Research Summary

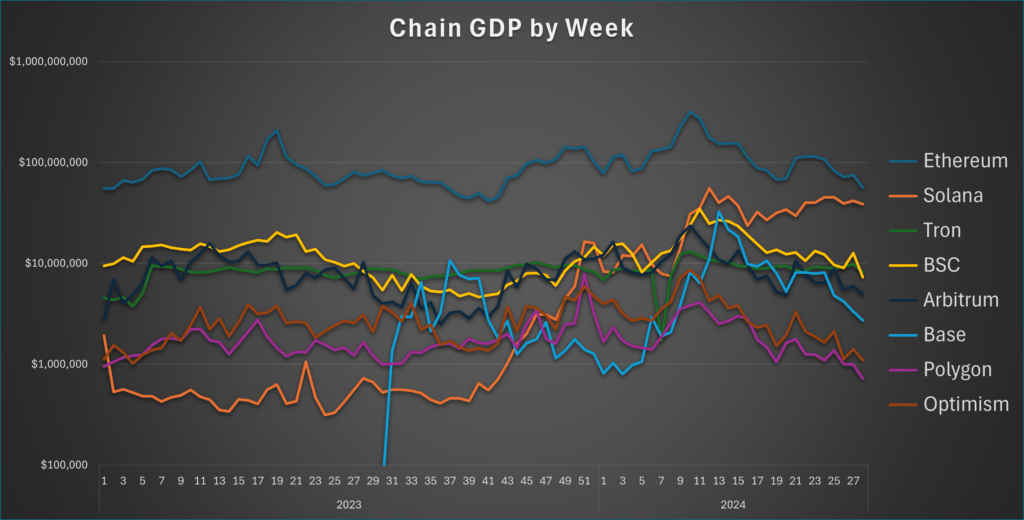

The report discusses the launch of Solana DEX aggregator Jupiter’s token $JUP, its distribution mechanics, and the subsequent market reactions. It also highlights the controversy surrounding the launch and the uncertainty about the future of the funds in the launch pool.

Key Takeaways

Launch of Jupiter’s Token

- Token Launch: Solana DEX aggregator Jupiter’s token $JUP went live for trading and claiming for eligible users. The eligibility criteria were based on the users’ engagement with the platform since its inception in 2022.

- Market Reaction: The launch was met with mixed reactions, with some speculators expressing disappointment over the token’s performance. The token’s price was trapped within the launch pool, leading to frustration among investors who had expected a price surge.

Launch Pool Mechanics

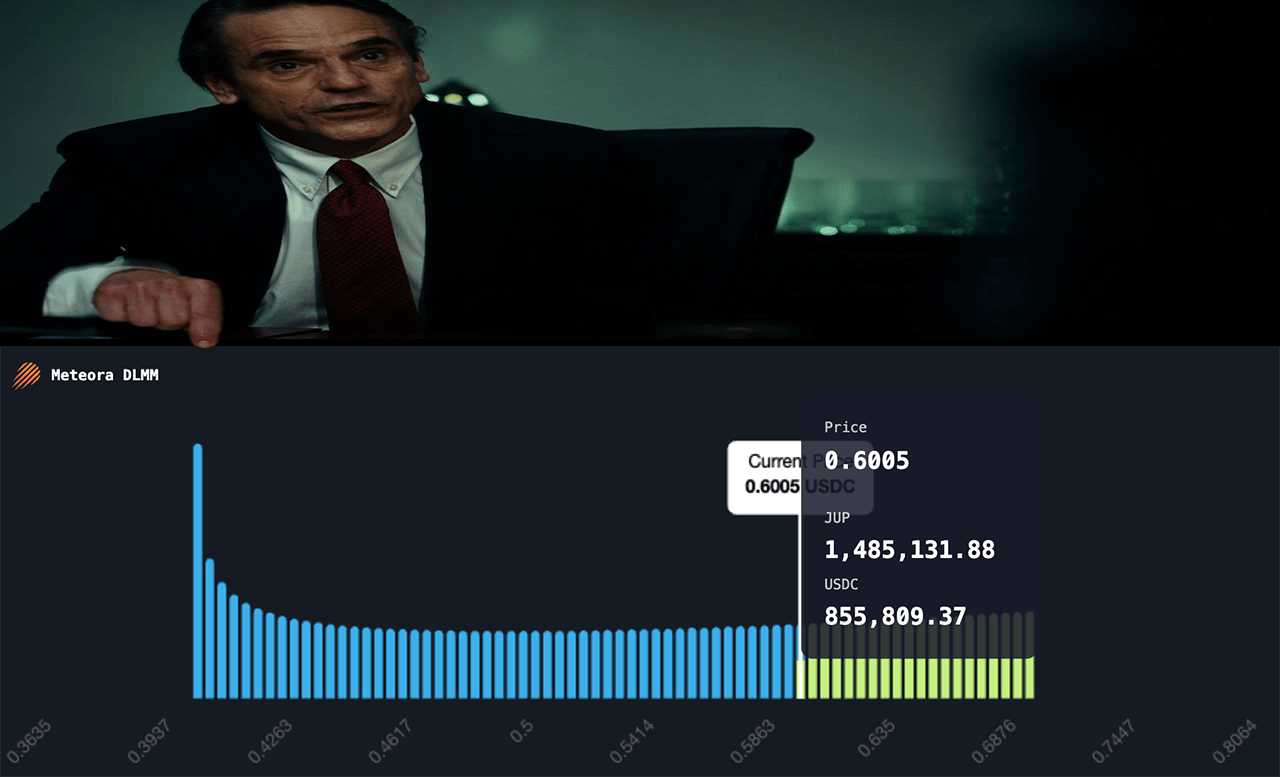

- One-Sided Concentrated Liquidity Pool: Jupiter used a one-sided concentrated liquidity pool to distribute their tokens. The pool started at 40c and ended at 70c, with each bin containing a set amount of $JUP. The total amount of $USDC needed to clear the entire pool was $135m.

- Price Stability Mechanism: The large liquidity pool was intended to cap volatility in both directions, requiring a significant amount of buying pressure to clear 70c and a large amount of selling pressure to drop below 40c.

Uncertainty Surrounding the Launch Pool

- Unclear Future of the Funds: There is uncertainty about what will happen to the funds in the pool after 7 days. If the team had provided a clear plan, such as allocating a certain percentage towards on-chain liquidity and keeping the rest, it could have increased investor confidence.

Actionable Insights

- Understanding Token Launch Mechanics: Investors should thoroughly understand the mechanics of a token launch, including the distribution method and the factors that could influence the token’s price. This can help manage expectations and make informed investment decisions.

- Importance of Transparency: Crypto platforms should strive for transparency, especially regarding the use of funds from token launches. Clear communication can help build trust with investors and potentially drive more engagement with the platform.

- Monitoring Market Reactions: Observing and analyzing market reactions to token launches can provide valuable insights into investor sentiment and market trends. This can be useful for predicting future market movements and making strategic investment decisions.