Research Summary

The report discusses the rise of Real World Assets (RWAs) in the crypto space, particularly tokenized securities like short-term US Treasury assets. It highlights the growth of the market cap of these assets, the role of DeFi protocols in facilitating on-chain loans backed by RWAs, and the increasing demand from both retail and institutional investors. The report also mentions the performance of native tokens of RWA DeFi protocols and the potential for growth in the on-chain loan market.

Key Takeaways

Growth of Tokenized Securities

- Surge in Market Cap: The market cap of tokenized securities, particularly short-term US Treasury assets, has grown by approximately 577% in 2023, reaching an all-time high of $794M. This growth is driven by positive market sentiment around potential Bitcoin ETFs and regulatory clarity for the DeFi industry.

Role of DeFi Protocols

- Facilitating On-Chain Loans: DeFi protocols have played a significant role in facilitating on-chain loans backed by RWAs. In 2023, these protocols facilitated $3.9B in loans, primarily through private credit loans backed by stablecoins. The ease and speed of obtaining loans, especially with illiquid assets, have contributed to this growth.

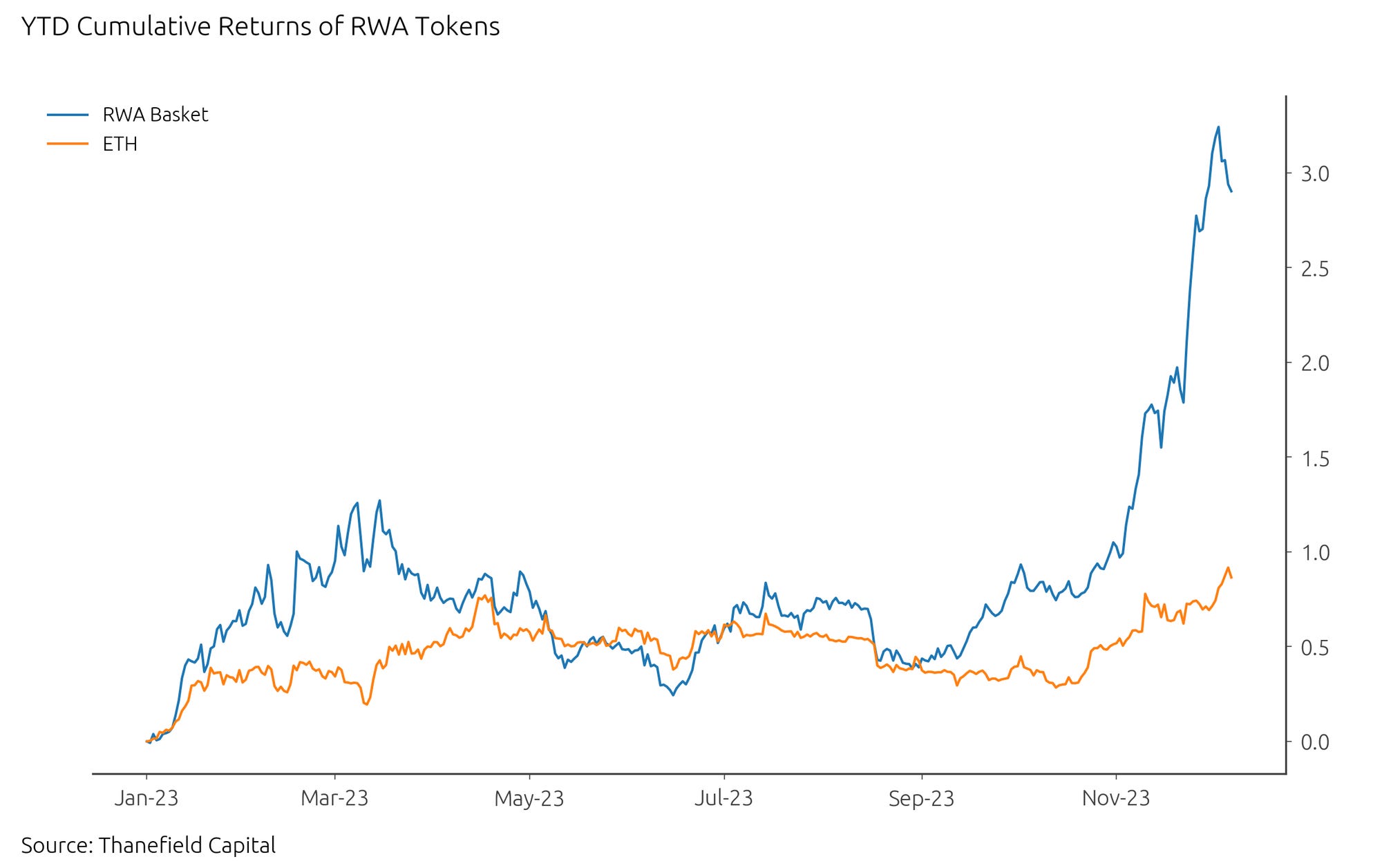

Performance of RWA DeFi Protocols

- Increased Returns: The native tokens of RWA DeFi protocols have shown a 290% increase in returns for 2023, outperforming Ethereum by more than threefold. If the trend continues, increasing demand for RWA offerings will bring greater returns to these DeFi protocols.

Demand from Investors

- Rising Demand: The steady growth in on-chain loans backed by RWAs and the rising market cap of tokenized securities indicate growing demand from both retail and institutional investors for RWAs on-chain. MakerDAO, the largest decentralized stablecoin protocol, has 52% of the total market cap of its DAI stablecoin backed by RWAs, mainly US Treasury Bills.

Potential for Growth

- Room for Expansion: With the increasing availability of on-chain services, there is significant room for growth in the on-chain loan market. However, it is crucial to ensure that as demand in the industry rises, barriers to adoption do not impede progress. Developing regulated infrastructure and service providers is key to supporting individual investors and ensuring a steady flow of liquidity in the RWA sector.

Actionable Insights

- Exploring the Potential of RWAs: Given the growth of RWAs, particularly tokenized securities, there is potential for investors and financial institutions to explore this space. The increasing demand from both retail and institutional investors indicates a promising future for RWAs on-chain.

- Understanding the Role of DeFi Protocols: DeFi protocols play a crucial role in facilitating on-chain loans backed by RWAs. Understanding how these protocols operate and their potential benefits can provide valuable insights for those interested in the crypto space.

- Monitoring the Performance of RWA DeFi Protocols: The performance of native tokens of RWA DeFi protocols has been impressive, outperforming Ethereum by more than threefold. Monitoring the performance of these protocols can provide insights into the potential returns from RWA offerings.

- Identifying Potential Barriers to Adoption: As the demand for RWAs on-chain grows, it is important to identify potential barriers to adoption and work towards overcoming them. This includes developing regulated infrastructure and service providers to support individual investors.