Research Summary

The report discusses five DeFi farming opportunities for the week, namely Arrakis Finance, Canto, Sommelier Finance, FusionX Finance, and Radpie. These platforms offer various yield opportunities through liquidity provision, staking, and other DeFi strategies.

Key Takeaways

Arrakis Finance: Advanced Liquidity Management

- High Risk-Adjusted Yields: Arrakis Finance, a protocol built on Uniswap, offers some of the highest risk-adjusted yields in DeFi through its advanced algorithms.

- Liquid Staking Vaults: The recently launched Liquid Staking Vaults allow users to earn a 36% APR in rewards on wstETH/USDC, plus additional LP fees.

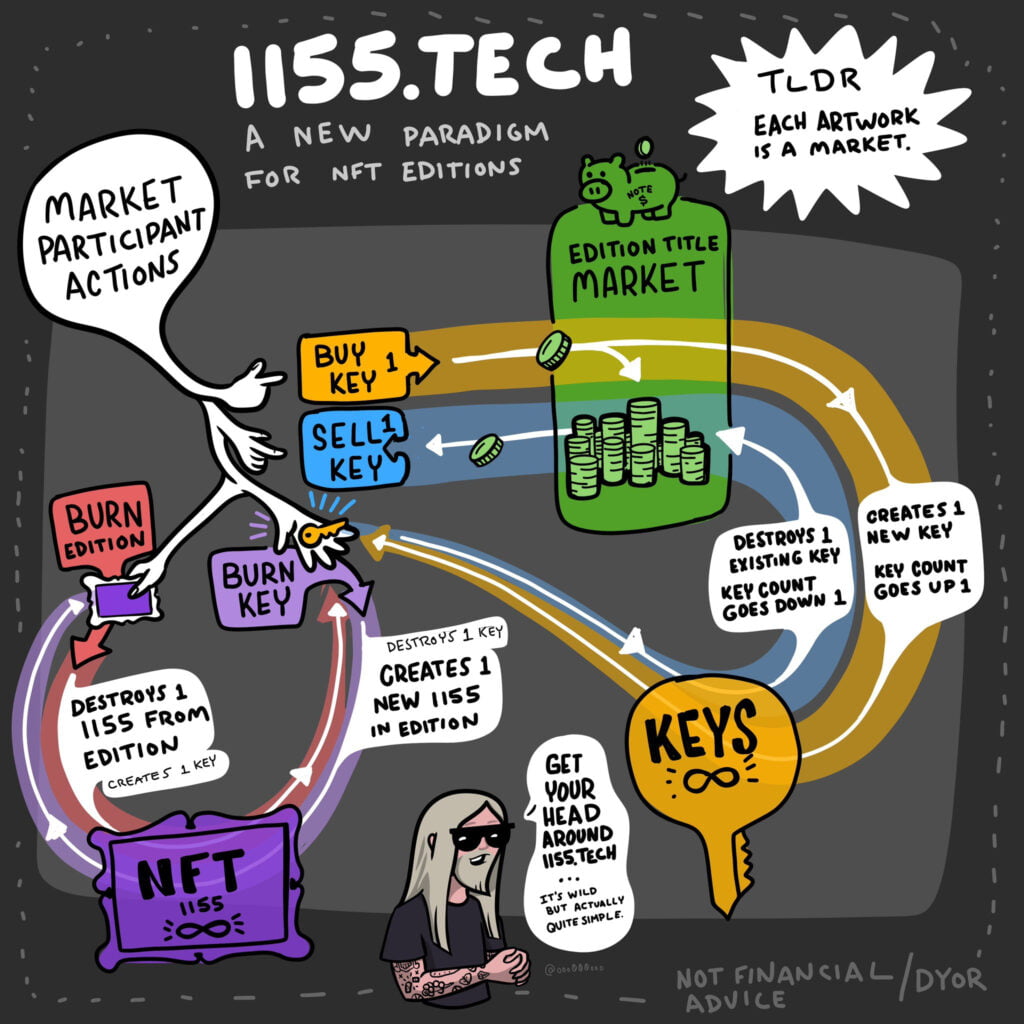

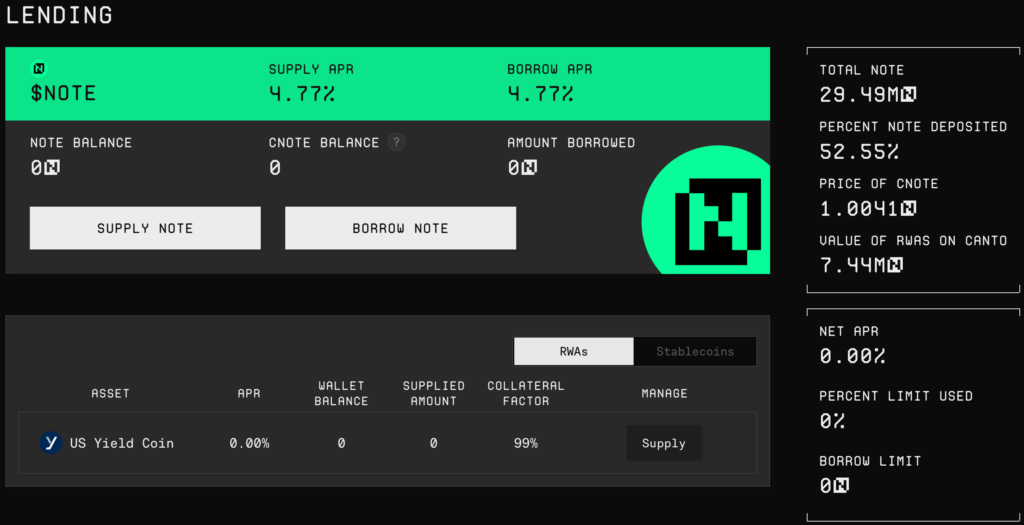

Canto: Cosmos-Based L1

- Expansion and Migration: Canto’s recent expansion to RWAs and upcoming migration to a ZK L2 have led to an increase in price and TVL.

- Lucrative Yields: LPs can earn boosted APRs on various pairs, including 84% on CANTO/ATOM, 88% on CANTO/ETH, 96% on CANTO/NOTE, and 35% on cNOTE/USDC.

Sommelier Finance: Yield Aggregator

- Increasing TVL: Sommelier Finance’s TVL continues to rise due to a consistent stream of new vaults offering high risk-adjusted yields for blue-chip assets.

- Lucrative Vaults: The platform’s Turbo stETH vault offers a 24% APY, while the Real Yield ETH Vault offers an 11% APY.

FusionX Finance: DeFi Suite in the Mantle Ecosystem

