Research Summary

The report discusses the development of the Blast ecosystem, with a focus on DeFi protocols, NFTs, and other projects. It also highlights the potential of NFT finance, particularly MetaStreet’s NFT lending platform.

Key Takeaways

Blast Ecosystem’s Broad Scope

- Not Just About NFTs: While the Blast ecosystem was expected to focus primarily on NFTs, it has evolved to include a wide range of DeFi protocols, including AMMs, borrow/lending, launchpads, and decentralized perpetuals or leverage trading products. This diversity suggests a broader appeal to different types of participants.

- Emerging Competitive Sector: The report notes that dex perps/leverage protocols appear to be the most competitive sector on Blast, indicating a high expectation for the platform to attract many participants.

MetaStreet’s NFT Lending Platform

- Innovative Lending Mechanism: MetaStreet has developed a permissionless and composable NFT lending platform that allows anyone to create a pool and offer an NFT as collateral against any ERC. Borrowers receive a tradeable debt token as receipt.

- Automatic Tranche Maker (ATM): MetaStreet’s ATM mechanism allows lenders to pool funds and choose their own risk profile. The lender taking the most risk earns the highest return but also bears the most loss if the borrower defaults.

MetaStreet’s Ascend Program

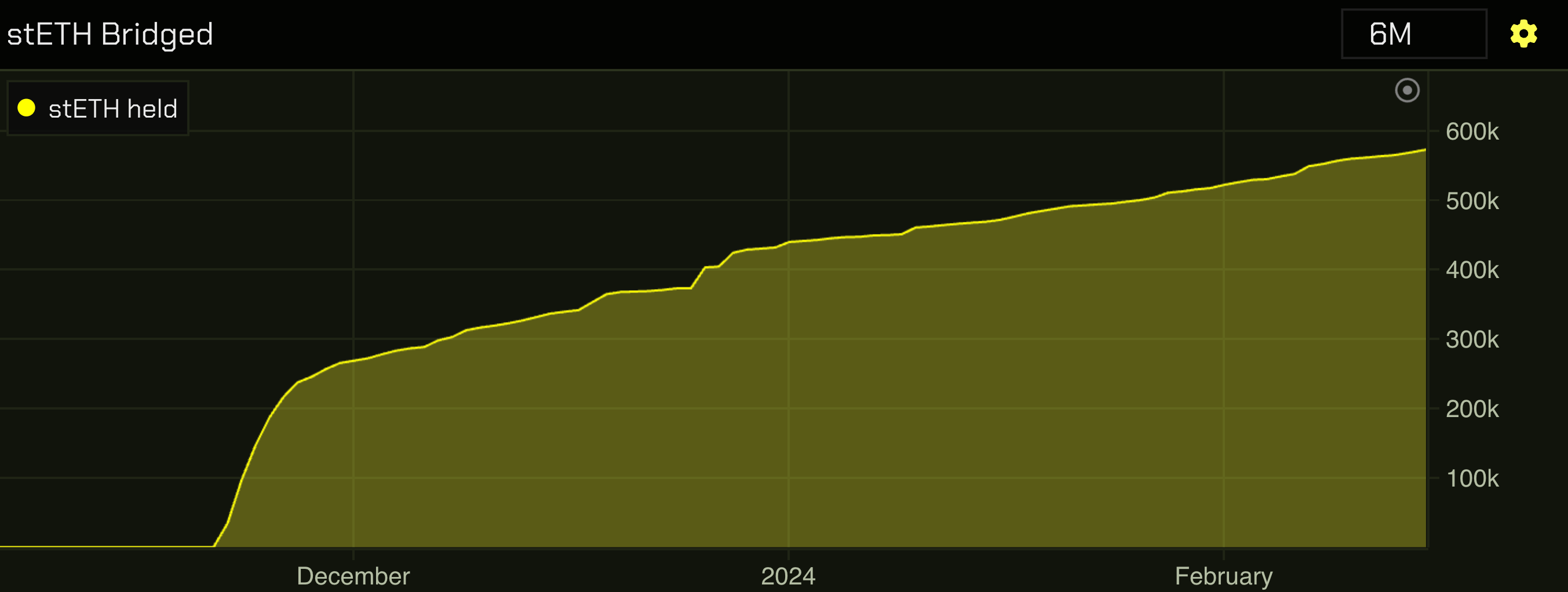

- Yield Bearing Token: MetaStreet’s Ascend program allows users to deposit wstETH to mint mstETH, a yield-bearing token offering a combined total of 17% APR. This process involves restaking yield-bearing wstETH into an NFT yield-bearing token.

- Additional Benefits: Participants in the Ascend program also earn MetaStreet XP points and can pair their mstETH with more wstETH for extra yield and XP.

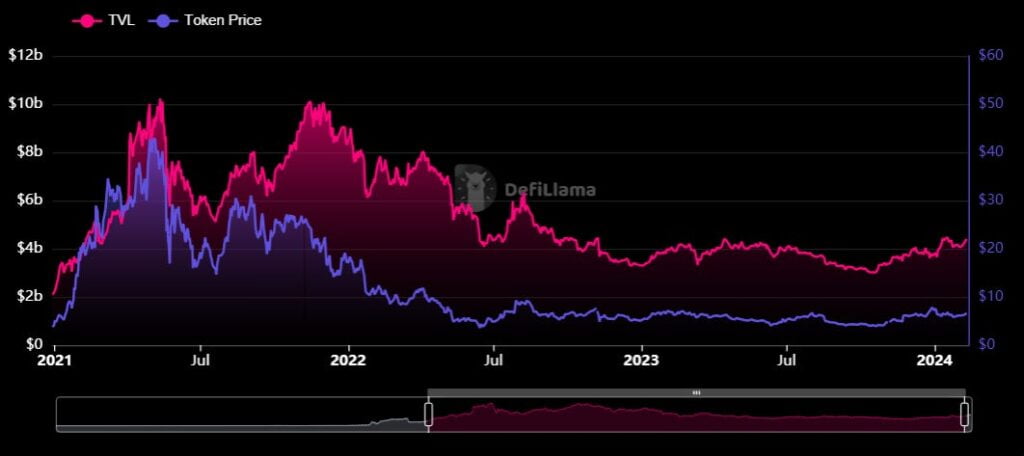

Future Potential of NFTfi

- Untapped Market: Despite steady growth in NFT lending activity on Blend, there is still a multi-billion dollar gap in the market. Permissionless LCTs, like those offered by MetaStreet, could be part of the solution to fill this gap.

Actionable Insights

- Monitor the Blast Ecosystem: Given the broad scope of the Blast ecosystem and its potential to attract a diverse range of participants, it could be beneficial to keep a close eye on its development.

- Explore MetaStreet’s NFT Lending Platform: MetaStreet’s innovative lending mechanism and ATM feature offer unique opportunities in the NFT finance space. Understanding these features could provide insights into the future of NFT lending.

- Consider the Potential of NFTfi: With a multi-billion dollar gap in the market, NFTfi could offer significant growth potential. Researching platforms like MetaStreet could provide a better understanding of this emerging field.