Research Summary

The report discusses the potential for a significant market crash, citing Robert Kiyosaki’s warnings about the S&P and the impact on 401ks and IRAs. It also explores the role of Bitcoin ETFs, the manipulation of markets, and the risks associated with the Japan carry trade. The author suggests that diversification and dollar-cost averaging are key strategies for navigating these risks.

Key Takeaways

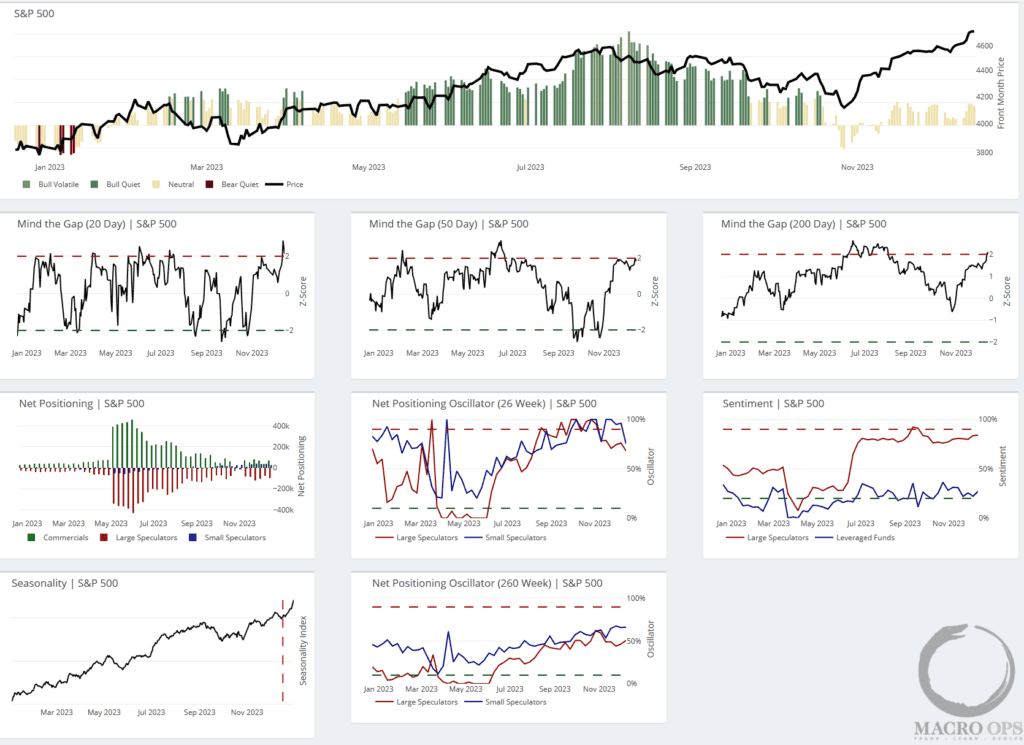

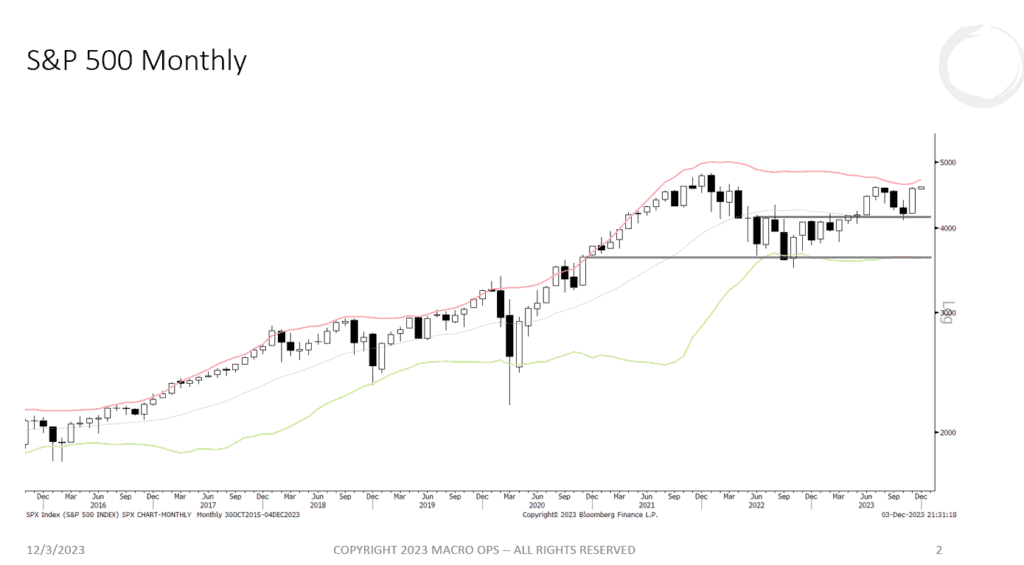

Market Crash Predictions

- Impending Market Crash: The report cites Robert Kiyosaki’s prediction of a significant market crash that could impact millions of 401ks and IRAs. The author agrees with Kiyosaki’s prediction but disagrees on where people should invest their money.

Bitcoin ETFs and Market Manipulation

- Bitcoin ETFs: The report discusses the recent sanctioning of large-scale spot Bitcoin ETFs by the SEC, suggesting that this could be a key moment in market history. The author disagrees with the idea that Bitcoin is a safe haven from a market crash.

- Market Manipulation: The author argues that almost every market is heavily manipulated by the industry that controls it, citing examples from the pandemic and the role of trading platforms like Robinhood.

Investment Strategies

- Diversification and Dollar-Cost Averaging: The author emphasizes the importance of diversification and dollar-cost averaging as key investment strategies, even in the face of market volatility and potential crashes.

