Research Summary

The report discusses various developments in the digital asset space, including the launch of Celestia’s TIA token, Backpack’s upcoming exchange, and Circle’s decision to stop supporting retail minting of their stablecoins. It also highlights the performance of different assets, trading volumes, and total value locked (TVL) in various platforms. Additionally, the report mentions a points program by Hyperliquid and governance proposals.

Key Takeaways

Celestia Token TIA Launches

- Celestia’s Mainnet Beta: Celestia has launched its mainnet beta, and its TIA token is now available for trading on several Tier 1 exchanges. Binance has also listed TIA perpetual contracts. The token is currently priced at $2.36, with a trading volume of $200 million. Only 14% of the total supply is in circulation.

Backpack’s Exchange Launch

- Backpack’s VASP License: Backpack, a crypto wallet, has acquired a VASP license from the Dubai Virtual Assets Regulatory Authority. It plans to launch an exchange, with the beta starting next month and public availability in Q1 2024.

Circle’s Retail Offramp / Onramp Accounts Closure

- Circle’s Stablecoin Minting: Circle will cease supporting retail minting of their stablecoins USDC & EURC. However, businesses and institutional clients will remain unaffected by this change.

HyperLiquid’s Points Program

- HyperLiquid’s User Incentive: Hyperliquid, a perpetual DEX, has announced a points program starting from November 1st. Over six months, 1 million points will be distributed to users every Thursday. A referral bonus points program will also be implemented.

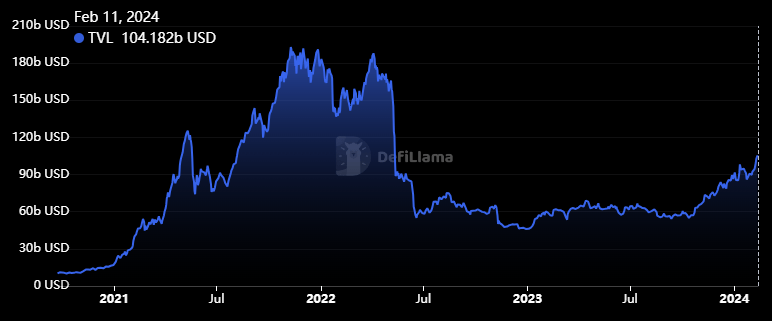

Asset Performance and Trading Volumes

- Asset Performance: The report highlights the performance of various assets. JOE, GF, and CYBER outperformed in the below $100M market cap category, while SUSHI and WLD performed well in the above $100M market cap category. ATOM was the top performer in the above $1B market cap category.

- Trading Volumes: Onchain trading volumes are slightly lower compared to the previous week, with ARB and LINK attracting the most volume.

Actionable Insights

- Monitor Celestia’s TIA Token: With the launch of Celestia’s TIA token and its listing on several Tier 1 exchanges, it may be beneficial to monitor its performance and market reception.

- Consider Backpack’s Upcoming Exchange: Backpack’s upcoming exchange, following its acquisition of a VASP license, could present new trading opportunities. It’s worth keeping an eye on its beta launch and subsequent public availability.

- Understand Implications of Circle’s Decision: Circle’s decision to stop supporting retail minting of their stablecoins could have implications for retail investors. It’s important to understand these changes and adjust strategies accordingly.

- Participate in HyperLiquid’s Points Program: HyperLiquid’s points program could offer benefits to users. Consider participating in the program and leveraging the referral bonus points system.

- Track Asset Performance and Trading Volumes: Keeping track of asset performance and trading volumes can provide insights into market trends and potential investment strategies.