Research Summary

The report discusses a breadth reversal signal, rising shipping rates, developments in crude oil, a bullish PGM play, and the performance of a small European market. It also highlights the performance of the NQ and SPX, the impact of EVs on the auto industry, and the potential of the Greek market.

Key Takeaways

Market Predictions and Trends

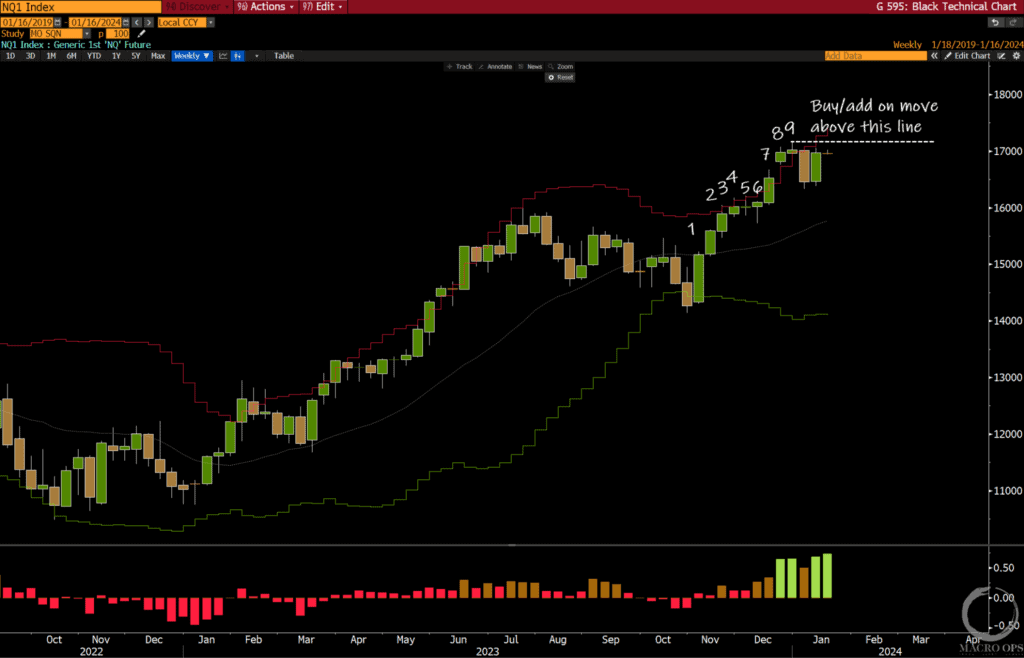

- NQ Market Predictions: The report suggests a small dip and some rangebound action in the NQ market this week, with a potential breakout to new highs. The recommendation is to wait for the market to show its direction.

