Research Summary

The report analyzes the potential for a new bull market in small-cap stocks. It discusses the current market regime, the strength of the SPX, the Russell 2000’s performance, and the technical strength in shippers. The report also highlights the performance of Navios Maritime Partners (NMM).

Key Takeaways

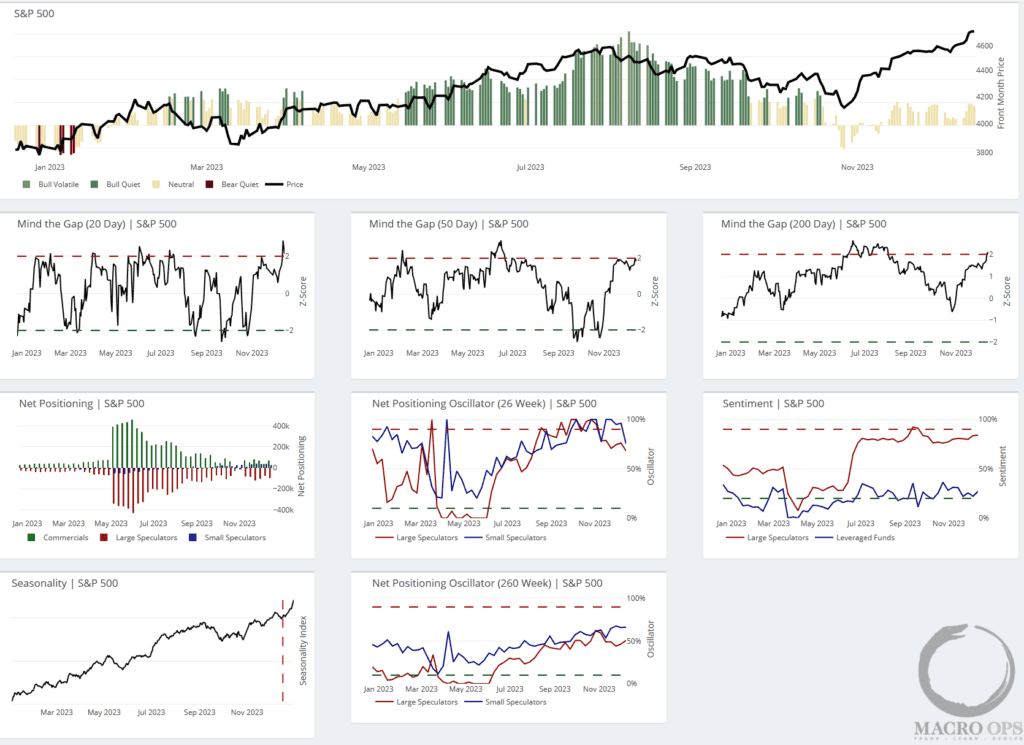

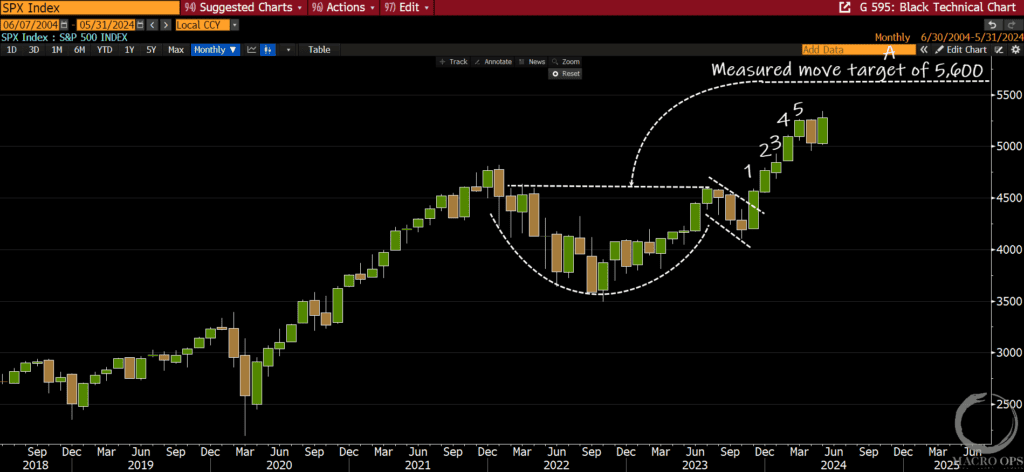

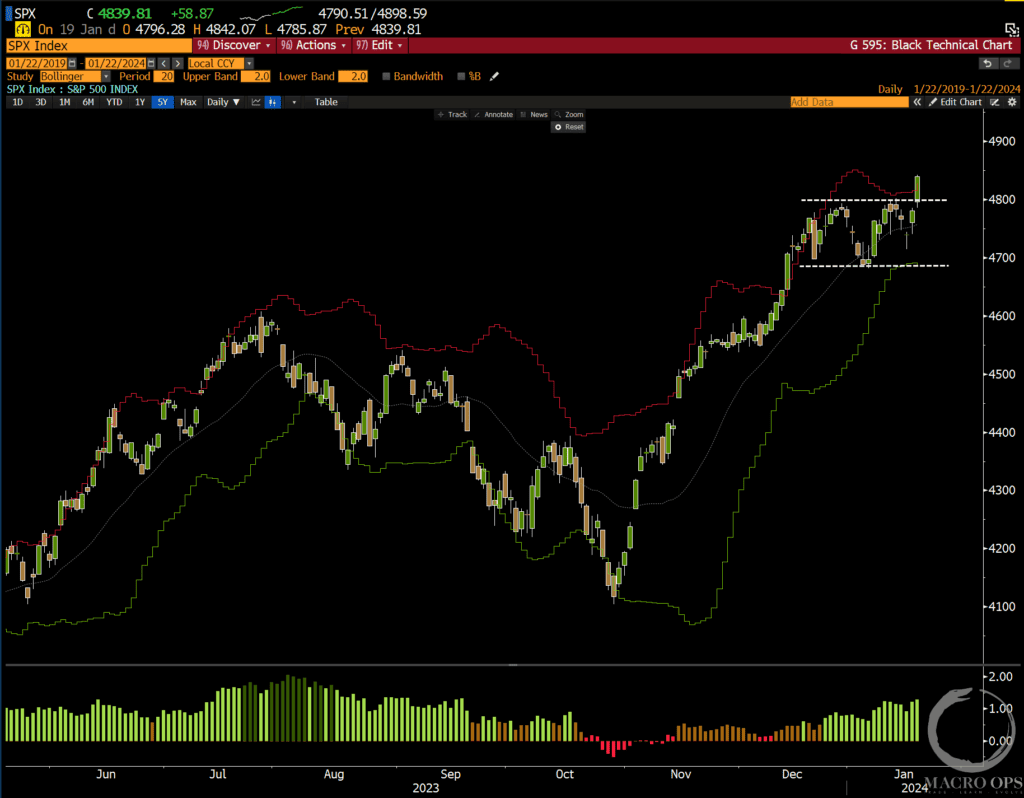

SPX’s Strength and Market Optimism

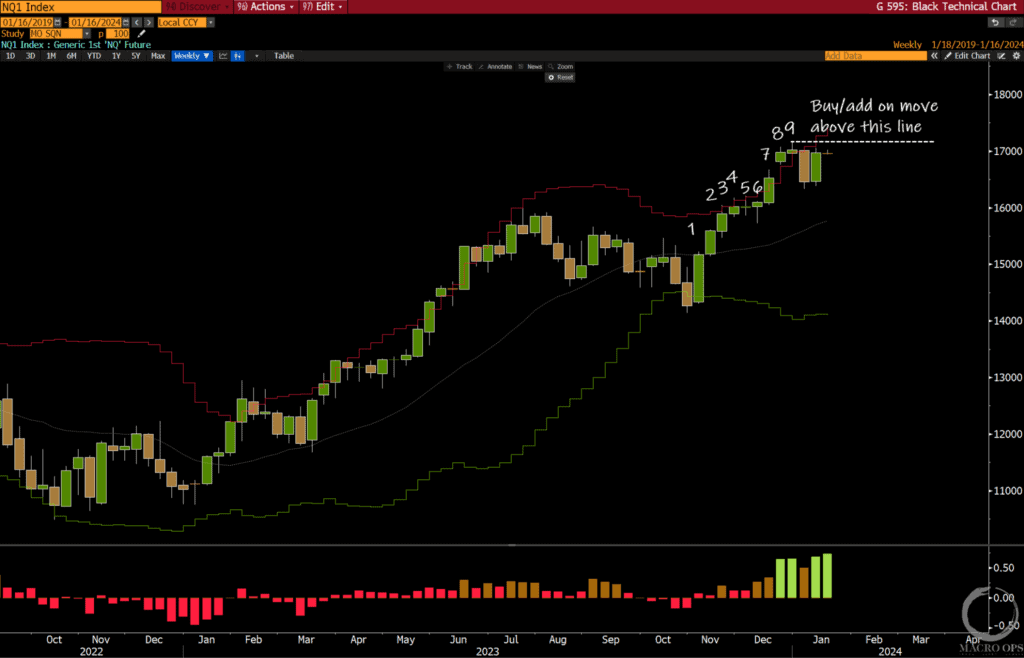

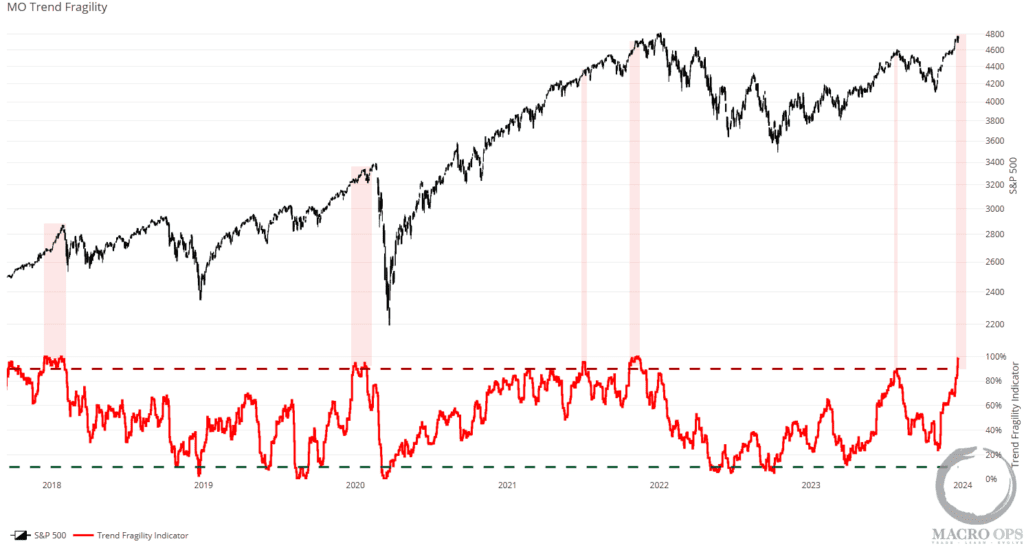

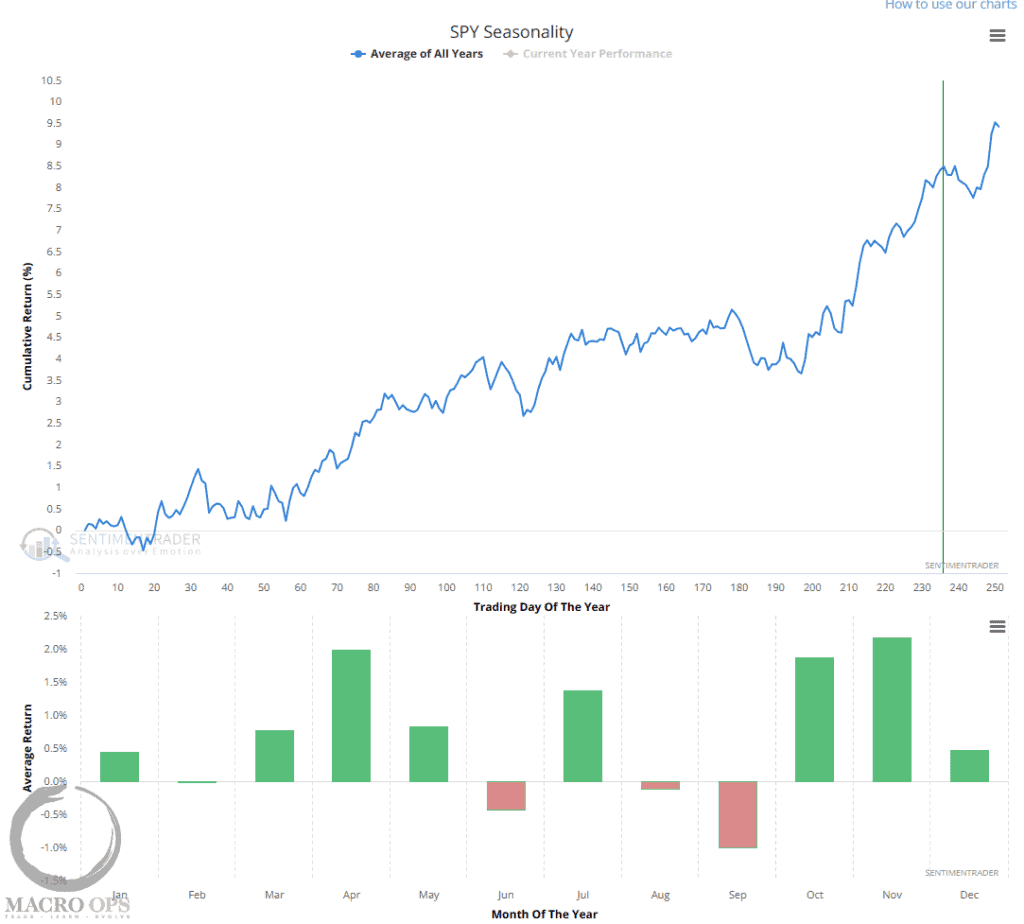

- SPX’s Bullish Trend: The S&P 500 (SPX) has shown seven consecutive bull weeks, indicating a strong market. The Trend Fragility score, which measures positioning and sentiment, has risen from 24% in November to 83%, suggesting increased market optimism.

