%.

- In Q3, 0x increased its support of liquidity sources to over 100, while adding support for Base in its Swap API. Also, it was integrated into Robinhood and Portal.

Primer on 0x

0x is an integrated suite of decentralized finance (DeFi) infrastructure APIs that enables developers and teams to build financial products on crypto rails. 0x APIs have processed over 60 million transactions and $133 billion in volume from more than 7 million users trading on apps like Coinbase Wallet, Robinhood Wallet, MetaMask, Zerion, Zapper, and more. Through the 0x APIs (offchain routing) and the 0x Protocol (onchain settlement via an open-source protocol), 0x connects Makers and Takers to facilitate the trading of digital assets. While Takers demand liquidity of digital assets on 0x, Makers are the parties that supply that liquidity. Onchain makers include AMMs and DEXs, while offchain makers are professional market makers that provide RFQ (Request-for-Quote) liquidity to 0x.

0x’s flagship product, Swap API, enables developers to deliver the best executed price to users directly in their applications. It does this by aggregating liquidity from 100+ sources, including decentralized exchanges (DEXs) and private market makers through the 0x RFQ, and its proprietary smart order routing. The best executed is different from the quoted price in that it is the best rate when the trade is realized, as opposed to the quoted rate subject to price slippage. Swap API is available on nine EVM-compatible blockchains including Ethereum, BNB Smart Chain (BSC), Polygon, Avalanche, Optimism, Fantom, Celo, Arbitrum, and Base.

The 0x platform also includes the 0x Dashboard, a developer experience tool with instant API keys, analytics, and monetization controls; Tx Relay API, which enables developers to enhance user experience to reduce drop-offs in the trading process (currently in beta on Ethereum and Polygon); and Orderbook API, which enables developers to add limit orders to their DeFi applications (available on Ethereum, Polygon, and BSC). 0x’s products have been powering the backend processes for much of DeFi since it launched in 2017, and they continue to be updated with new features and improvements.

Key Metrics

Performance Analysis

Volume and Trades

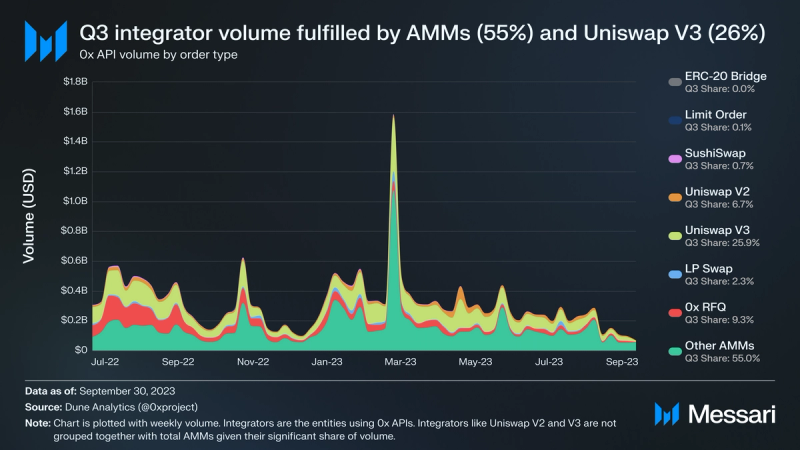

The volume serviced by 0x APIs in Q3 dropped 33% QoQ, from $4 billion to $2.7 billion. The biggest declines in order fulfillment came from Uniswap (-49%), 0x RFQ (-28%), and other AMMs (-19%). Regardless, the share of volume attributed to AMM fulfillment grew from 46% to 55% QoQ. The continued addition of new liquidity sources may lead to higher volume increases when increased market activity returns to crypto, even compared to previous well-performing quarters.

Despite Ethereum’s dominance in 0x’s volume share (81%), it does not facilitate most trading activity on the protocol. Instead, most 0x trades occur on Polygon (30%) and BNB Smart Chain (25%), while Ethereum hovers around 17%. Although Polygon and BSC accounted for the most trades this quarter, they actually lost share percentage as Optimism grew its share by 6% QoQ, from 8% to 14%. Optimism also outpaced Arbitrum, which dropped from 10% to 8% in Q3. Regarding volume, Optimism only added 0.7% in Q3, reaching 2.7% of total 0x volume. Arbirtrum had the largest movement in volume share QoQ, dropping from 11% to 7%. The distribution of 0x trade and volume share suggest that large-volume traders are still concentrated on Ethereum.

