Research Summary

The report discusses Synthetix, a decentralized protocol for creating and trading synthetic assets. It highlights the protocol’s use cases, adoption, revenue, tokenomics, and governance. The report also mentions the Synthetix ecosystem’s main tokens: $SNX, $sUSD, and $eSNX, and the protocol’s treasury holdings.

Key Takeaways

Synthetix’s Role in Decentralized Finance

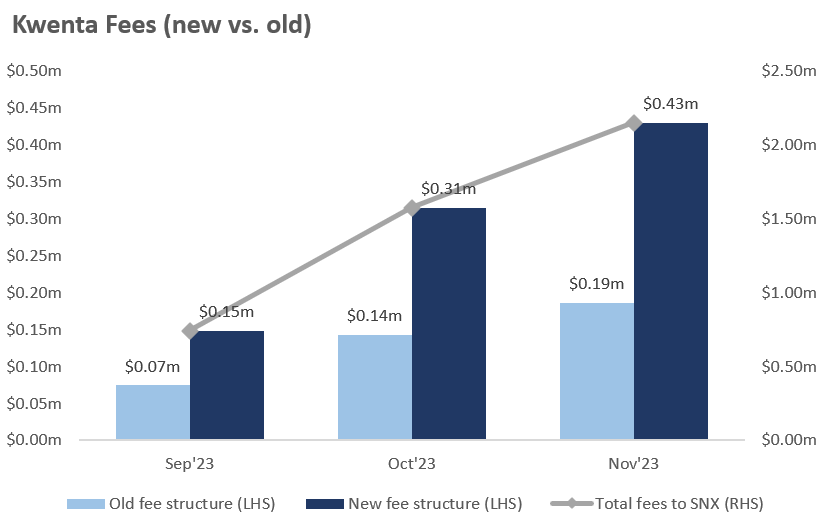

- Synthetix as a DeFi Backbone: Synthetix is a decentralized protocol that enables the creation and trading of synthetic assets, including commodities, stocks, and currencies. It serves as the backbone for popular DeFi applications like Kwenta, Polynomial, dHedge, and Lyra.

- Growth of Synthetic On-Chain Asset Class: The report suggests that the synthetic on-chain asset class is set for significant growth in the coming years, with users increasingly seeking permissionless trading of spot synthetics and on-chain derivatives of traditional assets.

Financial Performance and Tokenomics

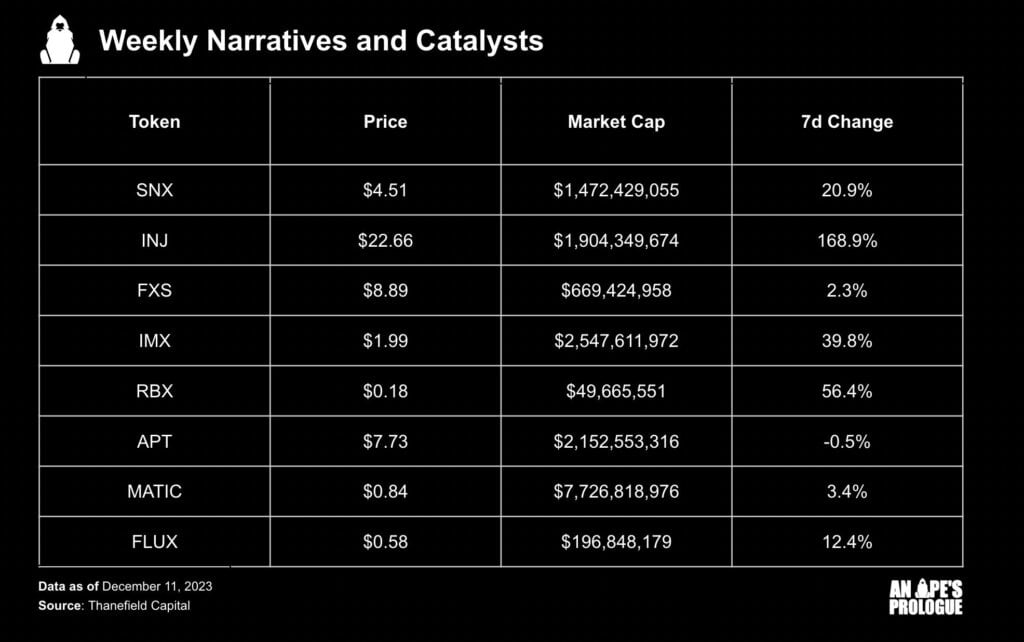

- Revenue Generation: Over the past 30 days, Synthetix has generated $4.2 million in revenue, ranking it the 6th highest among all protocols. Fees, ranging from 0.1% to 1% (average 0.3%), are generated on every synthetic asset exchange and directed towards $SNX stakers.

- Tokenomics: The Synthetix ecosystem uses three main tokens: $SNX for staking and governance, $sUSD for minting by locking SNX as collateral, and $eSNX for Synthetix V3. The majority of $SNX tokens are circulating, meaning no future unlocks to dilute the price.

Treasury and Governance

- Treasury Holdings: The Synthetix treasury holds $145.96 million, including $11.98 million in stablecoins, $0.46 million in BTC/ETH, and $125.65 million in their own token (SNX), placing them in the 20th position according to DefiLlama.

- Governance Structure: The protocol operates under the governance of four key bodies: Spartan Council, Treasury Council, Ambassador Council, and Grants Council. All councils are elected by SNX Stakers, and proposals are only implemented if they receive majority votes.

Market Position and Future Prospects

- Market Leadership: Synthetix is the clear market leader in the Synthetics category, with a first-mover advantage and a strong ecosystem of projects built using its infrastructure. Alchemix is currently the top contender with impressive TVL and revenue stats among competitors.

- Future Developments: Synthetix V3 is currently under development and has been audited by Open Zeppelin, iosiro, and 0xMacro. The report suggests several upcoming catalysts for Synthetix, including the full release of V3, DEX perps eating CEX lunch, and Infinex front-end.

Actionable Insights

- Monitor Synthetix’s Development: Given the upcoming release of Synthetix V3 and other catalysts, it would be beneficial to keep an eye on the protocol’s development and how these changes impact its market position and financial performance.

- Understand Synthetix’s Tokenomics: The unique tokenomics of Synthetix, including the roles of $SNX, $sUSD, and $eSNX, and the inflation mechanism based on a 70% staking ratio, are crucial to understanding the protocol’s operation and potential investment implications.

- Assess the Growth of Synthetic On-Chain Asset Class: The expected growth of the synthetic on-chain asset class could have significant implications for DeFi protocols like Synthetix. Assessing this trend could provide insights into potential opportunities and challenges in the DeFi space.