Research Summary

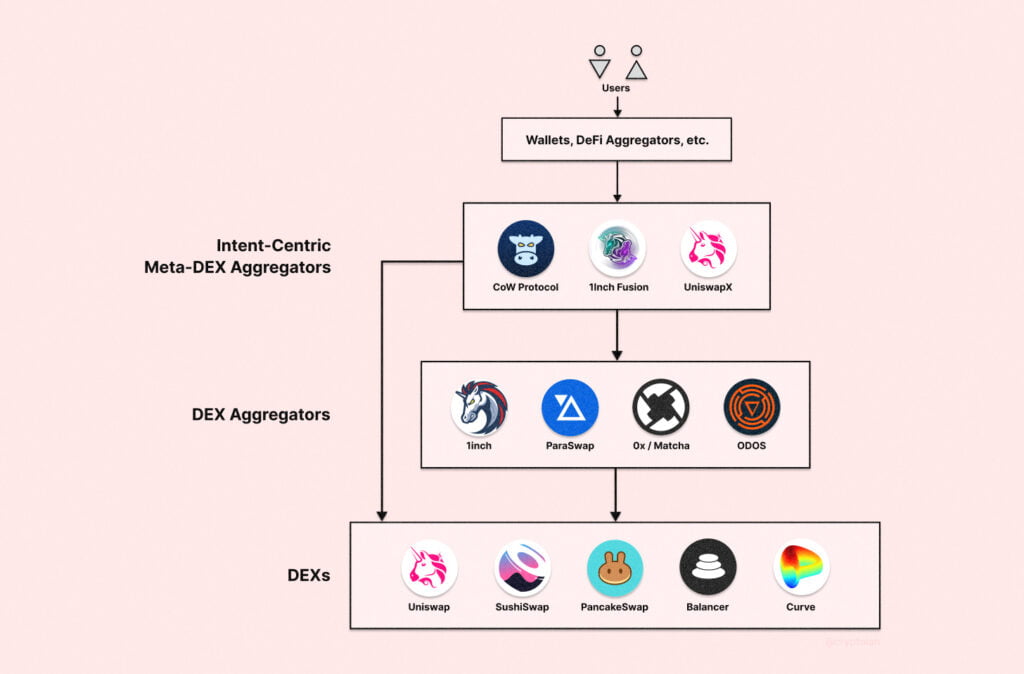

The research report discusses Cowswap, a fully permissionless trading protocol that uses batch auctions and coincidence of wants (CoW) to clear trades. This approach minimizes Miner Extractable Value (MEV) extraction and settles trades on-chain peer-to-peer without relying heavily on Decentralized Exchange (DEX) Automated Market Makers (AMMs). Cowswap’s system allows traders to trade without a middleman like an AMM charging excess fees and without the price impact of a constant function market-maker. The protocol also includes a competitive solver market to provide the most value to users.

Actionable Insights

- Understanding Cowswap: Cowswap is a trading protocol that uses batch auctions and CoW to clear trades, minimizing MEV extraction and settling trades on-chain P2P without using DEX AMMs as much as possible.

- Role of Solvers: Solvers look at all the intents to trade and create the optimal solution that provides the most trade surplus to users. They compete through a second-price auction mechanism to bid for the right to execute their solution.

- Trader Surplus: On average, traders have experienced a 0.468% trader surplus, indicating the effectiveness of the protocol.

- Future Developments: Cowswap plans to develop more advanced trade execution features such as safe composable conditional orders, DAO account abstraction, and other MEV solutions.