Research Summary

The report provides an in-depth analysis of Axelar, a cross-chain interoperability network. It discusses Axelar’s technology stack, tokenomics, and its role in the blockchain ecosystem. The report also highlights Axelar’s upcoming developments, including the Axelar Virtual Machine (AVM) and Interchain services, and its strategic focus on Ethereum Virtual Machine (EVM) compatibility.

Key Takeaways

Axelar’s Unique Interoperability Approach

- Full-Stack Interoperability: Unlike many interoperability protocols that focus on asset transfers, Axelar offers full-stack solutions that bridge not only assets but also arbitrary data and permissionless overlay message passing. This enables complex cross-chain logic, enhancing the network’s versatility.

- Decentralized Validator Set: Axelar’s permissionless validator set is a key distinction from competitors like LayerZero and Chainlink, which rely on multisig configurations for interchain messaging. This potentially offers a more decentralized and secure alternative.

Upcoming Developments in Axelar

- Axelar Virtual Machine (AVM): The development of the AVM is set to enhance the network’s cross-chain programmability and general messaging capabilities, positioning Axelar as a more versatile interoperability solution.

- Interchain Services: Axelar’s Interchain services, including the Interchain Token Service (ITS) and Interchain Amplifier, aim to maintain the fungibility of native tokens across different blockchains and simplify the process of connecting new chains to Axelar.

Changes in Axelar’s Tokenomics

- Deflationary Model: Proposed changes to the AXL token economics aim to scale the network’s capacity to integrate a vast array of new networks. The new tokenomics model suggests burning gas fees paid in AXL, which would apply deflationary pressure and potentially make the network deflationary.

- Incentivizing Validators: Axelar’s approach to incentivizing validators diverges from the traditional inflation model by allowing third-party sources to pool AXL tokens to fund validators directly, potentially enhancing the economic sustainability of the network.

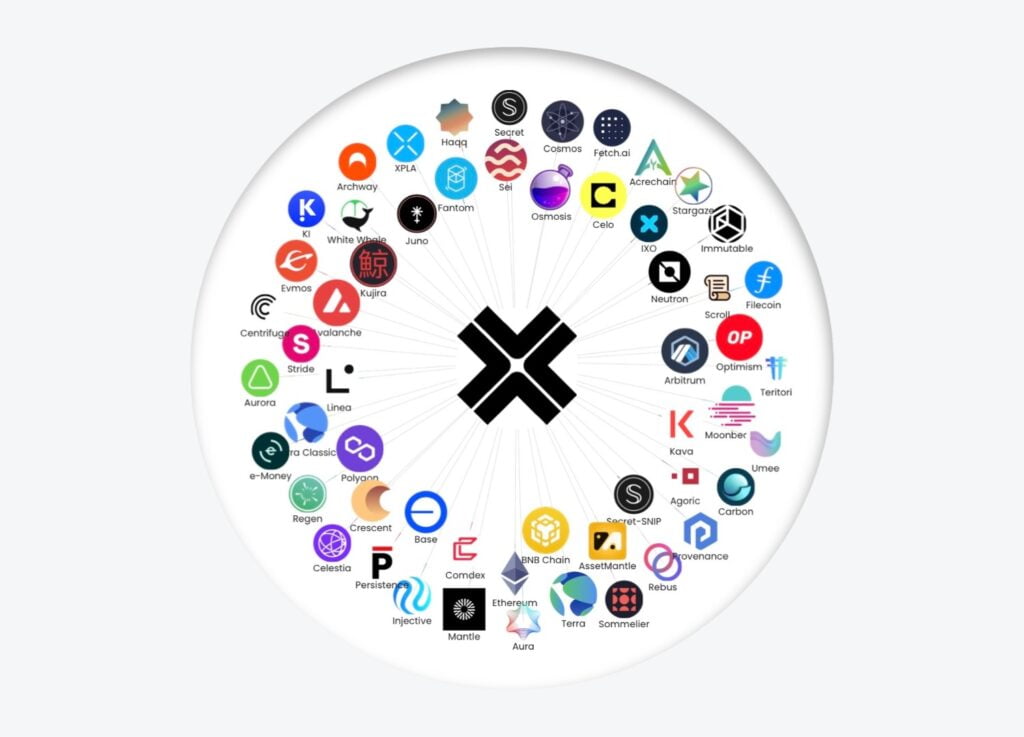

Axelar’s Role in the Blockchain Ecosystem

- EVM Compatibility: EVM users are highly active on Axelar, with 10 out of the top 15 chains by activity being EVM-compatible. This showcases the preference for Ethereum-like environments and Axelar’s strategic focus on EVM compatibility.

- Integration with Applications: Axelar’s integration with a wide range of applications, from DeFi platforms like dYdX and Uniswap to enterprise solutions from Mastercard and Microsoft, demonstrates its versatility and industry acceptance.

Actionable Insights

- Monitor Axelar’s Upcoming Developments: Keep an eye on the development and implementation of the Axelar Virtual Machine (AVM) and Interchain services. These features could significantly enhance Axelar’s cross-chain programmability and general messaging capabilities, potentially impacting its position in the interoperability space.

- Assess the Impact of Tokenomics Changes: Evaluate the potential effects of the proposed changes to Axelar’s token economics. The shift to a deflationary model and the unique approach to incentivizing validators could have significant implications for the network’s economic sustainability and growth.

- Research the Potential of EVM Compatibility: Given the high activity of EVM users on Axelar, further research into the potential of EVM compatibility could provide insights into Axelar’s strategic focus and its role in the blockchain ecosystem.