Risks of the Japan Carry Trade

- Japan Carry Trade: The report highlights the risks associated with the Japan carry trade, which has grown significantly as the Fed has raised rates and Japan has kept the monetary spigot open. The author suggests that this could confound Fed efforts to reinflate markets.

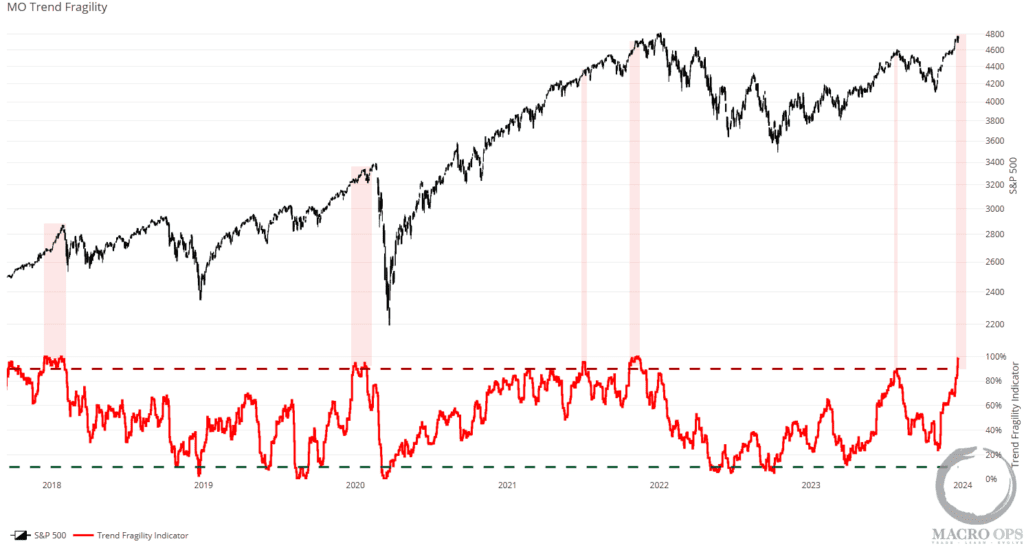

Market Volatility and Functionality

- Unprecedented Volatility: The author predicts unprecedented market volatility and suggests that many markets may stop functioning, potentially trapping investors for days at a time.

Actionable Insights

- Consider Diversification and Dollar-Cost Averaging: Given the potential for market volatility and crashes, investors may want to consider strategies such as diversification and dollar-cost averaging to mitigate risk.

- Be Cautious with Bitcoin ETFs: Despite the recent sanctioning of Bitcoin ETFs by the SEC, the report suggests that Bitcoin may not be a safe haven in the event of a market crash. Investors should carefully consider the risks associated with Bitcoin ETFs.

- Understand the Risks of the Japan Carry Trade: The report highlights the risks associated with the Japan carry trade, suggesting that this could confound Fed efforts to reinflate markets. Investors should be aware of these risks when making investment decisions.