For the second consecutive quarter, 0x attracted over 10,000 daily unique traders on average, outpacing its competitors in the DEX aggregator and liquidity provider landscape. In Q2, most of the market experienced growth in daily unique traders. ParaSwap experienced a 23% increase, other protocols jumped 31%, and 0x increased by 71%. However, in Q3, the entire market saw a decline in daily unique traders by 5%, with 0x only falling by 2% QoQ. 0x’s continued developments and increased integrations position it well to capture more users in the future.

RFQ trades

On 0x, offchain liquidity is sourced from professional market makers via the 0x Request-for-Quote (“RFQ”) system. The RFQ system enables traders to request real-time quotes from market makers. Using the RFQ system, traders can avoid slippage, mitigate the risk of MEV attacks, and ensure optimized trade execution. RFQ performs best on non-pegged pairs, including some of the most highly traded pairs such as USDC-WETH, USDT-WETH, USDC-WBTC, WBTC-WETH, and DAI-WETH. Over the past year, RFQ transactions have grown to dominate 0x activity on pairs where it’s available, rising from 29% in Q3 2022 to 71% in Q3 2023. This marks four consecutive quarters of growth. In any market condition, users will opt for trades that are more economical and avoid slippage/MEV risks.

Application Integrations

Application integrations of 0x APIs have continued growing since Q4 2022. In Q2, the number of applications using 0x increased by 32%, and in Q3, it increased again — this time by 14%, reaching 80 integrations. Despite the rise in integrations, daily average transactions fell by 18%, indicating a slump in general crypto usage. If crypto continues to recover into favorable market conditions, 0x will be ready to capture activity and usage as it integrates into more applications.

Qualitative Analysis

0x had a productive Q3 as it shipped new developments throughout the quarter — both for its namesake protocol and Matcha, a DEX aggregator developed by 0x.

Developments and Integrations

- The 0x Swap API increased supported liquidity sources to over 100. Notably, Maverick, an efficient AMM, and eight other liquidity sources were added in Q3.

- The 0x Swap API added support for Base.

- Robinhood integrated the TX Relay API to offer in-app swaps to users.

- Portal, a UX infrastructure company for Web3, implemented the 0x Swap API in its SDK, enabling developers to launch in-app token swaps.

- 0x launched paid plans for the 0x Swap API. This gives 0x a viable form of revenue as it continues to grow, add new features, and upgrade existing tools.

Matcha Developments

- Benefits from 0x developments such as increased liquidity sources and the addition of Base.

- Token coverage increased from 11,000 to 4.7 million.

- UX improvements such as gas-free token approvals, multichain search displays for supported tokens, and revamped interfaces.

- Limit order upgrades include support for fixed percentage adjustments to orders, setting an exact order amount, duplicating past orders, and canceling multiple orders at once (which costs gas).

- Launch of Matcha Auto transaction mode, which mitigates MEV risk, dynamically adjusts gas fees for block inclusion, abstracts away gas fees, and integrates orders into the RFQ book.

CFTC Charges ZeroEx Inc. $200,000

The Commodity Futures Trading Commission (CFTC) issued an order against ZeroEx Inc. (0x) in September 2023, charging the company $200,000 for facilitating leveraged and margined retail commodity transactions in digital assets. Through Matcha, users from the U.S. were trading these assets, which triggered the CFTC order. The assets in question provided roughly 2:1 leveraged exposure to digital assets like ETH and BTC. The CFTC classified the trading of these assets as leveraged or margined retail commodity transactions, which violated the Commodity Exchange Act (CEA). Matcha noted that the trading of these assets constituted less than 0.1% of its trading volume since inception.

Closing Summary

0x is one of the most robust and widely used liquidity aggregators for DeFi. It outpaced its competition in the number of daily unique traders and saw revert rates of only 4% in Q3 (all other competitors were above 5%). Despite a fall in volume processed, 0x added application integrations (+14%) and processed a higher percentage of RFQ transactions (+25%) in Q3. It also increased its support of liquidity sources to over 100, while adding support for Base in its Swap API. In addition, 0x was integrated into notable applications and systems like Robinhood and Portal. 0x remains poised to capture value in the next upward swing of the market cycle.

——