- Liquidity Bootstrapping Program: FusionX’s Liquidity Bootstrapping Program offers farming opportunities for those bullish on the Mantle ecosystem.

- High APRs: Users can farm RFSX on pairs like USDT/USDC @ 24% APR, WMNT/USDT @ 372% APR, ETH/USDT @ 79% APR, WBTC/USDT @ 89% APR, and MINU/MNT @ 150% APR.

Radpie: Yield Unlocking Protocol

- Automated Farming: Radpie allows users to deposit blue-chip tokens for automated farming of lending fees and RDNT emissions.

- Lucrative Yields: The platform offers yields such as DLP @ 58% APR, USDT @ 13% APR, USDC @ 14% APR, and BTC @ 8% APR.

Actionable Insights

- Investigate the Potential of Arrakis Finance: With its high risk-adjusted yields and Liquid Staking Vaults, Arrakis Finance could be a promising platform for DeFi enthusiasts.

- Explore Canto’s Yield Opportunities: Given Canto’s recent expansion and migration, as well as its boosted APRs, it could be worth looking into the platform’s native lending market yields.

- Consider Sommelier Finance’s Vaults: With its increasing TVL and lucrative vaults, Sommelier Finance could offer attractive yield opportunities.

- Assess FusionX’s Liquidity Bootstrapping Program: FusionX’s Liquidity Bootstrapping Program and high APRs could provide fruitful farming opportunities for those bullish on the Mantle ecosystem.

- Examine Radpie’s Automated Farming: Radpie’s automated farming and lucrative yields could be of interest to those looking to deposit blue-chip tokens.