- Overbought Market: Despite the SPX being overbought, the report suggests that this is a sign of demand strength that could precede further gains. The report advises caution if the Trend Fragility score rises above 90%.

Russell 2000’s Performance

- Strong Performance: The Russell 2000 (RTY) is performing strongly, with 48% of its stocks recording a 63-day high, the 5th highest level in history. Historically, when the percentage of Russell 2000 stocks registering a 63-day high increased above 38%, the index was higher a year later.

Bond Market Developments

- Yield Lead Indicator: The report suggests that the yield lead indicator is diverging higher, indicating a potential correction or consolidation in bonds. This suggests that investors should manage their bond holdings accordingly.

Leadership in Sectors/Industries

- Cyclically Bullish Price Action: The sectors with the strongest consecutive returns include home construction, homebuilders, semiconductors, and consumer discretionary. This type of leadership is not typically seen before a recession, suggesting a cyclically bullish price action.

Navios Maritime Partners’ Performance

- Breakout from Coiling Wedge Pattern: Navios Maritime Partners (NMM) is breaking out from a 2-year coiling wedge pattern and is trading at a discount relative to its historical multiples and peers. This suggests potential upside for the stock.

Actionable Insights

- Monitor the SPX: Given the SPX’s current strength and the potential for further gains, investors should keep a close eye on its performance and the Trend Fragility score.

- Consider the Russell 2000: With the Russell 2000 showing strong performance, it may be worth considering for portfolio diversification.

- Manage Bond Holdings: The potential for a correction or consolidation in bonds suggests that investors should review and potentially adjust their bond holdings.

- Review Sector/Industry Leadership: The leadership shown by certain sectors suggests potential investment opportunities. Investors should review these sectors for potential additions to their portfolios.

- Research Navios Maritime Partners: Given NMM’s breakout from a coiling wedge pattern and its current valuation, it may be worth researching further for potential investment.