Research Summary

The report provides a comprehensive analysis of the current state of the cryptocurrency market, key economic metrics, and macro events. It also discusses regulatory developments, legal cases, and country-specific crypto initiatives. The report further highlights the performance of various altcoins and the impact of broader economic resilience on the crypto market.

Key Takeaways

Regulatory Developments and Legal Cases

- Bitcoin ETF Approval: Grayscale remains optimistic about the approval of its Bitcoin Trust as an ETF by January 2024. This potential approval is positively impacting the crypto market.

- Binance’s Legal Woes: Binance has agreed to a $4.3 billion settlement over allegations of sanctions violations and inadequate AML practices. This indicates stronger enforcement against crypto platforms that fail to adhere to regulations.

- SEC Scrutiny: The SEC continues to scrutinize crypto exchanges, recently suing Kraken for allegedly operating as an unregistered broker and dealer. This evolving regulatory landscape significantly impacts market dynamics.

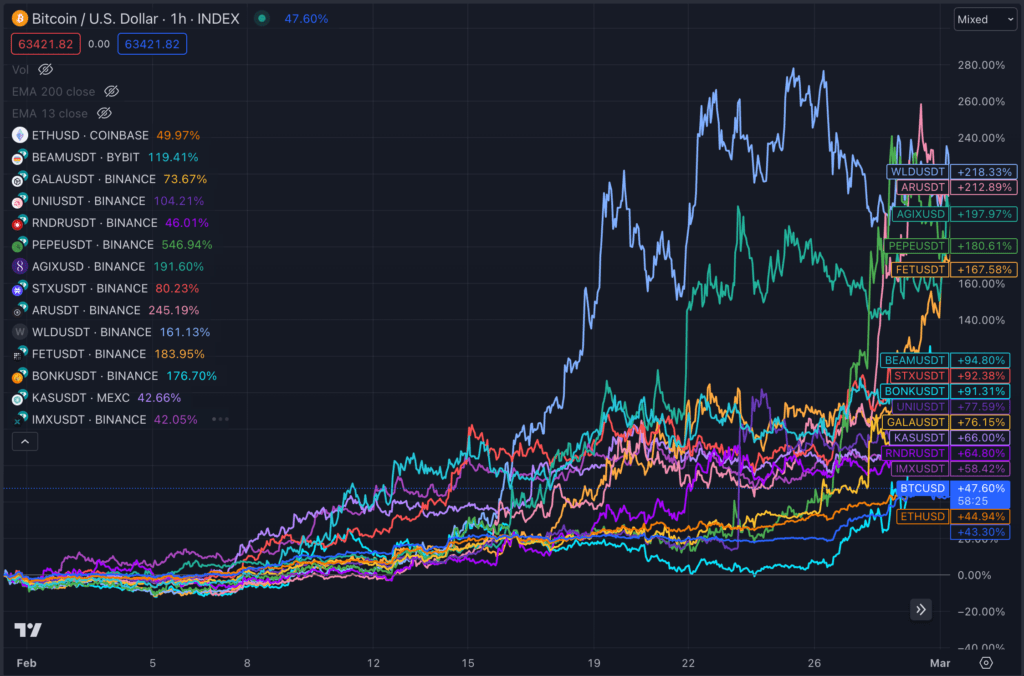

Altcoin Performance

- Litecoin’s Active Addresses: Litecoin’s active addresses reached a record high four months post-LTC halving, indicating increased activity and interest in the altcoin.

- Synthetix’s SNX Token: Synthetix announced the end of SNX token inflation, focusing on buybacks and burns. This led to a surge in the SNX price, followed by a drop.

- Aptos (APT) Token: Aptos (APT) Token soared to June-level highs, defying recent token unlock, indicating strong investor confidence in the token.

Key Economic Metrics

- US Deficits: The US budget deficit is expected to be 5.8% of GDP in 2023. While high, this is amid economic growth and low unemployment. The deficit is forecasted to gradually decline before rising again in coming years.

- Job Market Strength: Job growth accelerated in November from October, adding 199,000 jobs, indicating continued strength in the labor market. Other labor market indicators like unemployment falling to 3.7%, expanded labor force participation, and reduced youth unemployment also signal strength.

- Interest Rate Cuts: Investors expect the Fed to cut interest rates in 2024, with 125 basis points of cuts to put rates between 4-4.25%. This diverges from the Fed’s own projections.

Actionable Insights

- Monitor Regulatory Developments: The evolving regulatory landscape in the crypto market, including potential Bitcoin ETF approval and increased SEC scrutiny, could significantly impact market dynamics. Stakeholders should keep a close eye on these developments.

- Assess Altcoin Performance: The performance of altcoins like Litecoin, Synthetix’s SNX, and Aptos (APT) Token provides insights into market trends and investor sentiment. Stakeholders should assess these trends for strategic decision-making.

- Consider Economic Metrics: Key economic metrics such as US deficits, job market strength, and expected interest rate cuts can influence the crypto market. Stakeholders should consider these metrics when making investment decisions.