Research Summary

The report discusses recent developments in the decentralized finance (DeFi) sector, focusing on the activities of Orca, Sui, Frax, and Ondo Finance. It highlights Orca’s governance change and fee implementation, Sui’s new features and Alibaba Cloud’s support, Frax’s launch of Frax Bonds, and Ondo Finance’s token release and expansion plans.

Key Takeaways

Orca’s Governance Change and Fee Implementation

- Orca’s Fee Switch Activation: Orca, a Solana-based decentralized exchange, has activated its fee switch following a governance vote. This change allows the protocol to divert fees from liquidity providers to its DAO treasury. The new 12% fee is expected to generate $30M for the treasury over the next year.

Sui’s New Features and Alibaba Cloud’s Support

- Sui’s Developer Support: Mysten Labs, the entity developing the Sui blockchain, has announced new features to assist SUI ecosystem developers. These include an AI-assisted tool for writing code in the Move programming language. Alibaba Cloud will also support incubators and demo day events for projects building on Sui and offer full node services on Sui.

Frax’s Launch of Frax Bonds

- Frax Bonds Introduction: DeFi conglomerate, Frax, has launched Frax Bonds (FXB), zero coupon bonds that will be paid out in FRAX stablecoins at maturity. The bonds are sold via a gradual Dutch auction design, and the proceeds will be invested in U.S. Treasuries, overnight repo agreements, USD, and money market funds, with a small portion used for DeFi strategies to enhance yield. FXBs are designed to mirror the rate paid on U.S. Treasuries.

Ondo Finance’s Token Release and Expansion Plans

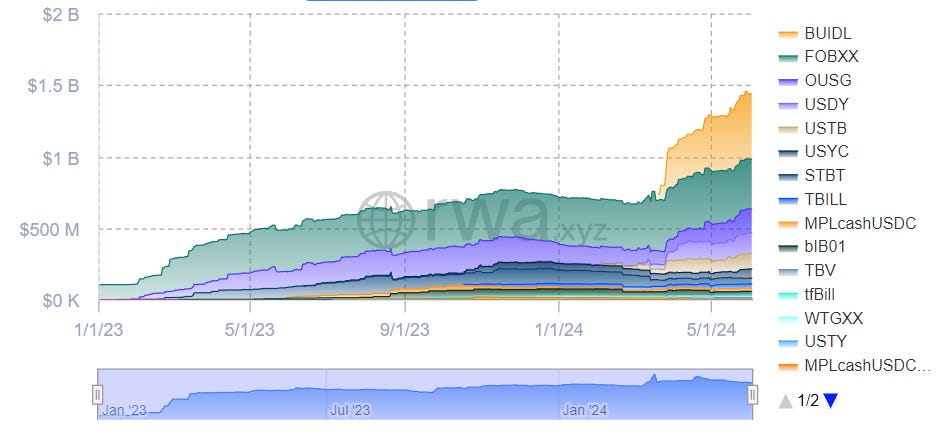

- Ondo’s Token Release and Listing: Ondo Finance, a real-world asset tokenization protocol, has released a token, $ONDO, which will serve as the governance token for Ondo DAO. Following its release, ONDO was listed on Coinbase, Huobi/HTX, and Bybit for trading.

- Ondo’s Expansion to APAC: Ondo Finance has announced its expansion plans to the APAC region, allowing investors exposure to U.S. securities. Since its inception in 2021, Ondo Finance has managed to amass $188M in Total Value Locked (TVL).

Actionable Insights

- Monitor Orca’s Performance: With the activation of Orca’s fee switch, it would be beneficial to monitor the impact of this change on the protocol’s performance and the DAO treasury’s growth.

- Assess Sui’s Developer Tools: The new features and support from Alibaba Cloud for Sui ecosystem developers could potentially enhance the blockchain’s functionality and adoption. It would be worthwhile to assess the effectiveness of these tools and support.

- Examine Frax Bonds: The launch of Frax Bonds presents an opportunity to examine their performance and impact on the DeFi sector, particularly in relation to U.S. Treasuries.

- Track Ondo’s Expansion: Ondo Finance’s expansion to the APAC region and the release of its governance token could have significant implications for the protocol’s growth. Tracking these developments could provide valuable insights.