Research Summary

The report discusses the current state of the stock market, highlighting the performance of the Magnificent Seven, the potential for a recession, and the prospects for gold. It also touches on the performance of small-cap stocks and the likelihood of an increase in unemployment.

Key Takeaways

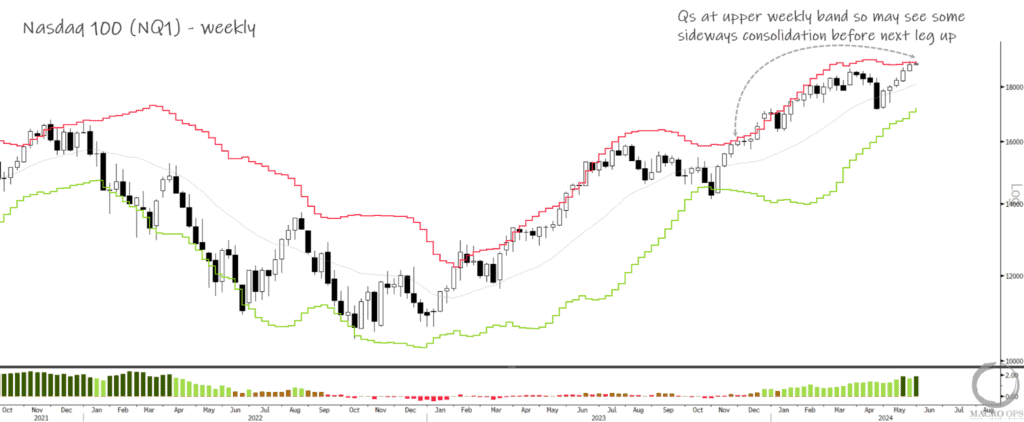

Market Performance and Predictions

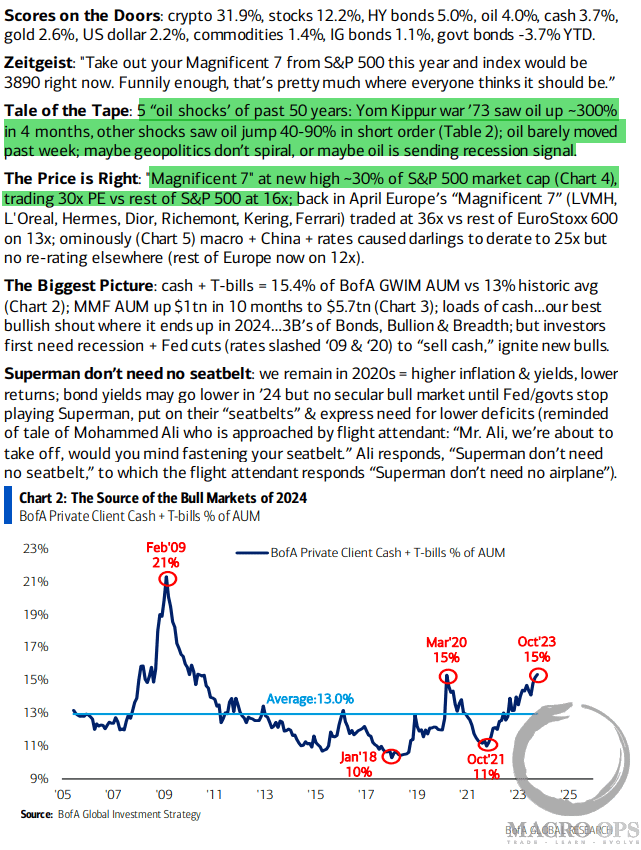

- Flow Show Summary: The report begins with a summary of the previous week’s Flow Show, which provides an overview of market trends and movements.

- Bull & Bear Indicator: The Bull & Bear indicator from Bank of America is on the verge of triggering a Buy Signal, suggesting that the path of least resistance for the market is upwards in the intermediate term.

- Magnificent Seven’s Market Cap: The Magnificent Seven, a group of large-cap stocks, have surpassed their market cap as a percentage of the S&P 500’s all-time high, reaching 29.6%.

- Seasonal Strength: The report notes that the market is about to enter the strongest seasonal period of the year for the S&P 500.

Small-Cap Stocks and Recession Indicators

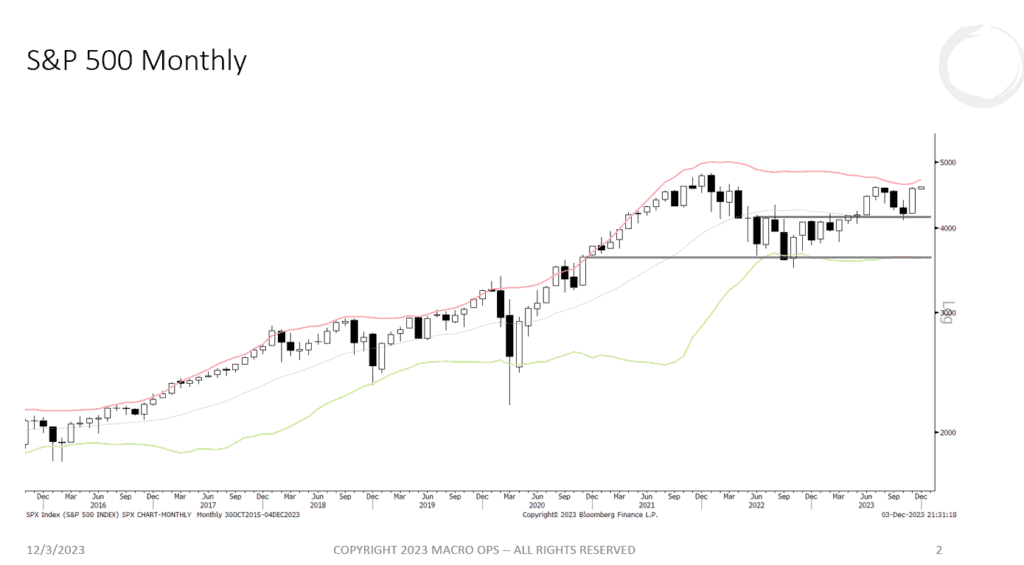

- Small-Cap Performance: Small-cap stocks are struggling, and if they start a new cyclical down leg, it could signal broader market downturns.

- Long-Term Breadth Indicators: The report’s long-term breadth indicators suggest a resumption of the cyclical bear market.

- Recession Predictions: The report suggests that a US recession is likely to start by the end of 2023, with the economy potentially tipping into one shortly after the turn of the year.

Gold Market Analysis

- Gold Market Sentiment: The report discusses an oversold buy setup in gold, with sentiment indicators for Large spec and Money Managers falling below the sub-20th percentile, which has historically marked major bottoms.

- Gold Price Threshold: A monthly close above the key $2,000 level in gold would signal a new cyclical advance.

Actionable Insights

- Monitor Small-Cap Stocks: Given the potential for small-cap stocks to signal broader market downturns, it would be prudent to keep a close eye on their performance.

- Prepare for Potential Recession: With indicators suggesting a likely recession by the end of 2023, it may be wise to consider strategies for weathering an economic downturn.

- Investigate the Potential in Gold: The report suggests that gold may be entering a new cyclical advance, making it a potential area of interest for further investigation.