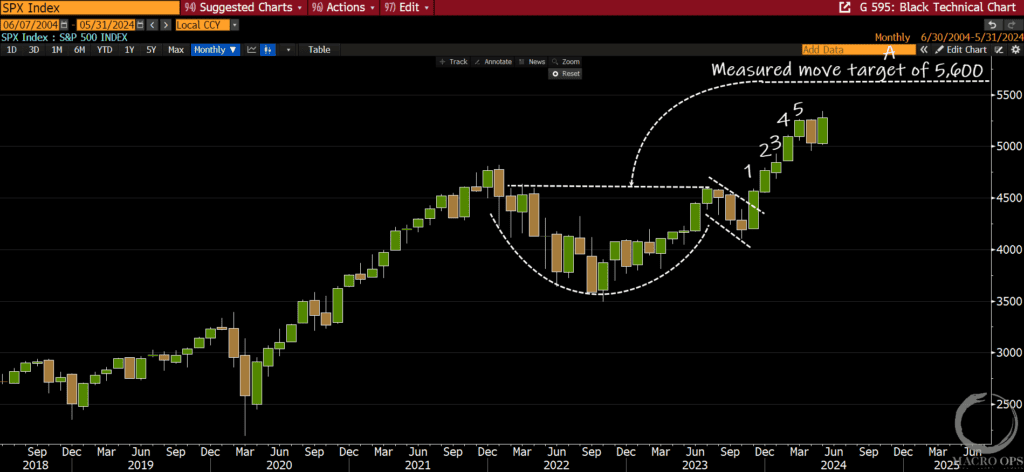

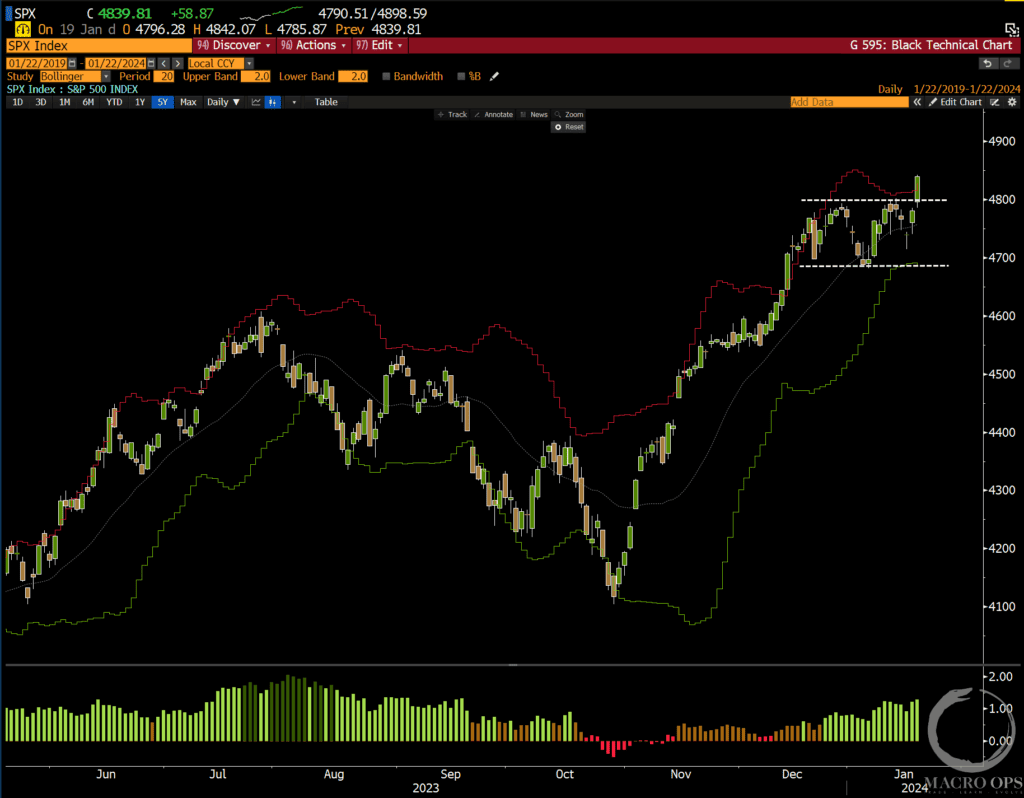

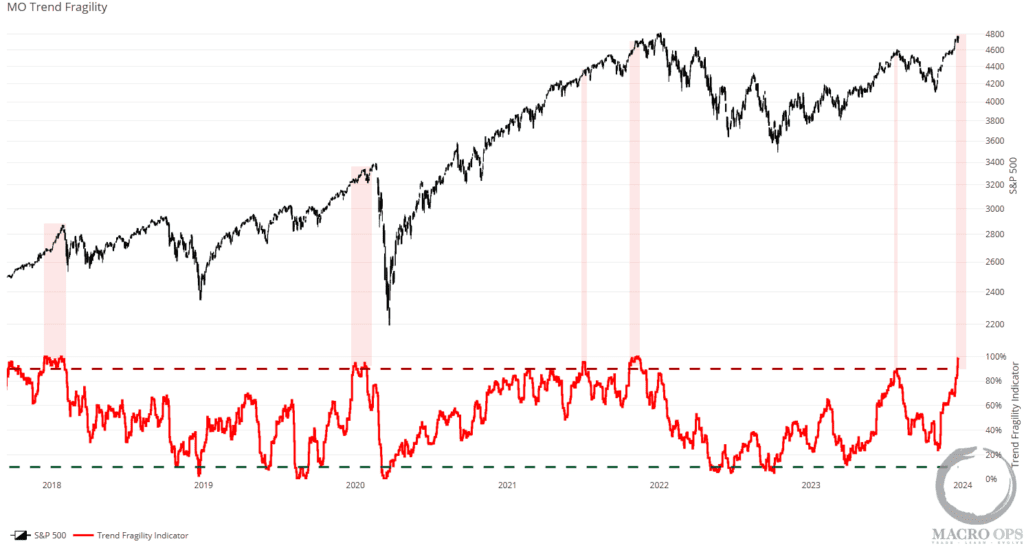

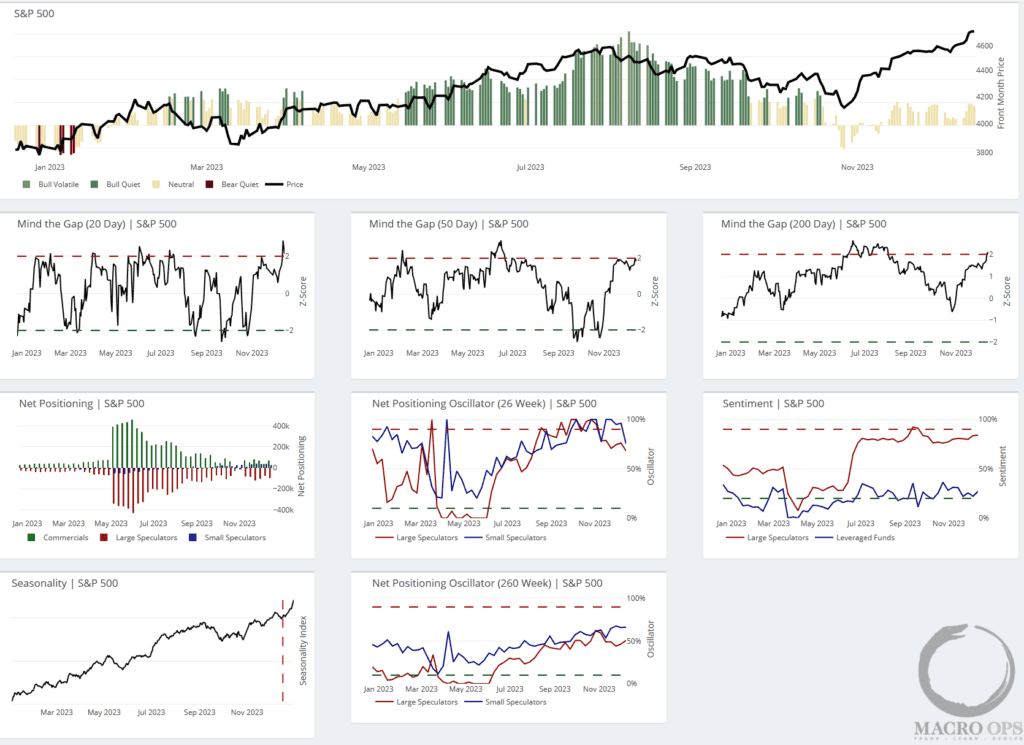

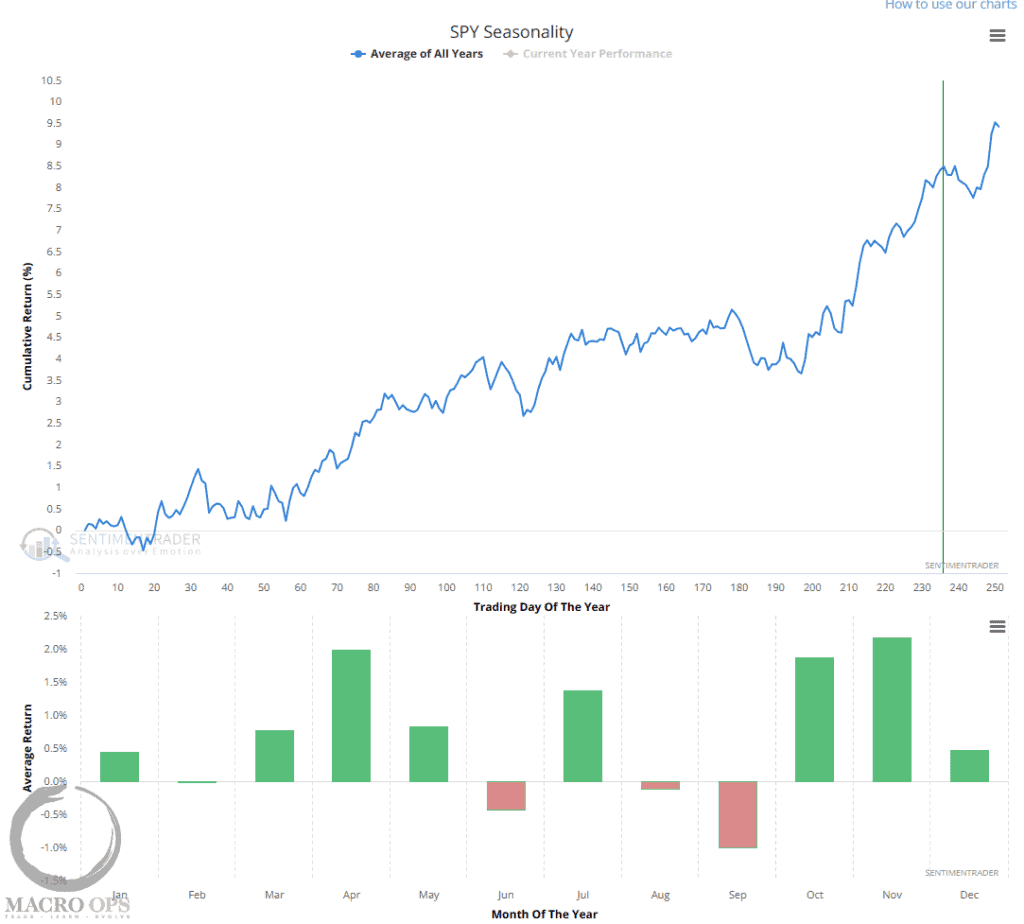

- SPX Trend: Evidence suggests that the primary SPX trend is bullish, with the market up 90% of the time 6 months later with median returns of +8.6%.

Shipping and Crude Oil Developments

- Rising Shipping Rates: The composite container freight benchmark and Shanghai to Rotterdam container rates are increasing due to difficulties in maintaining global shipping lanes.

- Crude Oil Outlook: Sentix’s Strategic Bias for crude oil is positive and rising, indicating institutional willingness to be long oil and related assets. The report suggests waiting for the market to show its direction before making a move.

Auto Industry Shifts

- Impact of EVs: Hertz’s decision to sell 20k EVs from their US fleet due to high maintenance costs could signal a trend with significant investment implications. This could impact the demand for metals like palladium and platinum used in ICE vehicles.

- PGM Play: Despite a drop in palladium and platinum prices, Sibanye-Stillwater (SBSW), a major PGM producer, is seen as a potential opportunity due to its strong balance sheet and ability to earn profits through the entire PGM price cycle.

Greek Market Performance

- Greek Market Returns: Greece (GREK) is the best-performing international market on both a 1yr and 3yr basis, returning 37% and 55% respectively. The GREK ETF completed an 8-year-long inverted H&S bottom this past year, suggesting potential for future growth.

Actionable Insights

- Monitor NQ and SPX Trends: Keep a close eye on the NQ and SPX markets for potential investment opportunities, particularly if the markets show a clear direction.

- Assess Shipping and Crude Oil Sectors: The rising shipping rates and positive outlook for crude oil suggest potential opportunities in these sectors. Research the potential of companies within these industries.

- Consider Impact of EVs on Auto Industry: The shift towards EVs and its impact on the demand for metals used in ICE vehicles could present opportunities. Research the potential of companies like SBSW that could benefit from these shifts.

- Explore Greek Market: The strong performance of the Greek market suggests potential opportunities. Research the potential of companies within this market.